NN IP: Credit markets face an eventful September

The post-summer credit supply poses a near-term risk for spread products. We closed our overweight US HY position due to investor outflows and limited expected oil price potential.

01.09.2017 | 12:46 Uhr

Since the crisis, spread products have been heavily supported by the easy monetary policies, conventional and non-conventional, developed by leading central banks. While fixed income in the broad sense has been the main beneficiary in terms of investor flows as a percentage of market capitalization over that period, spread products stand out even more favourably versus government bonds. Within spread products it has been the higher-yielding categories like HY and EMD that benefitted most from the multiyear trend of “search for yield”.

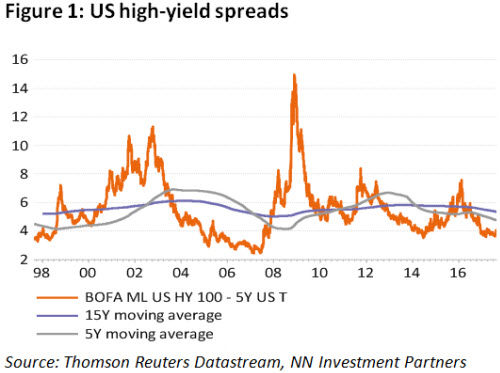

These relentless inflows in broad credits have squeezed spreads to levels not far removed from the current historic tights. As yields and spread levels tightened under the unabated force of easy monetary policy measures, longer-standing relationships between spreads and fundamental drivers have weakened. This appears to be the case for evolution of commodity prices, oil prices or macroeconomic surprises for example. In particular, spread levels in the last year have been less correlated to fundamental drivers than in the longer-term past. As such spread levels have tightened further despite declining commodity or oil prices this year. Similarly, momentum in economic growth surprises, which have been abating since March, has not prevented further tightening of spreads. By and large, this appears to be related to an easy monetary policy stance and investors’ expectations of a continuation hereof, or at least a gradual exit should these policies need to be normalized.

With subdued, below-target inflation in the US, Eurozone and Japan, investors feel strengthened in their expectations that monetary policy normalization, when it comes, is likely to be very gradual, regardless of current healthy cyclical momentum. By now this appears to be the consensus view. Of course, here lies an important risk. Any deviation from this view, being verbally by central bankers or in practice via QE tapering or interest rate hikes, may send flows in reverse. At that time, longer-term fundamental relationships with credits will re-establish themselves. Fixed income markets and spread products are therefore expected to remain at the mercy of central bankers in the foreseeable future. It currently represents a key current vulnerabilities for spread products.

In light of the current high dependency on monetary policy expectations, Jackson Hole unsurprisingly has been on investors’ mind. This year’s central banker jamboree, however, failed to alter the well-established view of gradualism in policy normalization. This may offer short-term relief, but with the Fed’s September meeting and the announced balance sheet unwinding soon upon us, the next hurdle is not far removed. The same goes for the ECB, which is soon expected to start debating “the way forward”.

September, therefore, presents itself as potentially eventful in this respect. With corporate bond supply simultaneously ramping up after some mild summer drought, especially in investment grade, credit markets appear more exposed and hence potentially volatile over this period. This volatility of course works both ways, but any further potential spread tightening or yield fall appears likely to fall short of a potential widening and credit yield increase in an expected asymmetric risk-return profile.

In our spread allocation we still like EMD, and we maintain a medium overweight EMD LC rates. EM monetary policy easing should further support local bonds. We also closed the underweight EMD HC sovereign. Indicators that improved recently, other than EM sentiment, are falling US Treasury yields and less-negative EM fiscal accounts. EM growth remains supportive while EM flows are resilient. In terms of relative valuation as measured by long term risk-adjusted spreads, EMD appears still attractive, in particular versus high yield.

With the closing of the overweight USD HY on August 21, global HY has been moved to neutral. EUR HY is also neutral. Valuation of HY, both EUR as well as USD HY, is unattractive currently with spreads not far removed from historic tights.

After tensions with North Korea intensified, USD HY witnessed a period of substantial investor outflows, the largest since May. Short-term momentum and sentiment indicators of USD HY have weakened recently. This was probably also related to increasing evidence of US policy ineffectiveness with expectations of expansionary US fiscal policy being priced out to a large extent, among other things. Moreover, indicators of US free cash flow and dividend growth have also weakened while liquidity as measured by the short term TED spread also worsened.

Oil prices, to which US HY in a relative sense is more correlated, may also have limited upside from here for the near term. Seasonality worsens from September on, with the end of US driving season and refineries going into maintenance. Also, speculative positioning in crude oil is again relatively high net long. This is mainly a result of substantial short-covering, indicating a less supportive technical picture. Meanwhile further producer hedging has also occurred.

Diesen Beitrag teilen: