Columbia Threadneedle: The right locations

Looking for pockets of value in European real estate credits. We explain why select BBB- rated bonds look attractive and highlight datacentres and German residential as favoured subsectors.

11.12.2023 | 07:08 Uhr

Our annual investment grade European real estate roundtable concluded that the sector offers potentially strong risk-adjusted returns over the medium term. While balance sheets are under pressure, operational performance is resilient and managements are taking bondholder-friendly actions. That contrasts with sentiment that’s still driven by news from particularly troubled areas, such as the Nordics or the office sector. By contrast we favour datacentres and German residential, and see real value among select bottom-tier investment grade bonds.

Sector yield spreads have only retraced half their 2022 blow-out

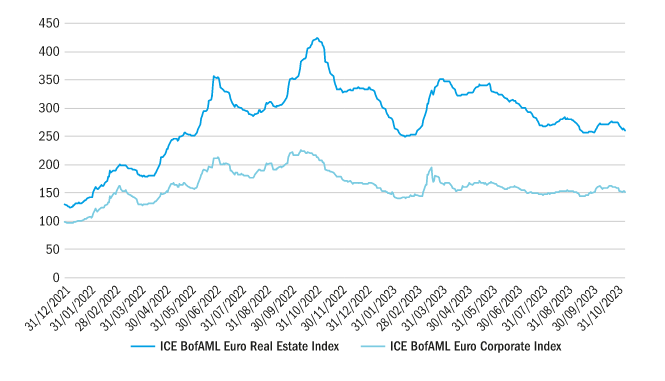

The 2022 “annus horribilis” saw spreads for the European real estate sector investment grade (IG) bonds widen by nearly 300 basis points (bp) at their peak, compared to 125 bp for European investment grade (IG) overall.

European real estate vs European IG spreads

Source: Columbia Threadneedle Investments, November 2023

Despite this year’s recovery, IG real estate bond spreads remain twice the level they started 2022 and at a much wider premium to the European IG market.

Within real estate, the best risk-adjusted value appears in the BBB- rated, bottom tier of investment grade bonds, where the average yield spread implies credit downgrades to the high yield segment. We think that the market is unfairly penalising this group as a whole and see strong risk adjusted returns opportunities for a select number of issuers where we can demonstrate robust bottom-up research-led security selection.

Resilient trading helps managements improve creditworthiness

Occupancy has remained broadly stable across European real estate markets, given constrained supply, while inflation-linked rents have supported revenues. However, as debt is refinanced, higher funding costs will impact cashflow. Interest rate coverage has dropped, and we forecast a further 25% drop in the next couple of years. However, most of the investment grade names we cover should remain comfortably above their downgrade thresholds.

Balance sheets have also deteriorated, hit by the fall in real estate asset valuations. Loan-to-value (LTV) ratios rose by an average of 5% over the past year in our research coverage universe. However, we believe we are close to the end of the real estate price readjustment especially for listed REITs compared with private ownership. This stabilisation of European real estate asset prices should unlock investment markets, facilitate disposals programmes, while greater liquidity and transparent pricing will reduce the risk premium for the real estate.

De-leveraging is now a priority for most REIT management teams, through dividend cuts, lower development budgets, asset disposals and debt refinancing. This bondholder-friendly stance should help support credit ratings. While new bond issuance was closed until very recently for many companies, bank financing remains open at margins which are often a fraction of current bonds spreads. We see a high likelihood of bond tenders for those companies whose bond spreads are the widest. We also note that a small number of European REITs have recently successfully issued in the EUR bond market, which could improve the hopes of many issuers executing bond refinancings in the short term. There is almost EUR40bn of EUR real estate debt to refinance in the next two years.

We favour datacentres and German residential

We remain most constructive on the datacentre space. A lack of supply due to planning and power grid constraints in major European metro markets is set against strong demand for cloud-computing and AI. European residential, especially in Germany, also remains a favoured sector given migration into top cities and low supply due to planning and development constraints, while long leases with indexation and low tenant churn provide cashflow visibility.

We have adopted a more cautious stance on logistics, as we see a normalisation of demand due to the manufacturing slowdown, easing of supply-chain issues and the reversion of e-commerce to trend growth after the pandemic boom. Offices remain our least constructive sub-sector, with headwinds from work-from-home, especially in the UK. However, we make a distinction between well-located buildings with strong green credentials in constrained central business district (CBD) markets and non-prime stock, especially if in need of investment to meet modern standards. We are currently cautious towards the Nordic regional markets. Here we see elevated refinancing risk, weak credit metrics, sub-benchmark governance practices, and an overdependence on local banking and investor base.

Diesen Beitrag teilen: