Morgan Stanley IM: China’s Reopening Offers Potential to Accelerate Growth Across Asia-Pacific Economies

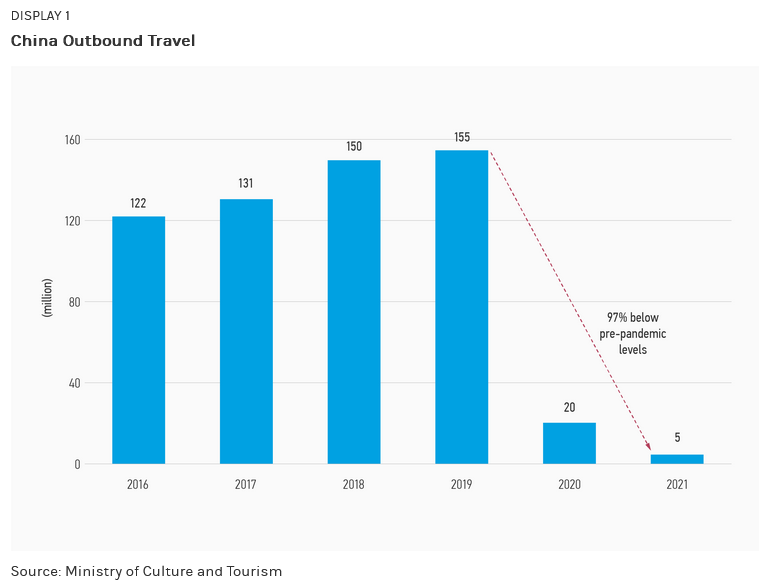

After three years of effective shutdown, travelers and shoppers are expected back in droves and investment is flowing in, and stimulating tourism brightens the outlook for the entire region.

03.04.2023 | 09:30 Uhr

Here you can find the complete article

Key Points

- Cross-border travel resumes between China and Hong Kong, Macau, Thailand, Indonesia, and the Philippines

- Uptick in luxury retail, travel, hotels, and restaurants paves the way for resurgence in wealth management business and office and residential space

- China’s reopening and easing of monetary and fiscal policy is likely to bolster each Asia-Pacific economy

- The incremental benefit to Hong Kong is expected to be most significant and far reaching due to its proximity and shared border with China

We believe the time is ripe to invest very opportunistically in Hong Kong and China, as reopening the second-largest economy positively impacts other markets throughout Asia-Pacific. Relaxed monetary and fiscal policies, easing COVID-19 restrictions, resuming tourism, and falling interest rates, are fueling China’s recovery. After three years of effective shutdown, travelers and shoppers are expected to return in droves, investment is beginning to flow in, and stimulating tourism brightens the outlook for the entire region. Tourism accounted for approximately 10% of the Asia-Pacific region’s gross domestic product in 2019 and 10% of jobs, according to the World Travel and Tourism Council.

Tourism accounted for approximately 10% of the Asia-Pacific region’s gross domestic product in 2019 and 10% of jobs, according to the World Travel and Tourism Council.

Cross-Border Travel Resumes Between Hong Kong, Macau, and China

Travelers from the mainland accounted for more than 75% of total visitors to Hong Kong pre-COVID-19 in 2019. While visitor arrivals to Hong Kong and retail sales still lag far below pre-pandemic levels, the resumption in issuance of tourism and business visas to Hong Kong and lifting quarantine for travel to the mainland are significant and will likely bolster consumer and business sentiment and activities. We anticipate a return of Chinese luxury shoppers will revive a major contribution to Hong Kong’s GDP after a three year absence.

The Hong Kong economy has dealt with dual shocks, as social unrest in 2019 coincided with the pandemic, hampering output and diverting government and private sector resources and attention away from longer-term plans. Absent further shocks, we believe there is opportunity for Hong Kong to focus on longer-term economic growth and development plans, such as the Northern Metropolis development strategy, a large-scale urban project introduced by the Hong Kong government for the northern districts bordering the city of Shenzhen, with a total land area of 30,000 hectares. Stronger connectivity and linkages will fuel greater economic growth and faster recovery, stimulating retail, tourism, gaming, residential real estate, and wealth management.

Risk Considerations

The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Emerging Markets Risk - The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Investing in companies in anticipation of a catalyst carries the risk that certain of such catalysts may not happen or the market may react differently than expected to such catalysts. Real Estate Risk - The risks associated with ownership of real estate and the real estate industry in general include fluctuations in the value of underlying property, defaults by borrowers or tenants, market saturation, decreases in market rents, interest rates, property taxes, increases in operating expenses and political or regulatory occurrences adversely affecting real estate. Real estate investment trusts (REITs) are subject to risks similar to those associated with the direct ownership of real estate and they are sensitive to such factors as management skills and changes in tax laws. Concentration Risk: Concentration in a single region may make the portfolio more volatile than one that invests globally.

China Risk: Investments in securities of Chinese issuers, including A-shares, involve risks associated with investments in foreign markets as well as special considerations not typically associated with investments in the U.S. securities markets. Investments in China involve risk of a total loss due to government action or inaction. Additionally, the Chinese economy is export-driven and highly reliant on trade. Adverse changes to the economic conditions of its primary trading partners, such as the United States, Japan and South Korea, would adversely impact the Chinese economy. Moreover, a slowdown in other significant economies of the world, such as the United States, the European Union and certain Asian countries, may adversely affect economic growth in China.

Diesen Beitrag teilen: