Morgan Stanley IM: Seeking Value in European High Yield

A closer look at the European High Yield sector reveals an improvement in quality over the long-term. Read why the Global Fixed Income team believes there is a compelling case to be made for investing in this sector in 2021.

01.02.2021 | 08:00 Uhr

Here you can find the complete article

At a glance, European high yield looks, at best, fairly valued and at worst, expensive. A common statistic used to support this notion is that credit spreads for the asset class are trading well through long-run averages. However, when you dig deeper, you will find that the asset class has improved in quality over the long-term and, especially, since the beginning of the pandemic. When you combine this evolution with valuation in a post-Draghi paradigm, and the significant potential for compression, we believe there is a compelling case to be made for investing in European high yield.

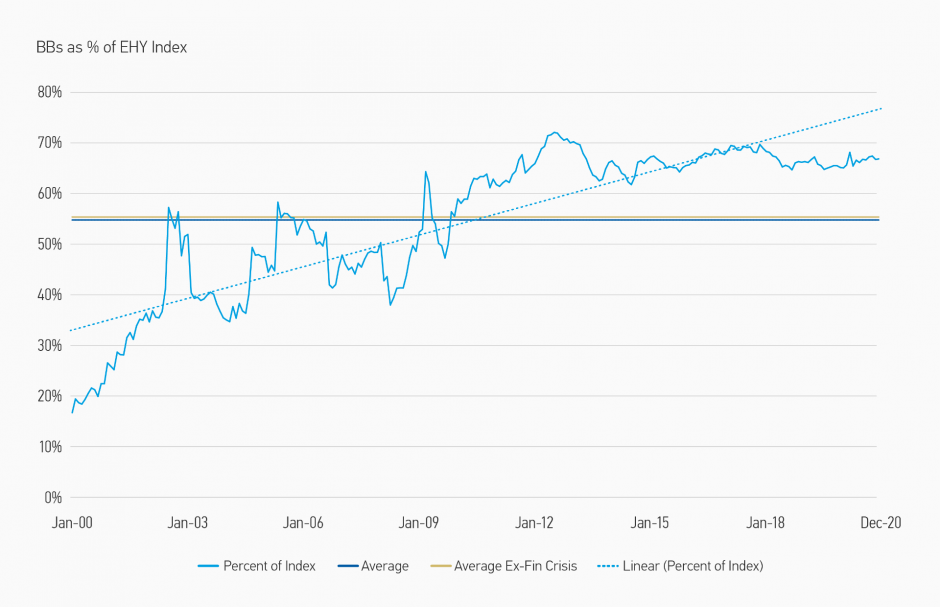

IRONICALLY, EUROPEAN HIGH YIELD HAS EVOLVED TO BE A HIGHER QUALITY ASSET CLASS OVER TIME. One of the key themes for 2020 was the large volume of “fallen angels” entering the high yield market. Whilst the phenomenon was expected to be negative due to the increase in supply without offsetting demand, we have seen fallen angels be readily absorbed into market and, in many instances, outperform upon downgrade into high yield. Furthermore, this steady supply of fallen angels has insulated the index from deteriorating in quality as a result of BB to B and B to CCC downgrades driven by the pandemic; in fact, the percentage of BBs in European high yield has increased over the course of 2020, moving from 64.7% to 66.9%1 (Display 1).

Display 1: The quality of European high yield has improved over time

Source: Bloomberg Barclays, MSIM. Data as of December 31, 2020. European High Yield represented by the Bloomberg Barclays Pan-European High Yield Index.

The index is for illustrative purposes only and is not meant to depict a specific investment.

IN SPITE OF THE EXTRAORDINARY ENVIRONMENT WE EXPERIENCED IN 2020, DEFAULT RATES IN EUROPE HAVE REMAINED MUTED, particularly compared to levels seen in the financial crisis. The default rate was 3.3% in 2020, a far cry from 10% in 2009 during the last crisis. This can be attributed at least partially to the speed and strength of the fiscal and monetary policy response. However, not all credits were insulated.

The lockdowns seen across the world accelerated trends that were present in the market before the pandemic began. Companies with unsustainable capital structures and/or obsolete business models were forced to confront longstanding issues and, in certain cases, restructure.

There have only been 12 defaults in our investable universe since March 31, 2020, but we estimate that that cohort represents nearly 110bps of OAS that was removed from the index.2 This too has, in our opinion, contributed to the improvement in the quality of the index.

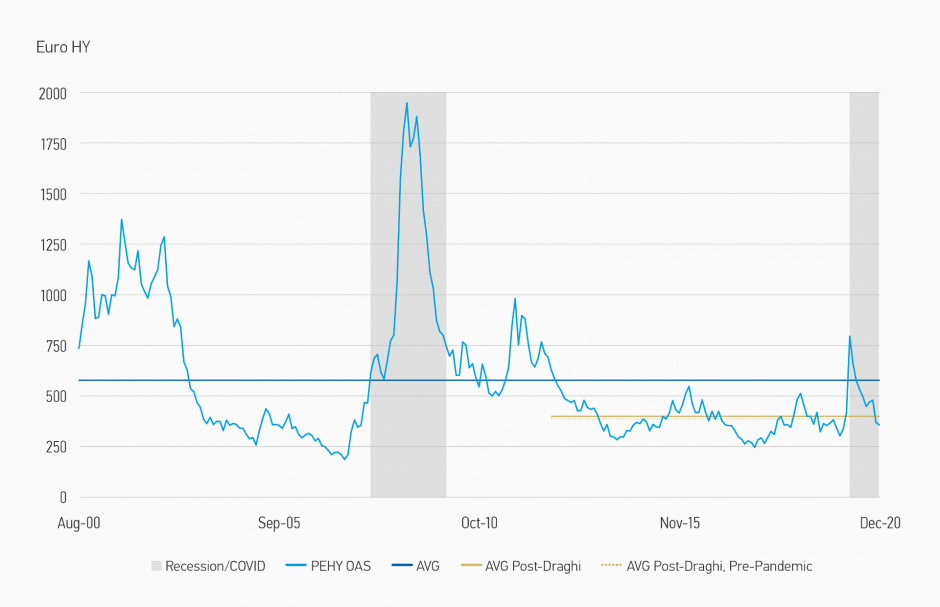

THE SUPPORT OF THE CENTRAL BANK AND THE TRICKLE-DOWN EFFECT OF THE CORPORATE SECTOR PURCHASE PROGRAMME (CSPP) ON EUROPEAN HIGH YIELD SHOULD NOT BE UNDERESTIMATED when thinking about valuation, particularly in the context of a higher quality market. The statistic of where we are today versus long-term averages is oft-cited as support that the asset class is tight. However, the current European high yield market OAS trades near the OAS average since Draghi’s “Whatever It Takes” speech, a pivotal discourse that marked a paradigm shift in Europe (Display 2). We believe that this is the most important long-term valuation metric today. As volatility decreases while we edge towards recovery and monetary policy conditions remain easy, there is the potential for spreads to tighten through these long-term averages.

Display 2: After spiking early in 2020, spreads have returned to “Post-Draghi” averages

Source: Bloomberg Barclays, MSIM. Data as of December 31, 2020. European High Yield represented by the Bloomberg Barclays Pan-European High Yield Index.

The indices are for illustrative purposes only. Past performance is no guarantee of future results. See Disclosures for index definition.

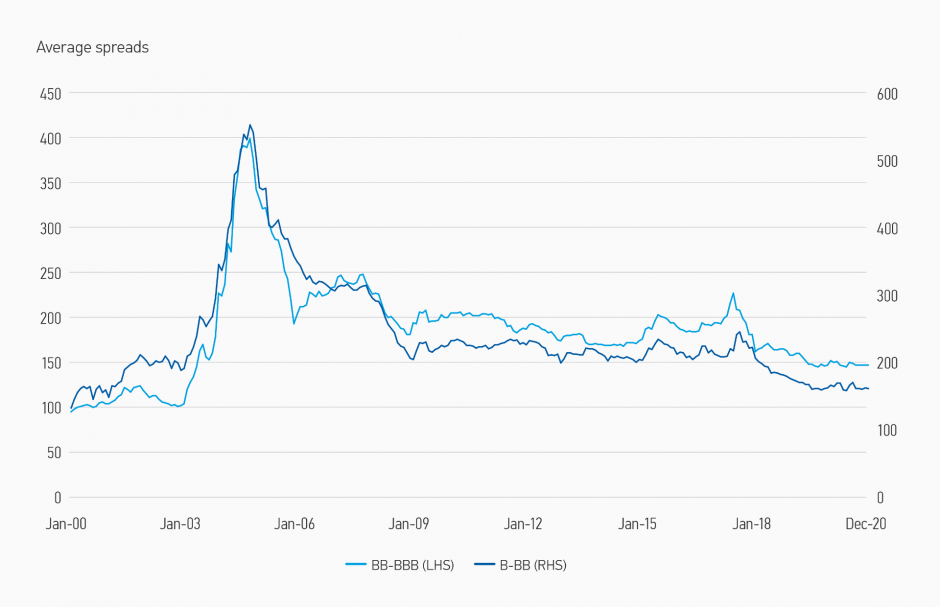

ECONOMIC RECOVERIES TEND TO COINCIDE WITH COMPRESSION WITHIN HIGH YIELD AS AN ASSET CLASS, and we are still wide relative to the tight BBB/BB and BB/B spread levels we saw in just January of 2020. As we inch closer to the recovery, history would suggest that we should see compression within the ratings spectrum. This, in addition to the relatively high carry on offer, is why we believe European high yield presents itself as an attractive opportunity.

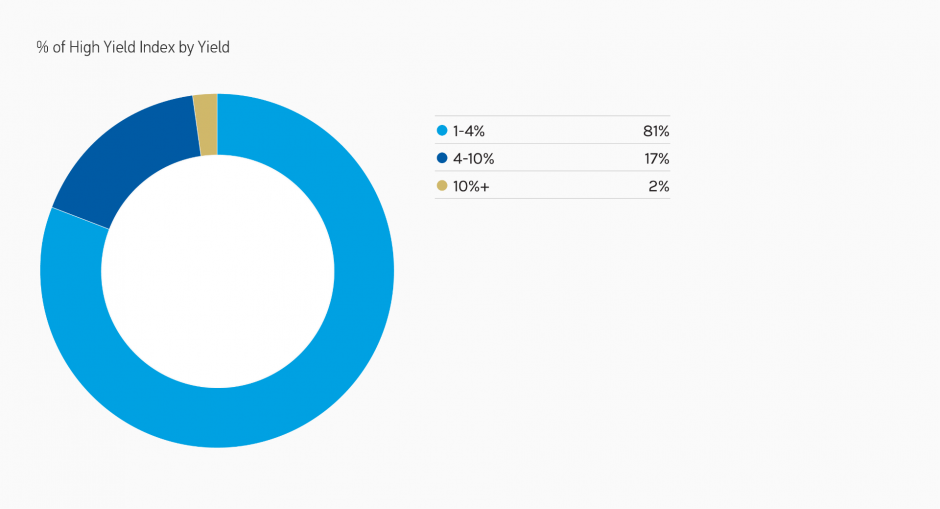

However, passively owning high yield alone is not compelling. The European high yield index yields 2.95%,3 but 17% of that index yields between 4-10%. That 17% consists of several types of companies, many of which were hard hit by the pandemic (Display 3). With defaults rate forecasted to be below 5% in 2021, it is implied that several of these companies will survive and experience capital appreciation in a vaccine-led recovery. Another potential driver of returns will be identifying and investing in companies that were severely impacted as a result of the pandemic but, using rigorous bottom-up fundamental analysis, have been identified as companies that will survive.

We believe this is where the major opportunity for 2021 lies; getting security selection right in this part of the investable universe will drive returns for active asset managers.

Display 3: Active management can help find yield potential among investable high yield universe Average spreads

Source: Bloomberg Barclays. Data as of December 31, 2020.

Source: Bloomberg Barclays. Data as of December 31, 2020.

European High Yield represented by the Bloomberg Barclays Pan-European High Yield Index.

The indices are for illustrative purposes only. Past performance is no guarantee of future results. See Disclosures for index definition.

Risk Considerations

There is no assurance that a Portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the Portfolio will decline and that the value of Portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this Portfolio. Please be aware that this Portfolio may be subject to certain additional risks. Fixed income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. High-yield securities (“junk bonds”) are lower-rated securities that may have a higher degree of credit and liquidity risk. European Investments Risk. Adverse political, social or economic developments in Europe, or in a particular European country, could cause a substantial decline in the value of the Portfolio. In addition, because investments are concentrated in Europe, performance may be more volatile than a more geographically diversified set of investments. If one or more countries leave the European Union (“EU”) or the EU dissolves, the world’s securities markets likely will be significantly disrupted. The financial instability of some countries in the EU together with the risk of such instability impacting other more stable countries may increase the economic risk of investing in companies in Europe. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. Foreign securities are subject to currency, political, economic and market risks. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed countries. Past performance is no guarantee of future results.

Diesen Beitrag teilen: