Morgan Stanley IM: Transitional year for energy markets

Andrew Harmstone, Manfred Hui: We expect a transitional year for energy, with higher oil and gas prices leading to some market rebalancing after disruptions last year. These energy dynamics are key to the inflation story, which in turn is likely to determine asset performance in 2023.

19.01.2023 | 07:05 Uhr

Here you can find the complete article

Following a two-month rally, in December equities across the globe sold off. The S&P 500 Index returned -5.8%1, whilst the MSCI Europe and MSCI Japan returned -3.5%1 and -5.2%1 respectively, in local currency terms. Although the MSCI Emerging Markets (USD) fell 1.4%, a notable exception was the MSCI China (USD) index, up 4.8%1 due to the accelerated reopening of China’s economy with limited setbacks so far. Despite U.S. inflation falling,2 the year-end market slump can be attributed to the hawkish tone of the December Federal Reserve meeting. The Fed is worried about inflation not only falling enough but remaining anchored near target levels by 2024. Recessionary concerns, the abrupt rise in government bond yields and reduced liquidity in the second half of the month likely contributed to the decline in markets in December. The U.S. 10-Year yield moved up, ending the month at 3.8%3. The VIX index remained range bound, reaching 21.7 by month end3.

Energy markets in transition in 2023

We expect a transitional year for energy markets in 2023, with higher oil and

gas prices leading to some market rebalancing after disruptions last year.

However, sanctions on Russia are likely to result in tight supplies globally

and remain a key inflation challenge. Recessionary headwinds are likely to dent

oil demand in 2023, but we expect sanctions on Russia, and gas-to-oil

switching, to be offsetting factors that could sustain relatively high prices.

OPEC’s announcement[1] of a production cut in an already tight market,

underscores the necessity to keep prices higher, to incentivise the investments

in supply needed to rebalance the market. A fall in prices now could

disincentivise investment and spell higher prices when demand recovers.

Essentially, whether central banks can push inflation down and successfully

anchor it is likely to be one of the most important determinants of assets’

performance in 2023 and energy dynamics are clearly key to the inflation story.

Investment implications

We remain cautious with respect to U.S. equities, due to the concern that

earnings are still likely to fall in the first half of 2023, but we are more

optimistic on global equities ex-U.S. However, the recent market retracement

after the hawkish Federal Reserve and European Central Bank (ECB)

announcements, and the light macro event calendar before year end, provided a

window for us to tactically increase risk from defensive levels. Furthermore,

investor positioning should provide support to the market, especially if

economic and corporate data surprise to the upside. We believe it is prudent to

separate our Chinese equities exposure from other Emerging Markets, hence we

made the following tactical changes in December:

U.S. and Eurozone Equities

We moved from underweight to neutral Eurozone equities and added to the U.S.

equity underweight. Eurozone equities are still trading at a substantial

discount to the S&P 500.

Japanese Equities

We moved from overweight to neutral Japanese equities. Often viewed as a safe

haven, Japanese equities seem to be moving past their peak and may no longer

outperform. However, we are moving overweight Japanese yen relative to the U.S.

dollar as there are some biases for further upside.

Emerging Markets ex China equities

We moved from neutral to overweight Emerging Markets ex China equities, as peak

inflation in the U.S. and EM suggests that central banks are near the end of

their tightening cycles. Markets expecting cuts in EM rates by the second

half of 2023 coupled with peak Fed hawkishness, also suggest that the U.S.

dollar peak might be approaching, which has positive FX transmission for EM

balance of payments. China's reopening could potentially be another positive

catalyst that could have a positive impact on its Asian trading partners.

MSCI China equities

In December, we moved overweight MSCI China equities as near-term reopening

could boost consumption and support growth in China, earlier than previously

anticipated, given a softening of China’s zero-covid stance and

reprioritisation of economic growth.

U.S. Health Care equities

We initiated an overweight to U.S. Health Care equities in a bid to lower our

exposure to U.S. equity beta. We see continued downside to overall U.S.

equities and together with its defensive characteristics, Health Care possesses

structural, higher-quality growth characteristics over other defensive sectors

such as Consumer Staples and Utilities.

Duration

We shortened U.S. duration as we are concerned that at current levels, the

market is underestimating the impact of the resilient labour market, with

strong wage growth and potentially misinterpreting the seemingly dovish tone of

the Fed from the November FOMC meeting. At the time of our reduction in

duration, the market was discounting 2-3 25bps rate cuts towards the end of

2023 and another 100bps worth of cuts in 2024. While this is certainly a

plausible outcome, we believe it is premature to price this with certainty

given persistent, core inflationary pressures and little visibility on the

level at which inflation will ultimately settle over 2023.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

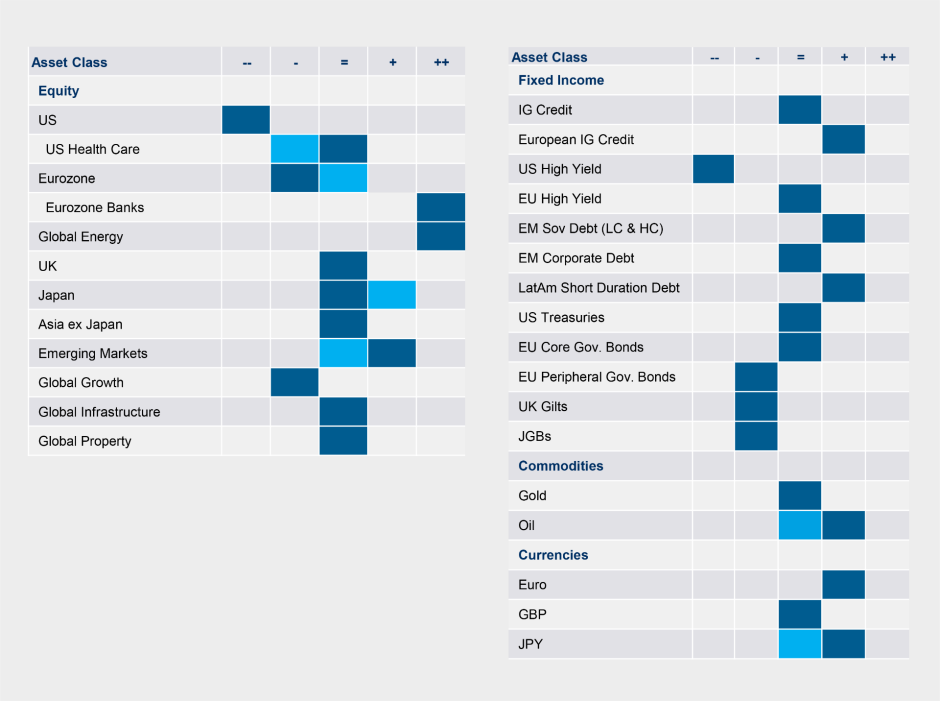

Tactical Positioning

We have provided our tactical views below:

Source: MSIM GBaR team. Previous view is as of 30 November 2022 and current view is as of 31 December 2022. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor. The signals represent the GBaR team’s view on each asset class. A negative signal indicates a negative or underweight relative view, a positive signal indicates a positive or overweight relative view.

1 Bloomberg, 1-month returns, as of 31 December

2022.

2Consumer Price Index News Release. November 2022 headline inflation

was 7.1% over the last 12 months, before seasonal adjustment, compared with

October at 7.7%. U.S. Bureau of Labor Statistics. 13 December 2022.

www.bls.gov/news.release/archives/cpi_11102022.htm

3 Bloomberg, 31 December 2022.

4 Announcement made on 5 October 2022.

www.opec.org/opec_web/en/press_room/7021.htm

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: