Janus Henderson: Recession must not quickly follow inversion

Market conditions do not currently support the contention that the US economy must soon be headed for contraction after 3-month Treasury yields moved higher than 10-year rates at the end of March.

18.04.2019 | 08:18 Uhr

If you want to know what is likely to happen next, should you take your cue from history? It is a fact that every recession since the 1960s was preceded by an inversion of the Treasury yield curve – where long-term rates drop below those of shorter-dated bonds – a year or so before.

On 22 March 2019, the yield on the benchmark 10-year Treasury note fell to 2.42 percent, dropping below rates on 3-month bills for the first time since July 2007. The logical conclusion is that if a recession followed the past six inversions, the next one must be on the way.

Fact versus belief

That is not a fact but is a belief that has permeated the investment community, with many market commentators citing prior inversions to confirm their conclusion that a recession must now be imminent. This classic example of data mining has led market participants to compromise their objectivity by keying in on data that underscore and support pre-existing beliefs without testing whether current underlying economics could lead to alternative explanations. That is the danger we now face.

Objectivity should lead to questions about why the yield curve inverted, because an inversion caused by rising front-end rates is very different economically to one driven by falling back-end rates.

Bull or bear inversion?

The key difference is in the price of money. Recent inversions have been driven by front-end rates rising as the US Federal Reserve (Fed) rapidly tightened monetary policy to fight inflation and counter a policy that might have been too stimulative, for too long. This caused front-end rates to rise well above inflation, making money expensive. Simplistically, overnight lending to a credible party is a near riskless activity, which should not return much more than inflation, so a large premium in excess of inflation means money is expensive. In historical inversions, money became very expensive, which naturally caused a drop in economic activity. We can call this a ‘bear’ inversion.

But this time around, rather than an aggressive Fed raising rates to curtail inflation – as prices appear to be in check – the inversion has been caused by the return of a dovish and accommodative central bank, which has pushed yields down across the curve, with those on longer-dated bonds dropping more. You could term this a ‘bull’ inversion.

Crucially, at no time during the Fed’s current tightening cycle – when it raised rates nine times – or after the inversion did front-end rates jump well above inflation, which would have made money expensive. Rather, a fundamental difference between the latest inversion and those of the past is that money remains fairly priced. At the time of writing, the yield on 3-month Treasury bills is just 30 basis points (bps) above core inflation (100 bps = 1%). By contrast, prior to every recession since 1960, the 3-month yield exceeded inflation by almost 200 bps. Money is relatively cheaper today than before prior corrections.

Looking beyond the Treasury curve

So we are sailing in unchartered waters with no historical examples to help indicate how the current situation might play out. Perhaps it’s wrong to place so much weight on the current shape of the Treasury curve, which likely has been distorted by years of extremely accommodative monetary policy. It might be prudent to look at other markets as a more reliable barometer of economic health. Credit curves, for example, tell a very different story.

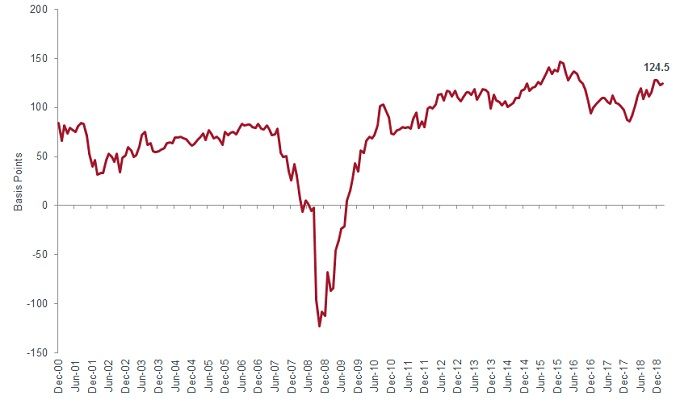

The difference in the credit spread between short and long-dated US corporate bonds is around 120 bps, well above its average of 80 bps since 2000. As shown in chart 1, this credit spread last inverted in March 2008, about five months before the Global Financial Crisis.

Chart 1: undistorted credit curves show no sign of inversion

Source: Barclays US Long Credit Index and Bloomberg Barclays US 1-3YR Credit Index. Data are monthly and from 29/12/00 to 28/2/19. This graph shows that the difference between long-dated corporate bonds and short-maturity credit spreads is far from inversion, with investors receiving 124 bps more yield to hold long-dated bonds over short-dated debt.

Nor are equity markets signalling imminent recession. On the contrary, they are forecasting growth. The upside implied by calls versus the downside implied by puts on the S&P 500 index are trading near average levels, while calls and puts for international equities are trading above average levels.

So what should investors conclude from the inversion of the 3-month to 10-year part of the Treasury yield curve? While the abnormal shape of the Treasury curve demands attention, years of monetary easing have created a unique set of circumstances, making it tough to conclude with any certainty that inversion inevitably means pending recession.

Sometimes, history tells us a lot to help us predict the future; sometimes it tells us little. In this instance, it might not be prudent to give too much weight to recent experience.

Reproduced here with permission and under license from Bloomberg. First published on 8 April 2019 at https://www.bloomberg.com/opinion/articles/2019-04-08/yield-curve-inversions-and-recessions.

Diesen Beitrag teilen: