Morgan Stanley IM: Brazil at a Turning Point

After his victory in Brazil’s presidential election, Luiz Inácio Lula da Silva (Lula) began his victory speech with a simple message: "Brazil is back." The question investors are now trying to answer is: back to what? The answer depends on which version of Lula shows up.

26.05.2023 | 06:42 Uhr

Will we see a return of the pragmatic Lula who, as president for the first time beginning 20 years ago, embraced responsible economic policies? Or will today's Lula act as a populist leader seeking aggressive redistribution? The answer will be the key driver for the Brazilian financial markets for the foreseeable future.

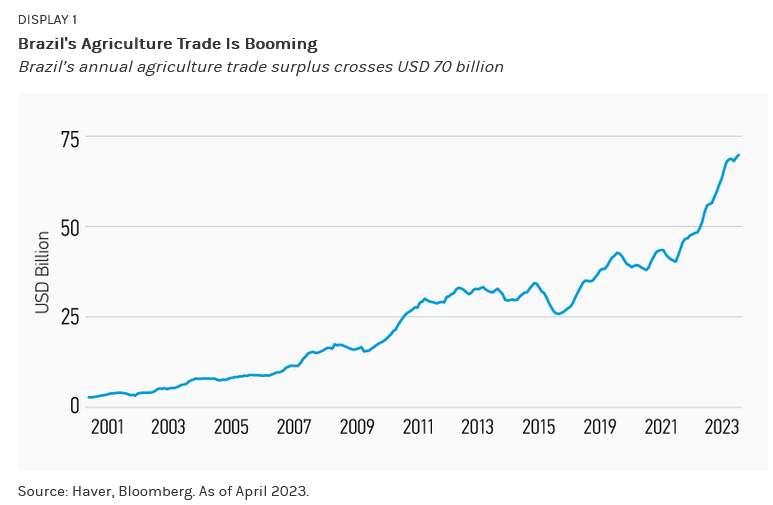

We recently visited Brazil and concluded that regardless of his recent push for populist measures, Lula remains constrained by a center-right Congress and a central bank laser focused on cutting inflation. Despite ambitious spending plans, we believe Lula will moderate his tone and ultimately implement reasonable economic policies. The path, however, will not be smooth as the market may end up “climbing a wall of worry.” Brazil is currently benefitting from a booming agricultural sector (Display 1) and high commodity prices, leading to an improving trade balance and better growth. Additionally, economic reforms, such as pension and labor market reforms introduced under the previous administration, are starting to bear fruit. If the new government can successfully manage fiscal policy, interest rates can come down and the market should re-rate.

Observers had expected Lula to moderate his rhetoric after securing the keys to the Alvorada Palace, the president’s residence. That hasn’t happened. Since coming into office, Lula’s call for more government spending, more state intervention and tougher regulations on business has unnerved investors.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment

objective. Portfolios are subject to market risk, which is the possibility that

the market values of securities owned by the portfolio will decline and that

the value of portfolio shares may therefore be less than what you paid for

them. Market values can change daily due to economic and other events (e.g.

natural disasters, health crises, terrorism, conflicts and social unrest) that

affect markets, countries, companies or governments. It is difficult to predict

the timing, duration, and potential adverse effects (e.g. portfolio liquidity)

of events. Accordingly, you can lose money investing in this portfolio.

Please be aware that this portfolio may be subject to certain additional risks.

In general, equities securities' values also fluctuate in

response to activities specific to a company. Investments in foreign

markets entail special risks such as currency, political, economic,

market and liquidity risks. The risks of investing in emerging market

countries are greater than the risks generally associated with

investments in foreign developed countries.

Diesen Beitrag teilen: