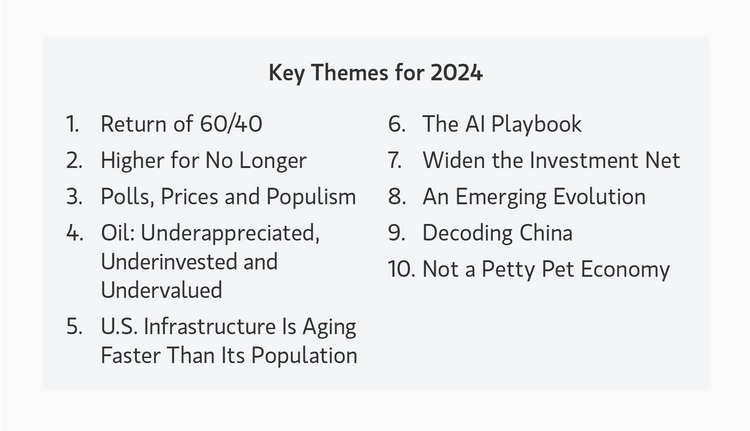

Morgan Stanley IM: Key Themes for 2024

Jitania Kandhari, Deputy CIO, Solutions & Multi Asset Group; Head of Macro & Thematic Research, Emerging Markets; Portfolio Manager, Passport Equity, outlines her Key Themes for 2024.

07.02.2024 | 06:36 Uhr

In the post-COVID world, many anticipated a shift in how economics, politics and finance would function. Instead, we are seeing signs of a reversion to familiar patterns. “Higher-for-longer” interest rates, a response to the inflationary pressures post-pandemic, may not be as prolonged as some had forecasted. The transition to green energy, seen as a swift response to climate change, is proving to be more gradual. Global populism, a fallout of increased inequality, may be peaking. The traditional 60/40 investment portfolio, thought to be outdated after a dismal 2022, is back. Artificial intelligence (AI), while transformative, will disperse throughout society and eventually trend toward becoming a commoditized service: important and influential, but not necessarily sensational. Read more in our Key Themes for 2024.

Diesen Beitrag teilen: