NN IP: Outlook for fixed income in 2018

Next year will be challenging for fixed income, but the pace of bond yield normalisation is likely to be gradual. Volatility in spread products may increase as a result of tight valuations and positioning risk, but strong fundamentals will keep spreads low.

01.12.2017 | 07:30 Uhr

This week we focus on the outlook for fixed income for 2018. After years of solid returns across fixed income, the environment for the fixed income investor has become quite challenging. How fast will the normalization of monetary policy be, and how will this weigh on fixed income assets? How vulnerable are fixed income assets? Where are the opportunities within fixed income?

Normalisation of government bond yields

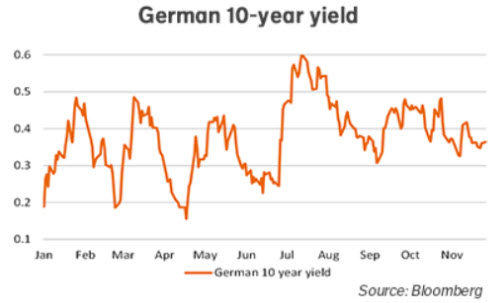

We have not really seen that much of a sustained upward trend in government bond yields so far. Although they are above their 2016 lows, bond yields have not risen much this year on balance. As of this writing, US 10-year yields are in fact lower than at the start of the year (-12bp). That said, we have seen periods this year when bond yields rose rapidly (20-30bp) as the market started to worry about monetary policy normalization (see graph). Looking ahead, we expect that the increase of government bond yields will be a gradual one, but we do expect that the path of bond yield normalization next year will be a volatile one as the market focuses either more or less on monetary policy normalization. Evolution of economic data can also trigger concerns about the monetary policy exit, or contribute to the market being more relaxed about it.

Steepening in Europe and flattening in the US

In a historical context the German 10-year yield may appear low at around 0.35%, but the curve steepness is quite normal, with a spread between 10- and 2-year yields of about 105bp. The curve has steepened over the past year, while the US curve has flattened and is relatively flat now at 60bp, about half the long-term average. The difference in the curves is basically a reflection of where these two respective regions are in the economic cycle. As the Fed has already increased interest rates for a number of times, the 2-year yield has already steadily increased, while the German 2-year yield is still very low. The longer end of the curve correlates relatively stronger with global conditions in comparison with the front end of the curve. As we expect the Fed to continue hiking next year while the ECB keeps rates on hold, we could see further flattening of the US curve in 2018 and some perhaps modest steepening of the German curve.

How vulnerable are fixed income spread markets?

The general economic environment is positive for FI spread markets. The positive growth environment translates into low default expectations, which justifies a low level of required spread compensation. These spread levels continued to fall further this year. Although fundamentally low spread levels are justified, the valuations of FI spread markets are historically very tight. At these levels, it is hard to see another year of significant spread tightening. For almost a decade we have seen significant flows into FI spread asset classes as investors embarked on a “search for yield”. Now that we are seeing some signs of rising bond yields, the question arises whether this will then undo some of the spread tightening we have seen as we move from “search for yield” to a “search for return”.

The combination of tight spreads, a long period of sustained investor flows into fixed income spread products and some signs of market liquidity constraints does signal some vulnerability of this asset class. As the past weeks have shown, we can expect periods of weakness in fixed income spreads. History has shown that particularly at monetary policy turning points – specifically, towards normalization of policy – we can see periods of moderate spread widening. However, a sustained and significant widening of spreads seems to require a rise in default expectations. That is why we have seen periods of sizeable spread widening only during recession periods. Given our constructive growth outlook for 2018, we do not rule out temporary volatility in spreads, but we don’t expect a large sustained spread widening.

Where are the opportunities in 2018 in fixed income?

Given our view of continued positive global growth with moderate inflation and a gradual monetary policy normalization, fixed income assets that are more oriented towards growth and/or shorter duration could outperform the fixed income universe on a total return basis. Examples are high yield, emerging market debt, specialised fixed income (i.e., convertibles) and less liquid strategies with floating coupon (i.e., senior bank loans, EM loans, export credit agency loans). Nevertheless, for the near term we maintain a tactical preference for investment grade over high yield and emerging market debt on a risk-adjusted basis.

Where are the risks?

We expect inflation to be contained next year. However, a surprise in the form of a faster pickup in inflation could lead to a more aggressive central bank reaction, which could become a headwind for all fixed income and for spread markets such as EMD. We expect that growth will continue to hold up well in 2018. If the growth environment deteriorates materially, it will be the long and safe duration assets that give the fixed income investor protection. By keeping some flexibility in the portfolio, investors can respond to changing macro and market conditions.

Diesen Beitrag teilen: