BNP Paribas: Why does artificial intelligence matter to China?

Computer scientists have reached impressive breakthroughs in AI. In China, the use of AI will particularly play an important role in the shift from a capital-intensive model to a consumption-based economy.

05.10.2018 | 10:41 Uhr

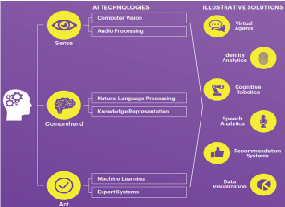

Artificial intelligence (AI) is a set of computational technologies that are inspired by the ways human use their nervous systems and bodies to sense, learn, reason and take actions. Sensors, including microphones and cameras, collect data in the external environment from our day-to- day interactions. Algorithms are coded to condition machines to gradually learn and make inferences based on past data. Over the years, AI has grown tremendously in complexity, transforming from handling process- driven tasks to data-drive ones.

AI technologies in a nutshell

The term AI was officially born in 1956 at the Dartmouth Summer Research Project on Artificial Intelligence. Between the late 1960s and early 1980s, theories such as heuristic search, computer vision, natural language processing, mobile robotics, machine learning and artificial neural networks emerged. However, by the mid-1980s, AI still saw no significant practical success. The gap was in part because of the lack of direct access to environmental signals and data, and in part because of over-emphasis on characterizing true or false logic and thereby overlooking uncertainty. Interest in AI began to drop and funding dried up. The “AI winter” loomed for the next decade and started to see a new boom in the 1990s.

Why is AI gaining serious momentum this time?

Technological advancements

According

to a Zignal Lab report from May 20171, 90% of the world’s data was

created in the last two years thanks to media and social intelligence.

2.5 Exabytes of media data are now produced daily. Coupled with improved

quality and wide availability of different hardware over the years,

data can now be fully and accurately captured, processed and shared.

Sophisticated software programs have also been developed to interpret

the output of algorithms and present data in easily digestible

visualizations, allowing humans to interface, analyze and synthesize

insights without the necessity of prior trainings in AI. Moreover,

computing and storage power have grown exponentially while costs are

reduced dramatically, further accelerating the processing efficiency and

the pace of innovation.

Changing demographics and economic needs

Another reason for this accelerating momentum hinges on the economic reality faced by the world’s major economies. The example of China is a telling one. The world’s second largest economy has relied heavily on its vast labor market and significant capital investment to sustain its economic growth over a long period. These two levers were the traditional drivers of production, yet they can no longer sustain the steady march of prosperity enjoyed in the past three decades. China’s demographics are turning from a tailwind to a headwind. With an aging population – nearly 50% of it is now middle-aged – China seems likely to fall well short of the workforce numbers needed to sustain economic growth at current productivity levels. The government acknowledges the increasing need for China to embrace a new growth model that relies less on a capital-intensive model (fixed investment and exporting), and more on private consumption, services and innovation to drive higher quality and more sustainable economic growth. China has to undergo structural reforms to address challenges arising from the past high-speed growth, such as excess capacity in numerous industries. The most realistic alternative for maintaining momentum would be to sharply accelerate productivity growth. The use of artificial intelligence is thus set to play an important role in boosting productivity. AI can augment labor by complementing human capabilities, offering employees new tools to enhance their natural intelligence. In our view, a significant part of China’s economic growth from AI will come, not from replacing existing labor and capital, but in enabling them to be used much more effectively. As AI technology continues to evolve and value slowly outweighs the cost of adoption, these emerging markets are more willing to adopt AI to solve some of their most pressing issues.

In the Middle East, the dependence on energy is pushing governments to diversify and leverage technology more. Even though gulf countries focused on cost-cutting after the oil price collapsed from its peak price in 2014, most countries today still have fiscal breakeven oil prices above the average trading Brent price. In Saudi Arabia, foreign exchange reserves collapsed from a peak of $750 billion USD in 2014 to below $500 billion USD in 2017, as the government had to draw down the reserves to cover a budget deficit caused by low oil export receipts.

Exemplary cases of AI adoption

China consumer - AI changing how people shop online

China

is an interesting case in which AI-powered tools are already widely

adopted in people’s daily lives. For instance, Taobao, Alibaba’s leading

online shopping website with over 500 million users, applies AI across

the entire customer journey: from product discovery to purchase

decision, delivery and after-sale service. AI redefines the shopping

experience for millions of China’s online shoppers and merchants. Some

of these developments may be subtle to the consumers, but they actually

significantly improve the consumption experience. For instance, after

opening the shopping app, users will see virtual storefronts that

display information tailored to them as individual shoppers based on

their unique characteristics and preferences. The system is smart enough

to use users’ browsing history, shopping history and other interesting

behavioral traits that they leave online to create a list of products

and advertisements appropriate for each potential shopper. The product

search results also become uncannily precise. All of these features are

implemented in real time with the aim of increasing the opportunity to

match what a person wants with what is available. These AI-powered tools

are capable of increasing conversion rate (sales) by as much as 20%.

Customer-service chatbot is another example how AI is slowly changing how consumer service are delivered. Ali Assistant, Taobao’s customer chatbot, now handles more than 90% of customers’ queries. It can conduct both spoken and written queries, functioning as both a customer- service representative and personal shopping assistant. Ali Assistant not only can provide answers on specific transactions, it can also recommend products based on text, photo or voice description. The chatbot function not only assists in lowering cost and increasing customer service efficiency, it also provides a more friendly-efficient environment along consumers’ shopping journeys and increases the chance that consumers come back to the platform for future consumption. All these amazing capabilities are only made possible with the emerging AI technologies in the fields of voice recognition and natural language processing.

China Logistics

China has a gigantic online

shopping segment, which creates a substantial challenge – how to rapidly

deliver millions of packages daily to customers’ hands on a consistent

basis at a manageable cost? This is where AI can substantially improve

productivity. The combination of consumer behavioral data, real-time

warehousing and logistical data, as well as automation of warehouses

allow delivery companies to speed up the delivery time and optimize the

utilization of infrastructures (e.g. warehouses and trucks).

One of

the best examples of this in China is Alibaba’s Cainiao system, a smart

logistic system that can identify which box is required to pack items of

different sizes or weight, thus optimizing the use of materials. This

AI-driven solution already reduces the use of packing materials by more

than 10%. With the help of AI, the system can also determine the fastest

and most cost-effective delivery routes to speed up parcel delivery. In

addition, it helps online and offline merchants to forecast product

demand, and thus prepare and allocate the appropriate level of

inventory. As a result, merchants can reduce working capital cost and

minimize the loss of revenue due to out of stock popular items.

AI’s

ability to efficiently handle large volumes of data to generate a useful

prediction or action also applies to other logistics needs. For

instance, China’s food delivery market (with 18 million orders per day),

represents nine times the size of the US market and faces a daunting

challenge to deliver time-sensitive goods (such as hot food) to feed

hungry clients quickly. Meituan-Dianping, a leading food delivery

application in China, uses the logic discussed previously in its AI

engine to generate the most time-efficient delivery routes. Meituan’s

o2o Real Time Logistic Dispatch System is an engine that uses predictive

modeling to support millions of orders between restaurants and

customers every day with an average delivery time of less than 30

minutes.

Transport generally poses greater problems in China than in

the rest of the world because of the country’s high density. For

example, some of its major cities are as big as five cities in other

parts of the world. Didi Chuxing, a leading ride-sharing application in

China, operates on a scale which is five to six times larger than that

of its US competitors in its home market. The company uses AI, by taking

into account weather, car numbers, customer profile and road conditions

to forecast rider demand and car supply 30 minutes in advance with over

80% accuracy. By deploying AI, the system dispatches drivers in advance

to meet potential demand and provides the most efficient route so that

drivers can pick up customers and deliver them to their destinations in

the shortest time. In Hangzhou, the government partners with Alibaba to

deploy a smart city system to manage the city’s traffic flow by using a

combination of AI powered traffic light and accident detection systems.

The city’s traffic congestion is reduced by 10% as a result.

South Korea healthcare – AI accelerates discovery

In

January 2018, Seegene Inc., a South Korean biopharmaceutical company

that manufactures In Vitro Diagnostic (IVD) products, became the first

company in the world to have successfully developed diagnosis reagents

using a newly created AI based system. The company set up the system

with data on pathogen and disease information accumulated over the last

15 years. This approach simplified a complex research and development

process through its self-developed algorithm and virtual experiment,

reducing the development period from a typical one year to just four

days. In general, a researcher needs to examine 200 to 300 cases of data

each year to develop a new drug. An AI system can parse through more

than 1 million dissertations and clinical test data for 4 million people

during the same period.

Besides Seegene, many other Korean

biopharmaceutical firms are actively leveraging AI in their research and

development process. In December 2017, CJ Healthcare Corp signed an

agreement with genome and exome data analysis firm Syntekabio Inc. to

co-develop a new anticancer immunotherapy using an AI model. Dong-A ST

Co. has been collaborating with the u-Health Information Research

Institute at Ajou University since 2016 to develop new drugs by

analyzing data on patients’ medical records.

Russia oil & gas – AI reduces costs and errors

In

June 2017, Gazprom Neft, an integrated oil and gas company in Russia,

signed a Cooperation Agreement with Yandex, Russia’s leading internet

search company, on implementing AI-enabled projects in the oil and gas

sector. The two parties are developing Russia’s first integrated

platform for the processing and interpretation of seismic data, a

platform to support the entire seismic-survey cycle. AI helps reduce the

significant costs that are typically incurred in managing disjointed

data and modules. The end goal of the platform is to develop cognitive

assistants that will process information and carry out calculations in

order to provide engineers with pre-prepared solutions for further

actions.

AI ecosystem beyond platform companies

Semiconductor

With

more data collected, demands for computing power and storage memory

have skyrocketed. In the driverless cars industry, Google and Intel

estimated that there would be 4TB of raw data, or 400GB of compressed

data, collected in an average 1.5-hour driving day. The large amount of

data increases demand for servers, which are needed to store and process

data with low latency. Alliance Bernstein estimated last year that

cloud servers would grow 50% and enterprise servers would grow 25% by

2025.

Within DRAM memory alone, analysts estimate that revenue

derived from assisted driving and data centers will increase to $24

billion by 2030. Memory is just one example in the downstream

semiconductor sector that is set to gain from the AI revolution. All

parts of the value- chain, including silicon wafer, chips, and foundry,

will benefit from the megatrend. Semiconductor strongholds Taiwan and

Korea, and even newcomer China, should benefit.

Metals

One of the most exciting AI applications is the eventual shift to autonomous driving. Electric vehicles are often deemed the ideal solution for autonomous vehicles, from both an environmental and an engineering standpoint. Adding autonomous driving equipment to a car adds weight, aerodynamic drag, and electrical power consumption, leading to increased fuel consumption. However, with electric vehicles, emissions can be reduced by 55% to 65%. On the engineering side, there are much fewer moving pieces in an electric vehicle, resulting in less room for mechanical failure.

Should the world reach a 100% electric vehicle adoption, demands for

many metals will skyrocket. The vast opportunity lies in not only the

battery packs but also the body and the motor. These estimates do not

yet include the additional demand created from complementary

applications such as grids and charging infrastructure, applications

that accelerate the need for metals. While electric vehicle adoption is

still nascent, investment and consolidation in the metal industry have

picked up significantly.

Cobalt, an essential metal in cathodes, is

constrained by supply in tonnage and origin. Almost 60% of the world’s

unrefined cobalt output in 2017 came from the Democratic Republic of

Congo, whose output was more than 10 times that of the second producer

Russia. The price of cobalt has nearly tripled in the last two years,

surging 129% in just 2017. Players along the value chain scramble to

secure additional supplies. GEM, a China-based battery producer and

recycler, struck a deal in March this year to buy a third of the cobalt

output from projects owned by international commodities major Glencore

over the next three years.

On the lithium front, even though it is

not as supply-constrained as cobalt is, suppliers have quickened the

pace in reaching greater concentration in an already oligopolistic

market. In May this year, China-based Tianqi Lithium agreed to buy a

23.8% stake in Chile’s Sociedad Quimica y Minera for $4 billion USD. The

acquisition will boost Tianqi’s global share of the metal’s output to

18 % from 13%.

In addition to cobalt and lithium, other EM mining

firms such as Norilsk Nickel (Nornickel) in Russia and Vale in Brazil

are also principal players in the race for electrification. Nornickel is

the world’s leading producer of nickel, palladium and copper. Vale is

the largest producer of iron ore and nickel in the world, and an

important producer of manganese, copper and cobalt.

For most of the EM countries, especially in Latin America, South East

Asia and India, digitalization and 4G are still novel concepts. For

example, the average 4G penetration in Latin America is just 17% and

only 26% of total subscribers are on post-paid plans. However, as the

economy recovers and as rollout for end-applications using digital

services accelerates, growing evidence shows that customers are willing

to pay more for better connectivity and network coverage. As 4G

penetration deepens, the percentage of post-paid subscribers should

therefore rise, enhancing the value proposition and monetization of

telecom operators.

In more advanced EM countries, such as China and

Korea, operators are moving into 5G deployment and value-added services

such as payment, e-commerce, Internet of Things and data center, riding

the AI growth wave.

Why is investing in emerging markets AI attractive?

China

is an interesting case as to why so many AI-related investment

opportunities are emerging. Firstly, China has a large data pool across

many verticals and industries. The country has over 900 million

smartphone users with easy internet access (four times the number in the

US or India), the market is also an eager adopter of leading

technologies in their daily lives. For instance, the total value of

mobile payment transactions in China is more than 10 times that in the

US. Digital penetration is very high across a range of day-to-day

applications, ranging from retail and travel to entertainment and local

services. This large volume of data generated by various applications

form the backbone of AI development.

Secondly, China has a large pool

of low-cost engineering talent. Every year, 3-4 million students

graduate in math, science and engineering or technology related

disciplines vs. approximately 500,000 in the US. Today, China has the

world’s highest number of R&D personnel, three times the number in

the US. China’s large economy and booming business opportunities mean

Chinese technology companies can now compete with western firms in

hiring the most talented engineers. Chinese companies have opened

research labs in Silicon Valley and offer comparable salaries.

Last

but not least, the Chinese government is highly supportive of AI

development and is already setting the goal of positioning the country

to be a major AI innovation hub in the next decade. In 2015, the Made in

China 2025 policy was announced by the State Council – the first

ten-year action plan that calls for green, innovative and intelligent

manufacturing in China. In the “Internet+” Action Plan, the plan listed

AI as one of its 11 key focus areas. In 2016, the Chinese government

published the Three-year Implementation Plan for “Internet Plus”

Artificial Intelligence. This identifies six specific areas of support

for AI development, including capital funding, system standardization,

IP protection, human capital development, international cooperation and

implementation arrangement. The importance of AI was reiterated in 2017,

with the government’s New Plan on Artificial Intelligence Development,

in which China’s goal is to catch up with global leaders and achieve

world-leading positions in AI by 2030 by solving issues such as a lack

of high-end computer chips, software and trained personnel. The

government looks set to play a growing role through policy support and

regulation. It expects China’s overall AI industry to be synchronized

with international development, and to lead the global market in

system-level AI technology and applications.

Most EM countries have favorable policies toward AI adoption. According to SAP, more than half of 1,500 AI research projects in Russia in the past decade were paid for by the state2. Hungary and Poland have actively supported the growth of start-ups by setting up special economic zones, investing in infrastructure, and providing tax breaks. In the UAE, the government just appointed its first minister for AI in October 2017 and it launched a $270 million Dubai Future Endowment Fund in the same year. Saudi Arabia shares a similar ambition to invigorate the economy through innovation in the National Transformation Program 2020 and Vision 2030 programs announced in 2017. In November 2017, Saudi Arabia’s Crown Prince Mohammed bin Salman also pledged $500 billion to build a new, high tech city called Neom on the Kingdom’s Red Sea Coast.

Future development

For

EM markets as a whole, some existing structural issues should get

resolved in the short to medium term. Currently, lack of talents is the

most commonly cited reason for the gap in AI development that exists

between developed and emerging markets. Many countries also lack

infrastructure. However, the long-term attractiveness of AI investment

and the rapid adoption in EM are clear trends. Many foreign owned

companies have long deployed resources in EM. For example, in India 58%

of the companies are using AI at work at scale4. The sector is dominated

by foreign firms such as Accenture, Microsoft, and Adobe, all of which

have their innovation centers in India. Foreign presence in the country

is an important step to AI adoption as it helps raise awareness and

educate the local workforce.

In China, the country is gradually

narrowing the gap with developed markets in some key technology building

blocks. China has already outstripped the US in terms of AI research

publication and citation. It is already spending more than the European

Union in terms of R&D and the spending gap with the US continues to

narrow quickly. Today, China has over 600 AI start-ups, making it

already second only to the US. Since 1999, China has invested about USD

10 billion in AI, again bringing the nation second to the US (with USD

16 billion). As detailed previously, an increasing number of leading AI

talents are coming back to China to work for local companies. China is

seeing the rapid emergence of domestic technology leaders, such as

Baidu, Alibaba and Tencent. These companies have participated in over

300 AI-related equity deals since 2014, over 50% of which have been

outside China. They have created investment and research centers around

the globe including in the US and Israel. AI-related investments in

China are also slowly diverging beyond the popular fields (e.g. computer

vision and voice recognition)

Conclusion

In short, despite a number of challenges, AI could bring many new opportunities to emerging markets. A number of markets, such as China, are already progressing at the forefront. More companies from the region are well positioned to benefit from AI, either as technology drivers of AI or as the early adopters of AI in traditional industries.

Diesen Beitrag teilen: