NN IP: Summer drought in spread markets, with Jackson Hole looming

The Goldilocks scenario continues for spread products. Emerging market debt remains attractive on a risk-adjusted basis in the current environment.

22.08.2017 | 07:22 Uhr

The so-called Goldilocks scenario continues for spread products. Growth momentum is comfortable, with risks to the outlook as perceived by central banks as roughly or broadly balanced. Meanwhile, inflation remains subdued and below monetary policy targets in developed markets, keeping these same central banks patient in their intended monetary policy normalization. Simultaneously, corporate earnings didn’t disappoint and commodity prices have risen, in particular oil and industrial metals, which are key for spread products.

In this environment, investors dismissed the initial fear that followed Draghi’s Sintra speech fairly quickly and money was redirected to broad spread products at large. This is not to say that spread levels tightened in an uninterrupted fashion. A continued pace of supply (some of it M&A driven) was not simultaneously matched by lower summer demand. This was especially the case in early August, when some mild spread widening was seen. Simultaneously, this was also related to a risk off-pattern amid increased geopolitical risk, with the situation in North Korea standing out in this respect.

This benign environment can be expected to last over the summer and spread products could therefore remain supported in the near term. Nevertheless, valuations of spread products at large leave little room for disappointment in this respect. Central banks and in particular their forward policy guidance are most influential in this respect. This is especially the case in view of the major search for yield that they have orchestrate with their unconventional policies since the crisis, leaving spread products in this era less sensitive to the pace of underlying economic recovery, or to commodity prices for that matter. Of course these relationships are expected to re-establish themselves again once monetary policy normalization gains further traction, a process that in itself is unprecedented given the unconventional nature of the crisis measures. Vulnerability therefore appears high currently.

In terms of potential triggers for a reversal of fortunes for spread products, it therefore seems appropriate to think about potential monetary policy announcements. A first upcoming event that springs to mind is the annual Jackson Hole gathering, this year scheduled for 24-26 August. Thereafter, September appears to be the month the Fed will announce the unwinding of its balance sheet, something the Fed itself has said will come “relatively soon”. Later this autumn there is the likely ECB tapering discussion to look forward to. Of course, while all these in principle constitute event risks, they could as well prove non-material in the sense that they are in line with current market expectations. In that case the trend of spread tightening could continue for longer. Nevertheless, from current tight spread levels, the risk-return profile for spread products appears asymmetric.

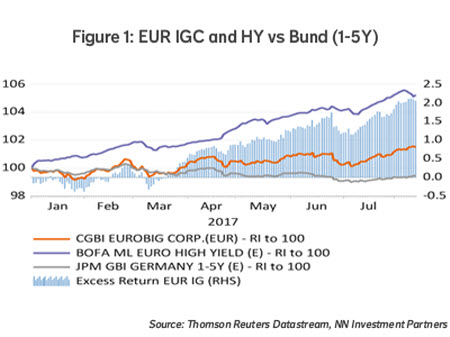

So far this year, EUR credits have considerably outperformed their USD counterparts. This holds for both investment grade as well as high yield. EUR credit spreads tightened considerably more than USD. Bund yields have been on the rise since the start of the year while the opposite was the case in the US. Excess returns of EUR credit therefore have been solid so far this year (see Figure 1).

We hold on to an overweight EUR IG currently while remaining neutral EUR HY. Investment grade overall is preferred over global HY. Within HY, USD HY is small overweight.

In terms of investor flow dynamics, after a short interruption, EMD (both HC and LC) managed to attract inflows. So far this year, as a percentage of AUM, inflows in EMD are close to +13%. In relative terms the bulk of it has gone to Latin America.

Within EM, monetary policy easing potential appears intact, with inflation on a downward path and improving capital flows. We overweight EMD LC rates. EMD HC sovereign nevertheless is small underweight, as it appears most vulnerable to a rise in DM government bond yields, sentiment around monetary policy normalization and geopolitical tensions (most recently Korea).

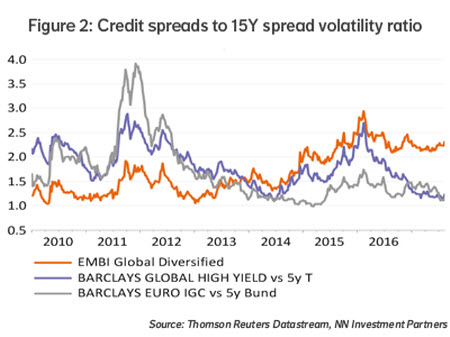

On a risk-adjusted basis EMD still appears attractive relative to HY or IG (see Figure 2). The ratio of EMD HC sovereign spreads over the long-term spread volatility (15-year average) remains above the same metric of global HY and EUR IG. This metric also has declined less for EMD HC sovereign than for global HY since the early 2016 highs.

Diesen Beitrag teilen: