Morgan Stanley: The Tide Turns - It’s More than Hope

Despite unprecedented bad economic data and the uncertain course of the coronavirus, markets continued on an upward trajectory in May and rallied further.

07.07.2020 | 08:20 Uhr

The S&P 500 rose another 4.5%1, Bloomberg Barclays US Corporate High Yield Index returned 4.4% and Bloomberg Barclays US Corporate Index spread tightened by another 29 basis points2. Maybe it was not quite the bounce we saw in April, but given that the U.S. employment report released in early May was the worst since the Great Depression, and the fact the S&P was already up 13% in April, it was impressive nonetheless. Once again government bond yields, usually negatively correlated to equity and credit market performance, were nonplussed, hardly moving over the month. Remarkably, despite the risk-on environment over April and May, 10-year U.S. Treasury yields actually fell two basis points, a strong testament to the Fed’s firepower being deployed to buy Treasuries to keep yields low. A depreciating U.S. dollar also helped the bull case, as a weaker dollar is a bellwether for a stronger global economy, particularly in emerging markets.

The Fed and Treasury’s commitment to ensuring the flow of credit to households and businesses was also instrumental in buoying financial market confidence in an economic rebound when lockdowns eased. The 88% rise in WTI oil price3 futures over the month did not hurt either! It was a remarkable rebound considering prices went negative on April 20. Indeed, one can easily argue that with employment falling by over 20 million for the month, and mobility data showing de minimus travel, leisure and entertainment spending (de facto zero), factories closed and individuals not leaving home, things were sure to improve – what goes down, must go up, especially when that bottom is already close to zero.

The U.S. and Europe are in the unusual situation where economic data almost have to (arithmetically) get better as lockdowns ease, which again gets to the heart of the issue: coronavirus policy and economic policy. Success in virus containment allows economies to reopen. Massive fiscal and monetary easing help ensure incomes and confidence are maintained so that when lockdowns ease, spending and production can go up. We see this globally and can see how fast the supply side of the economy can rebound -- witness the strong recoveries in Asia. Moreover, as long as economies are on the re-opening trajectory, data will likely improve.

The most significant risk to markets remains a second wave of infections requiring reduced mobility and economic shutdowns. For now it looks like financial markets are in a relative sweet zone, where data exhibits steady improvement, bolstering confidence, and reducing or even eliminating left tail (catastrophic) risks while increasing the probability that the economic rebound will be more V-shaped, even if the right-hand side of the V is flatter than the left-hand side. What we are seeing is the impact of conservatively positioned investors adding risk to their portfolios given the relatively good news (even if it’s dire in absolute terms), continued strong policy support (with the threat of more if need be), and very low interest rates. While fixed income performance has rebounded faster than expected, we believe it is likely to continue -- even if more selectively -- as some high-quality assets have more than recouped their February/March losses.

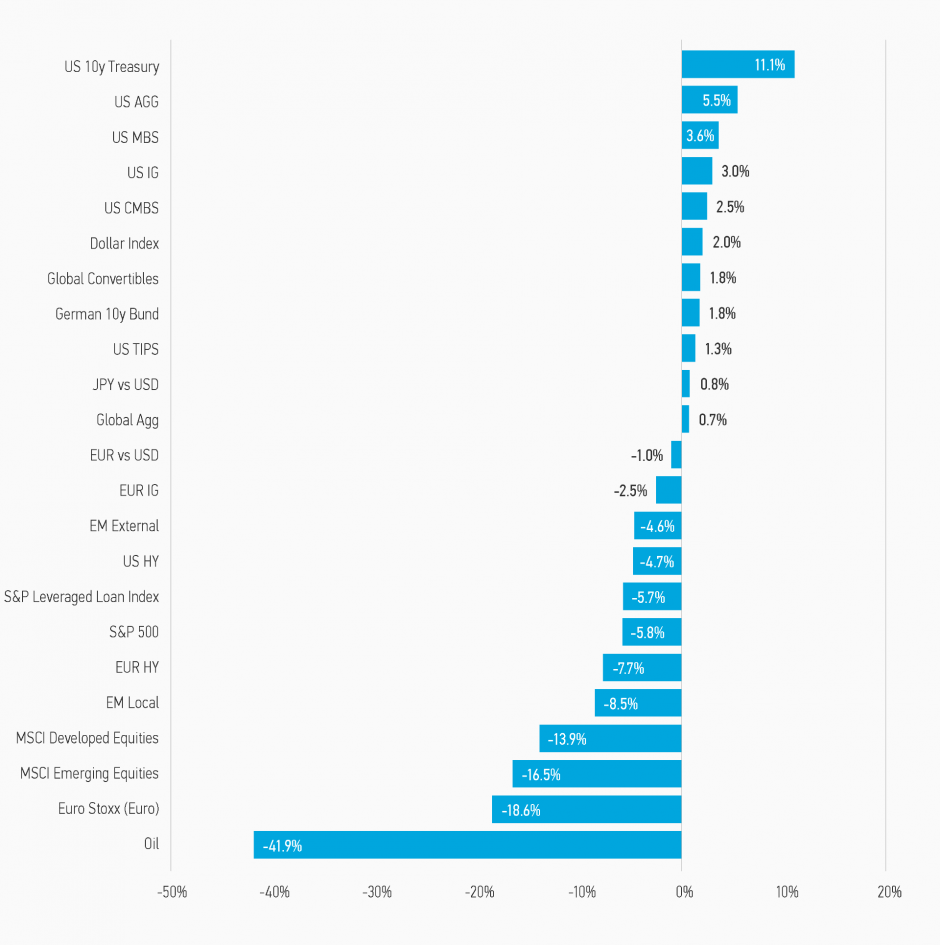

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of May 29, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

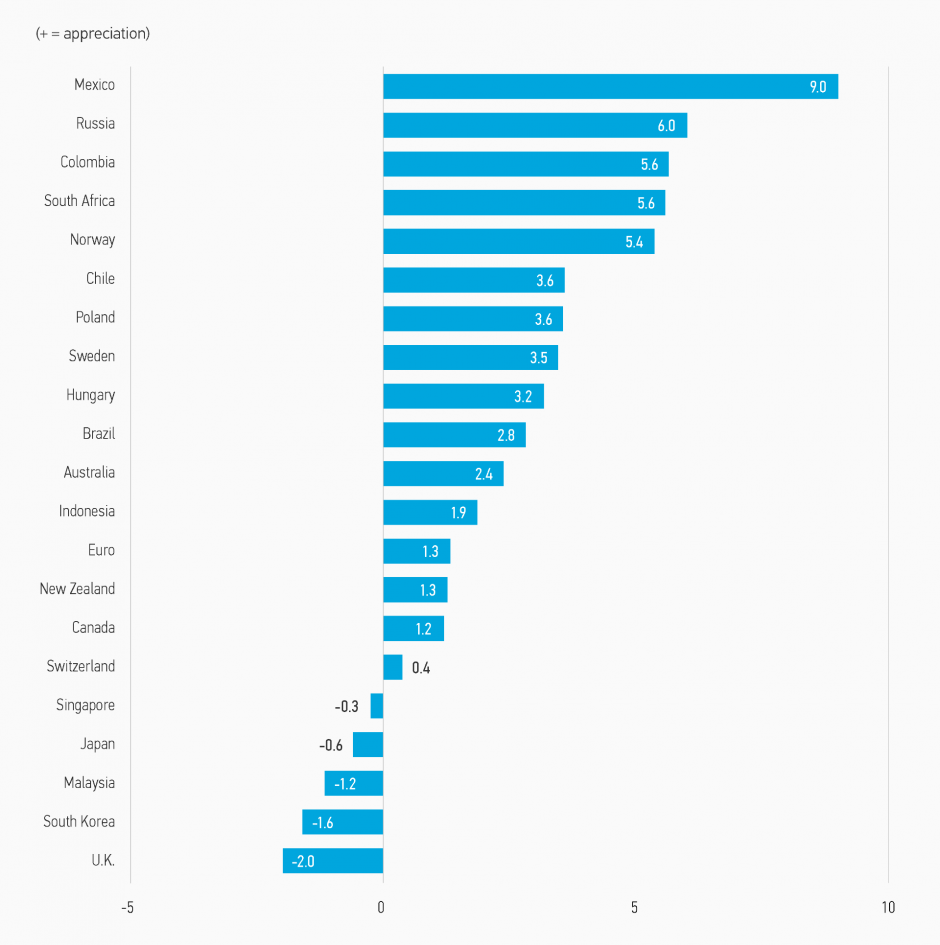

Display 2: Currency Monthly Changes Versus USD

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JP Morgan. Data as of May 29, 2020.

Fixed Income Outlook

The rebound of risky assets and the muted response of government bond yields shows the combined power of better economic data, easing of lockdown restrictions, improved confidence, and, most importantly, generally better news on the pandemic front. There is no doubt that markets have moved quickly, so quickly that many market participants appear to be suffering from whiplash and a bit of bewilderment as to how something so bad could turn around so quickly. There are risks ahead, however. The U.S. presidential election, combined with the large-scale social protests (and their ramifications), have injected added uncertainty into an already complicated world. To make matters even more convoluted, U.S./China political issues have been resurrected. So while markets may consolidate while they catch their breath and re-evaluate the future and relative risks, we believe corrections should be shallow. The recent risk-on moves are likely to continue.

With that being said, June will be an important month, as several developed market central banks will meet once again and potentially announce further fiscal-support measures. Additionally, government programs such as the Fed’s Term Asset Backed Securities Loan Facility (TALF) will open for its first subscription in mid-June, and the Fed’s corporate credit and main street lending programs are not yet functioning. Plus, any serious backsliding on COVID-19 containment/elimination could have deleterious effects on consumer and business confidence, lowering the probability of a strong second-half economic comeback. That said, once economies emerge from lockdowns, we think it will be very difficult, if not impossible, to reimpose them. Of course, if the development of a vaccine and/or therapeutics did occur, this would be a catalyst for the continued recovery of financial markets and economies.

As a result of continued monetary policy support (central banks have not been disappointing the market with their policies so far), we expect government bond yields to remain at very low levels, although concerns about increased issuance in the U.S., especially at the long-end of the curve, and potential ratings downgrades (for euro sovereigns) could lead to upward pressure. While better-than-expected economic data may also push yields higher, this is likely to come mainly from a rise in interest rate risk premia, rather than higher central bank rate expectations. If yields do break higher and hold above recent levels, we believe it will be reflective of better economic data and risk sentiment and will not meaningfully impact the economic rebound we expect in the second half of the year.

Not surprisingly, we remain constructive on Emerging Market (EM) debt. Much of the EM universe has lagged the recovery in other risky assets in the U.S. These assets were clearly not under the U.S. or general developed market “policy tent” and were likely to underperform until more was known about the trajectory of the virus, policy responses and easing of lockdowns. As economies around the world gradually reopen, we expect risk premia in emerging markets to fall. Regardless of the driver, we think that the global reopening trend is likely to proceed in the next few months, keeping commodity prices firm and boosting high-frequency economic data. Despite the sharp rally in risk assets last month, EM returns still materially lagged those in developed country credit markets, and therefore we still think there is value in EM debt, particularly in high-yield hard currency as well as EM currency with the growing consensus for a weaker USD providing a further boost to risk sentiment.

There have been sharp rallies in credit markets in the past two months, and that trend should continue, albeit with the reasonable probability of a near-term pause. Looking forward, the question is whether the trend for May will repeat with the optimists in the driver’s seat. We think yes, even if we do not think it will occur in a straight line. Most of the economic losses should prove transitory and as such not be meaningfully negative for corporate valuations. Indeed, businesses continue to implement risk-reduction strategies through asset sales, dividend cuts and reduced capex. As economies improve we expect corporate performance to improve meaningfully, with short-term corporate losses and higher leverage being less important, though important nonetheless for differentiating outperforming businesses. Although the largest gains for investment-grade bonds are behind us, the outlook remains good. We believe high yield has more room to recover in this scenario, although the longer the horizon the more likely it is we will see strong performance. Our target is for tighter spreads in six months, but would not expect them to tighten in a straight line over the coming months.

The securitized credit sector has been a tale of two cities. Agency mortgages and much of the AAA-rated securitized sectors have recovered mostly or even completely, and the upside is somewhat limited going forward. Lower-rated bonds have been distinct laggards. Although there has been some spread recovery in lower-rated bonds over the past two months, spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate sector. TALF should also provide a major tailwind for securitized credit markets in June as over $100 billion in demand will hit ABS and CMBS markets beginning June 17.

Developed Markets

Monthly Review

The stabilization and rebound in April continued into May as risk appetites continued to improve. Some developed economies began to reopen as infection rates declined and promising initial results from COVID-19 vaccine trials were released, resulting in increased confidence in the global recovery. The U.S. dollar weakened4 as demand for safe-haven assets declined. Market-based inflation expectations increased for the second month in a row, consistent with the more positive risk sentiment and rising commodity prices. While the U.S. Treasury 10-year yield was close to unchanged over the month, euro sovereign spreads tightened significantly in response to proposals for an EU recovery fund, leading to lower yields on most government debt.5 Developed market central banks remained committed to doing whatever it takes to promote stability and recovery in the global financial markets.

Outlook

We continue to expect monetary policy to remain accommodative across developed markets in the coming months in order to support the continued stabilization of the global economy and financial markets. Having eased aggressively in March, most central banks are now closely monitoring incoming economic data to determine if further easing is necessary. This will depend on market conditions and developments in the underlying economy, but with inflationary pressures very weak and economies hit by a severe exogenous shock, there is every reason to believe central banks will be ready to ease further, although most will have to do so via unconventional policy measures (e.g., QE and liquidity provision measures) given policy rates in most DM economies are already at the lower bound.

Emerging Markets

Monthly Review

Emerging Market (EM) assets continued to rally in May. Investors were encouraged by monetary policy accommodation, continued fiscal easing across EM and DM economies, as well as the disbursement of IMF funds to developing nations. EM dollar-denominated sovereigns led performance, especially high-yield and energy exporting countries, as oil prices rose on higher consumption and growth expectations. Local currency debt followed, as EMFX strengthened versus the U.S. dollar and domestic debt yields declined, with commodity exporting countries outperforming.

Outlook

We remain constructive on EM debt in the near term, as economies in several parts of the world gradually reopen after the peak of the coronavirus crisis. Though setbacks are expected, we expect governments to address them with more targeted measures than the aggressive lockdown strategies implemented a few months ago, as testing capabilities and hospital availability improve. For poorer countries, the decision to relax quarantines will probably be dictated by their heavy economic cost and population fatigue. Regardless of the driver, we think that the global reopening trend is likely to proceed in the coming months, boosting high-frequency economic indicators as well as asset prices, particularly in the riskiest segments of EM fixed income, which have significantly underperformed year-to-date.

Credit

Monthly Review

Spreads were tighter in May, both in the U.S. and in Europe. The key driver was a more optimistic expectation for economic activity as the coronavirus debate moved to strategies for exiting the lockdown, and the monetary/fiscal policy response intensified with additional programs announced in multiple developed markets. Political risk did increase in the month with U.S./China headlines resurfacing, but markets broadly ignored the risks. Oil rallying and equity volatility falling as risk assets rallied was supportive for credit in the month.

Outlook

Looking forward, the questions are, will the trend for May repeat with the optimists driving markets as economic activity picks up? Will fiscal and monetary support packages continue to outweigh economic costs? Will corporates continue to implement risk-reduction strategies through asset sales, dividend cuts and reduced Capex? Or do the political tensions, corporate losses and the scale of the rally create some market volatility? Our target is for tighter spreads in six months, as we believe the weak economic activity is transitory, but we would not expect them to move in a straight line over the coming months.

Securitized Products

Monthly Review

The securitized credit markets continued to recover during May with consumer credit, office-backed commercial real estate, and housing-related sectors all experiencing spread tightening; however, sectors most directly impacted by COVID-19 such as hotel and retail shopping commercial backed securities (CMBS) continued to perform poorly. Agency MBS spreads were essentially flat in May despite the continued substantial MBS purchases by the Fed. Current coupon 30-year agency MBS spreads were essentially unchanged in May. The Bloomberg Barclays US MBS Index outperformed the Bloomberg Barclays US Treasury Index by 0.03% on a duration-adjusted basis, but has still underperformed the Treasury Index by 0.31% year-to-date.6 The Fed has purchased $700 billion agency MBS over the past two and a half months since announcing its plans to begin purchasing agency MBS in response to the economic shutdown7, which has helped bolster this sector and kept mortgage rates at record lows. Mortgage servicer refinance efficiencies continue to improve despite potential complications from the current work-from-home environment.

Outlook

We expect to see spreads continue to tighten across most securitized sectors in June. While we have seen some spread recovery over the past two months, securitized spreads remain much wider than February levels and have lagged the recoveries experienced by the corporate credit sectors. Fundamental data remains critical and the market are closely watching for signs of material credit deterioration from the spike in unemployment. The economy has proved to be rather resilient as the performance deterioration has been relatively mild for most securitized sectors and far better than investor expectations, and the economy is slowly showing signs of life. TALF should also provide a major tailwind for securitized credit markets in June as over $100 billion in demand will hit ABS and CMBS markets beginning June 17.

1 Source: Bloomberg, as of 5/29/2020

2 Source: Bloomberg Barclays, as of 5/29/2020

3 Source: Bloomberg, as of 5/29/2020

4 Source: Bloomberg, as of 5/29/2020

5 Source: Bloomberg, as of 5/29/2020

6 Source: Bloomberg Barclays, as of 5/29/2020

7 Source: The Federal Reserve, as of 5/29/2020

Here you can find the complete Article

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: