Janus Henderson Investors: Immobilienaktien - Ruhe bewahren und langfristig investieren

Ein Kommentar von Guy Barnard, Tim Gibson und Greg Kuhl vom Global Property Equities Team bei Janus Henderson Investors.

25.03.2020 | 09:45 Uhr

Die drei Finanzexperten geben darin einen aktuellen Überblick über die Immobilienmärkte und die Auswirkungen des Coronavirus auf die Investitionsentscheidungen des Teams.

Kernaussagen

Der weltweite Ausverkauf von Vermögenswerten hat zwar auch vor Immobilienaktien keinen Halt gemacht, die einzelnen Subsektoren des Immobilienmarkts sind jedoch unterschiedlich stark betroffen

Die Bewertungen börsennotierter Immobiliengesellschaften liegen nahe den Tiefstständen während der globalen Finanzkrise. Doch obwohl diesmal Auswirkungen auf die künftige Nachfrage zu erwarten sind, scheinen die Cashflows und die meisten Bilanzen widerstandsfähiger zu sein, als der Markt derzeit anerkennt

Anlagen in Immobilienaktien können zwar kurzfristig volatiler sein, eröffnen langfristig aber auch die Möglichkeit, unterhalb ihres immanenten Werts in Immobilien zu investieren

Der vollständige Kommentar in englischer Sprache

We have seen a broad-based sell-off in global assets in recent weeks as investors (including ourselves) come to terms with the growing impact of the COVID-19 coronavirus, and an effective shutdown of many economies. The latest phase of the sell-off and extreme volatility seems to be driven by a general unwinding of risk and a scramble for liquidity across all asset types. Correlations among asset classes, countries, sectors and individual securities have increased and there have been few places to hide.

Evidence that ‘a rising tide does not lift all boats’

This same trend is being felt across listed real estate markets where property shares in most geographies and property types have been impacted. That said, we are seeing a distinction between different sectors, which are being impacted to differing degrees, and at different rates. Retail-focused companies, as well as those with hotel exposure and weaker financial positions are seeing the sharpest falls. Here, we do expect downward earnings revisions and dividend cuts, and indeed this is already occurring for some retail and hotel landlords. Already stretched balance sheets, particularly among retail companies, may also lead to the need for additional funding if these challenging conditions persist. Having previously identified retail and hotels as sectors as weak links based on their supply and demand characteristics, we have minimal exposure here and the effects of virus containment efforts have only served to accelerate an ongoing negative structural trend.

Focus on fundamentals

While the de-rating in shares has been painful to watch, we continue to believe that the companies we hold have far more defensive income streams, robust balance sheets, lower leverage and more diverse sources of funding than current share prices give credit for. Hence we do not yet see this as a credit crisis issue as it was in 2008-9. In our view the value of these robust income streams will come to the fore when market volatility subsides.

Those parts of the real estate market that are most stressed are areas we felt were already under structural pressure and have been avoiding. Conversely, areas we have favoured such as logistics, manufactured housing, cell towers and affordable rental housing have proved more resilient. As a result, we have not made many meaningful changes to our overall positioning, helped by the greater emphasis we had already placed on balance sheet quality and our investment processes embedded top-down macro risk controls.

Our portfolios remain overweight to the logistics market where the current backdrop is supporting the acceleration of the structural shift toward online shopping and reinforcing demand from their tenant base, an example being Amazon’s recent comments around further expansion with the addition of 100,000 extra warehouse and delivery staff in the US alone. How many people using online grocery shopping for the first time will continue to do so even when the coronavirus lockdowns are lifted?

Portfolio holdings in gaming real estate investment trusts (REITs) in the US have been impacted, along with certain stocks with exposure to property development globally. However, we have maintained our positioning given the team’s longer-term investment focus.

Are current valuations justified

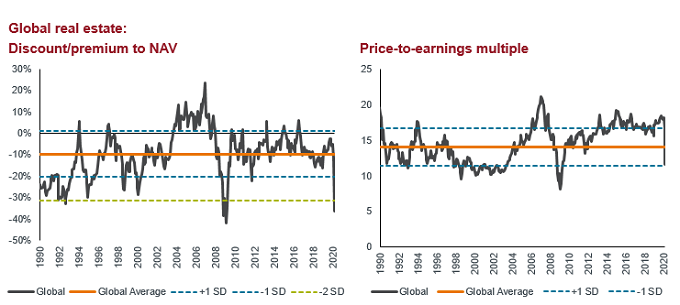

Clearly, the situation is incredibly fluid, and our conviction has to be lower, but we do continue to believe that those parts of the market offering more resilient cash flows can benefit from the resulting ‘zero rate world’ we may likely be in again. Indiscriminate selling creates opportunities and the moves of the last few weeks have been in extreme in a historical context. Listed property valuations are close to the low levels seen during the Global Financial Crisis (see charts below) and while this time is different and will likely impact future demand, there looks to be greater resilience in many property companies’ financial health than the market is currently giving credit for. Therefore we think it is reasonable to expect some re-rating from current levels in the medium term.

Last week, global real estate stocks underperformed wider equity markets, as fixed income, notably credit markets, became more disorderly. Central bank actions to give greater confidence here need to be watched closely.

Source: Worldscope, I/B/E/S, Refinitiv Datastream. Charts reproduced with permission. NAV= net asset value, SD= standard deviation. Past performance is not a guide to future performance. Estimated data may differ from final figures.

In the short term, markets will remain volatile and investing in this backdrop can be inherently uncomfortable. Before the market begins showing sign of normalisation there are several criteria that we think are needed:

- Peaking or signs that the coronavirus is being contained (especially in Europe and the US)

- A return to the smooth operating of capital markets (fixed income in particular)

- Adequate policy response (both monetary and fiscal)

Our portfolios continue to invest purely in liquid real estate securities. While investing in listed real estate may lead to greater volatility in the short term, it also may create opportunities to access real estate for less than its intrinsic value, which we believe to be the case today.

At present we see many compelling opportunities in the listed property sector at valuations not seen for more than a decade. With many property companies providing resilient cash flows, the good news is that we are ‘still being paid’ by regular income as we wait for a re-rating.

Disclaimer

Die vorstehenden Einschätzungen sind die des Autors zum Zeitpunkt der Veröffentlichung und können von denen anderer Personen/Teams bei Janus Henderson Investors abweichen. Die Bezugnahme auf einzelne Wertpapiere, Fonds, Sektoren oder Indizes in diesem Artikel stellt weder ein Angebot oder eine Aufforderung zu deren Erwerb oder Verkauf dar, noch ist sie Teil eines solchen Angebots oder einer solchen Aufforderung.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fonds.

Der Wert einer Anlage und die Einkünfte aus ihr können steigen oder fallen. Es kann daher sein, dass Sie nicht die gesamte investierte Summe zurückerhalten.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Diesen Beitrag teilen: