Morgan Stanley IM: Assess, Engage, Perform - The Value of ESG Integration within High Yield

The high yield market provides both challenges and opportunities when it comes to integrating Environmental, Social and Governance (ESG) considerations into the investment process.

01.03.2021 | 11:20 Uhr

Here you can find the complete article

The primary challenge comes from availability and quality of data, compared to investment grade names. The opportunity, however, is compelling. By systematically integrating ESG into the investment process, we believe we have the ability to more effectively manage risk and capture alpha. In 2018, we launched and integrated our proprietary Morgan Stanley Investment Management ESG credit scoring framework.

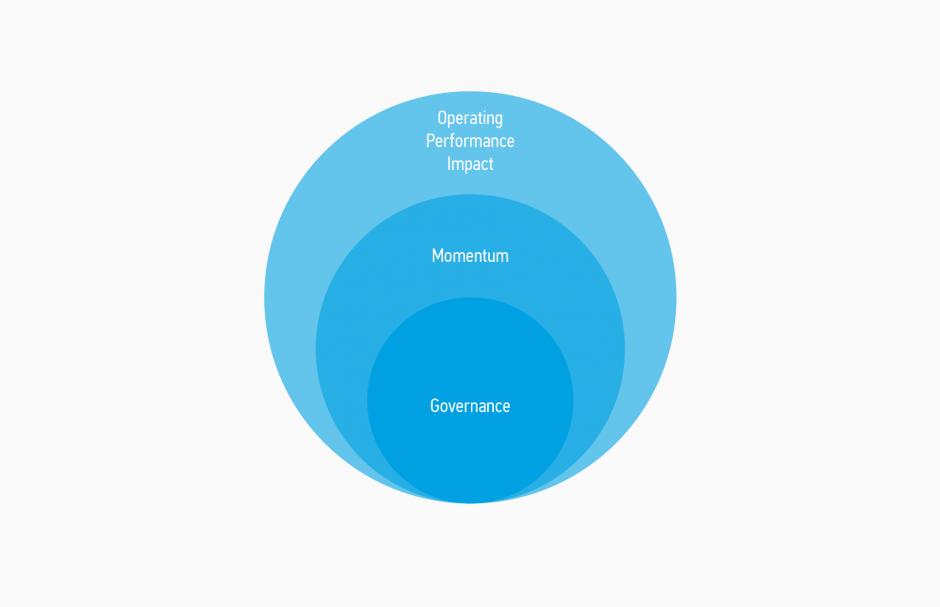

While ESG has always been a core part of our team’s credit analysis, our approach to sustainability has continued to evolve, and we have now formally defined and labelled it. Since then, we have used our ESG pillars (Display 1) and proprietary scores as another factor to consider when making investment decisions. 2020 was a tumultuous year, but on the positive side, it has further raised awareness of sustainability factors and the importance of establishing constructive communication channels between investors and companies. In this paper, we provide tangible examples of how our ESG framework has helped to contribute to both alpha generation and risk mitigation in our high yield portfolios last year.

Display 1: MSIM Fixed Income’s Key Pillars of ESG Analysis in High Yield

Source: Morgan Stanley Investment Management

The charts represent how the portfolio management team generally implements its investment process under normal market conditions.

Pillar 1: We focus on ways ESG can impact operating performance, both positively and negatively.

We believe that consumers and investors alike are increasingly rewarding companies that “do the right thing” and, conversely, punishing companies that engage in actions that may be viewed as unscrupulous. This decision is made easier in industries where these actions are subject to punitive regulation, which leads to fines or operating challenges and, in turn, to balance sheet deterioration.

EXAMPLE: Company A is a small, regulated bank in Spain. In late 2018, the bank experienced an increase in the number of allegations of usury relating to one of its credit card products. Its revolving credit card's annual interest rate was 27% while the annual rate it charged on consumer loans was just 7%. This seemed to be in direct contradiction to Spain's position that borrowing costs should not be significantly higher than the normal cost of credit. Ongoing lawsuits came to a head in early 2020 when the Spanish Supreme Court ruled against the bank and the likelihood of additional claims increased significantly. As investors digested the news and forecasted the size of future compensation, the bond price plummeted.

The early identification of heightened social risk via our scoring framework and potential for adverse regulation to impact operating performance worked in our favour: we had zero exposure to this bond at the time of the court ruling, and therefore avoided the ruling’s negative ramifications.

Pillar 2: We aim to identify and invest in companies that demonstrate positive momentum through analytics and engagement.

ESG is undeniably now a mainstream investment approach and companies seeking capital, particularly in Europe, must demonstrate that they are thinking about and integrating ESG considerations into their everyday business practices. However, we do appreciate that companies in our investable universe are all starting from different places. As a result we identify companies that we believe have both the willingness and ability to improve upon their sustainability policies, and we engage with them to share best practices and encourage change. This, in turn, allows us to potentially benefit from an improved credit profile that can result in bond price appreciation.

EXAMPLE: Company B is a publicly listed healthcare company. It had been targeted by a short-seller report in late 2019. The report identified a complex organisational structure with potentially concerning intracompany transactions, as well as high auditor turnover. However, when we engaged with the company in early 2020, the company demonstrated its commitment to improving its transparency and ESG disclosures, in line with our recommendations. Over the course of the year, it revised its compliance policies, introduced a number of nonfinancial key performance indicators covering social and environmental matters, and hired a recognised independent auditor. Furthermore, by July 2020, the company executed on its plan to obtain a credit rating, which further increased their level of disclosure.

Engaging directly with the company’s management allowed MSIM to benefit from the positive momentum associated with the development of an ESG strategy and the formalisation of the company’s credit rating.

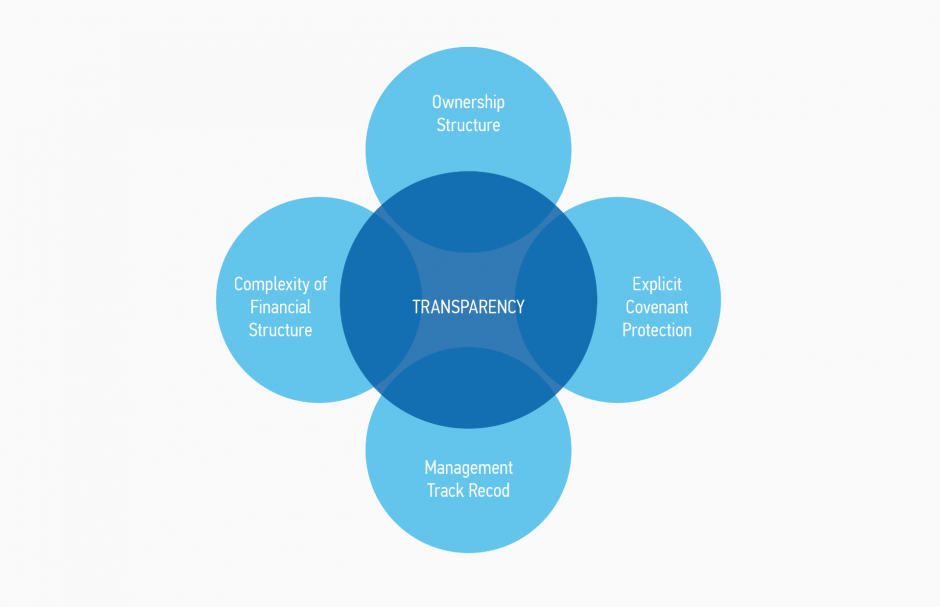

Pillar 3: We pay close attention to Governance, particularly in privately-owned companies that make up a large proportion of our investable universe.

As bondholders, we believe the cornerstone of a strong company is good management and as part of our scoring framework, we place a heavy emphasis on Governance (Display 2). We actively seek out evidence of internal controls to ensure that the business we have invested in maintains the same attractive characteristics that prompted the investment in the first place. One of the key factors in our analysis is ownership. While we do not avoid all companies with a single owner or family ownership, we do scrutinise them more heavily, particularly since companies with this ownership structure tend to have less "red-tape" and can more quickly pivot their business strategy and intentions.

In addition, we tend to find that companies operating within the real estate sector in particular can easily shift strategies by changing or repositioning their portfolio of assets, especially when compared to companies operating in different sectors. As a result, governance is a critical factor to consider when investing in this sector to ensure accountability for these potential transformational shifts.

EXAMPLE: Company C operates in the real estate sector and had one main influential shareholder. In 2020, Company C, which had been scrutinised in the past by market participants, was in the spotlight again when said main shareholder unexpectedly divested his holdings and its supervisory board resigned. The situation is ongoing.

Guided by our scoring framework's emphasis on Governance, we took a conservative approach to this sector and ownership structure, which worked again in our favour: We had zero exposure to this bond at the time of the board resignation.

Display 2: Incorporating Governance Factors into High Yield Credit Analysis

Source: Morgan Stanley Investment Management

Putting It All Together: ESG and Its Role in Relative Value investing

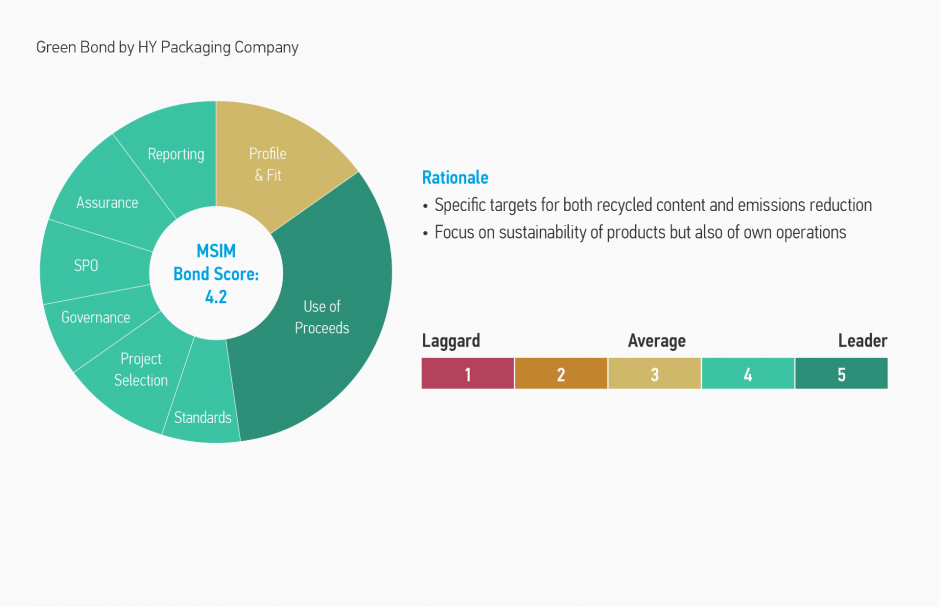

The pillars of MSIM Fixed Income’s ESG framework contribute to long-term fundamental investment decisions, but also help us identify and strengthen the case for certain relative value trades. For example, when analysing two similar credit profiles in the same sector, we look to our proprietary ESG score as a potential differentiator. In the summer of 2020, we identified a switch from Company D into Company E in the Packaging sector. These two companies had very similar credit profiles and fundamentals, but we favoured Company E due to its higher ESG score. In addition, Company E’s bond was a top scorer in our Sustainable Bond Evaluation Model (Display 3). This trade worked out favourably and we were able to benefit from Company's E's subsequent outperformance.

Display 3: Sustainable Bond Evaluation Model for Green Bond by High Yield Packaging Company

This is provided for illustrative purposes only. ESG ratings are relative and subjective and are not absolute standards of quality. Ratings apply only to portfolio holdings and do not remove the risk of loss.

Conclusion

As we have highlighted above, a holistic approach to integrating ESG into our investment decisions has proven to be an important tool in enhancing our active approach to portfolio management in high yield. It has enabled us to identify attractive opportunities for our clients, as well as to help mitigate risk. In our opinion, two characteristics make high yield stand out as an asset class well suited for ESG integration: First, high yield portfolios typically own a much larger proportion of an issuer’s debt than on the investment-grade side, meaning companies tend to be more responsive to engagement. Second, high yield is an idiosyncratic asset class with the potential for high default experience. Avoiding defaults is key to outperformance. We believe by incorporating a dynamic approach to ESG into our credit analysis - one that combines proprietary scoring and active engagement - we have the ability to further minimize defaults and offer clients the best chance of providing attractive risk-adjusted returns.

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. ESG strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

Diesen Beitrag teilen: