Morgan Stanley: The Devil Is in the Details

Our Global Fixed Income team discuss a “most challenging month for financial markets” and argue their long risk position is the best way to position portfolios.

22.10.2020 | 09:16 Uhr

Her you can find the complete article

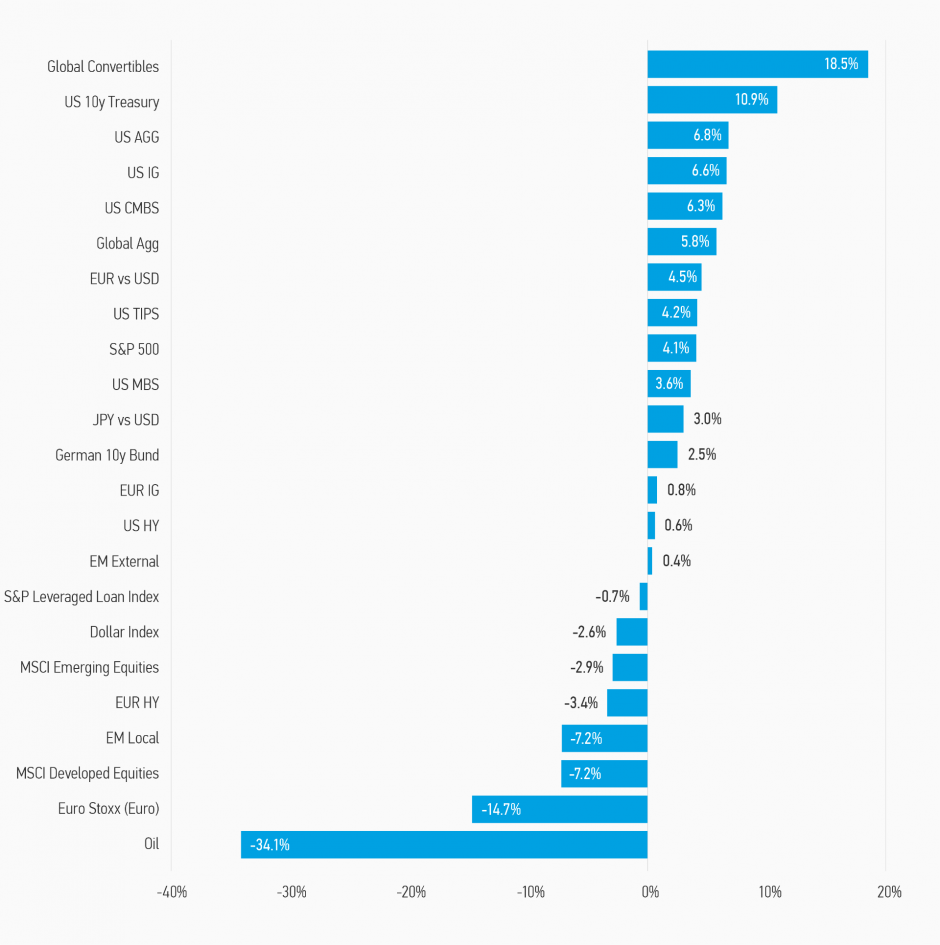

September proved to be the most challenging month for financial markets since March. Equities and corporate bonds posted negative returns while government bonds rallied only modestly. A lack of new good news and demanding valuations were the primary culprits with government bonds doing well, as they should, when risky assets struggle and economic/policy data disappoints. The news/data flow were distinctly uninspiring relative to the continuous stream of good news seen since April. From the absence of a U.S. fiscal stimulus package, to a relatively lackluster response to the Fed’s announcement of a new monetary policy strategy to bad news on the virus front, there was not much to celebrate. Luckily, there is not much to be too worried about either, but given the rebound we’ve seen in asset prices (S&P 500 up 8.9% in the third quarter), a pause was to be expected. We view recent credit and emerging market underperformance as nothing more than constructive consolidation, potentially creating an attractive entry point to add to risk. Good news has been discounted. Volatility with regard to policy, politics and the pandemic have increased while valuations, in general, have rebounded. That said, fundamentals continue to support an economic recovery, albeit slower than Q3/Q4. Employment continues to rebound, global trade and manufacturing remain in strong recovery mode and consumer spending in particular, remains robust with retail sales moving above pre-COVID levels in many developed countries.

All of this suggests that our modestly long risk position is, in our view, the best way to position portfolios as we navigate between disappointing data and policy (any risk is too much) and potential upside surprises with regard to policy and the pandemic. We remain positioned to potentially benefit from riskier fixed income assets outperforming, and low-risk government bonds trending sideways. These positions will be adapted to changing fundamentals as they relate to monetary and fiscal policy, economic data, vaccine news and, of course, the ever-present pandemic.

Although we continue to hold a positive and upbeat view with regard to the evolution of the economy and credit spreads, risks remain. Rising infection rates leading to larger and more aggressive lockdowns could easily slow economies and upend our views. We do not think this is likely as all governments seem to be adopting more selective, targeted lockdowns to deal with local issues. As long as local issues do not spread and/or hospitalization and mortality rates do not climb too much, economies should be fine. Vaccines continue to be the lynchpin of a broader solution to get the sectors of the economy like travel, leisure and entertainment back to semi-normal, thus allowing national incomes to potentially return back to pre-COVID levels.

In the interim, fiscal and monetary policy loom large. The U.S. fiscal policy, in particular, remains key. Fiscal policy should passively tighten significantly next year and this needs to be addressed. The stalemate in Washington does not look like it will be resolved pre-election. Income growth has been strong and high household savings rates should cushion the blow as long as expectations of a stimulus package next year remain intact. Indeed, a Biden victory, which looks more likely on the back of rising support in polls, could easily raise expectations for an even larger stimulus package next year. What is actually delivered will depend not only on the outcome of the presidential election, but also those for the Senate, and the potential for the Democratic Party to control both the presidency and Congress. If fiscal policy becomes net stimulative next year (taking into consideration the passive tightening of existing programs coming to an end), growth should continue to recover. Higher household savings rates in 2020 could boost consumption as well, to the extent it reflects pent-up demand and household incomes remain robust. Clarity on how the Fed’s new monetary policy framework will be implemented looms large. It is one thing to say we want inflation to overshoot, but by how much? For how long? The devil is in the details.

On the positive side, developments could lead to tighter corporate and Emerging Market (EM) spreads by year-end or certainly in 2021. With inflation well below central bank targets and economic risks (growth and inflation) still skewed to the downside, central banks are likely to remain super accommodative for years to come. The decline in government bond yields means governments have been given freedom (if taken!) to spend more. Corporations have been able to shore up their balance sheets at a historically low price. The economic data still points to improvement, and with medical progress being made on COVID-19, there are both up and downside risks around the pandemic. We are still inclined to believe buying the dip is the right strategy.

Display 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of September 30, 2020. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

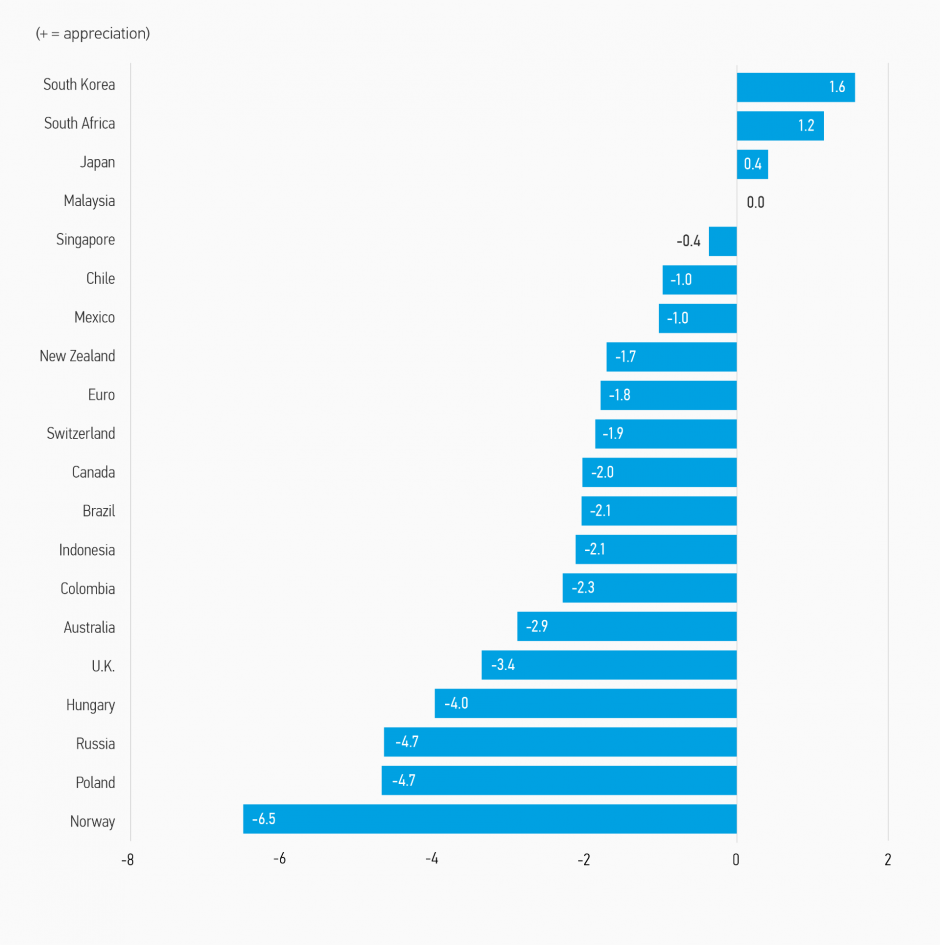

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of September 30, 2020.

Source: Bloomberg, JPMorgan. Data as of September 30, 2020.

Fixed Income Outlook

The September correction in equities was probably coming for some time. Credit spreads, although wider over the month, outperformed relative to equities and their historical correlations. This is testament to the power of liquidity to drive markets and confidence in policymakers’ abilities and willingness to deliver enough stimulus to keep the economy growing above trend in 2021. No doubt these beliefs will be tested in the months ahead, particularly after we see who wins the U.S. presidential election.

With medium-term trends intact, our investment outlook is also largely unchanged. We remain cautiously bullish, given good economic data (even if the rate of change is slowing) and because we do think more monetary policy stimulus is coming either through clarification of the implications of the Fed’s new monetary policy strategy or via larger quantitative easing (QE). Additional fiscal support should come in size after the November election in most scenarios. Indeed, Fed Chairman Powell’s remarks in early October indicate the Fed supports more fiscal action with risks being greater from doing too little rather than too much, in their opinion. The heavy sectoral, potentially long lasting impact of the pandemic on the economy strongly supports the need for additional fiscal action. However, valuations in most areas of fixed income are no longer below fair value by our estimation, even with the correction in September, giving rise to an only modestly long position in riskier fixed income assets.

Considerable downside risks persist. Economic growth remains well below potential, especially in the services sector. Pent up demand is fading, as is fiscal support. Many countries are experiencing localized or more general rising COVID-19 infection rates, leading to local lockdowns and restrictions hurting growth. And, we cannot forget those geopolitical risks that will not go away – U.S./China tensions, Brexit, tensions between Russian and Europe and last but not least, the U.S. elections. At the same time, progress continues to be made in developing potential COVID-19 vaccines, which could lead to a more sustained resolution of the pandemic.

The market’s reaction to the Fed’s announcement of a new monetary policy strategy and targeting framework was lukewarm to say the least. Part of the reason was it was old news. Chairman Powell essentially laid it out in his Jackson Hole speech. And, with little further details added in September, the market yawned. There is no doubt that the Fed’s thinking with regard to how they will change interest rates in response to shifting economic conditions (e.g., growth/unemployment and inflation) has changed. But the question is how much? Modest change? A revolution? The fact is the Fed did not release more details, and the language used was ambiguous. Moreover, the fact that there were dissenters and maybe more we do not know about suggests the Fed has not decided on the details. We need more information. What is definitely true is that the Fed does not think the economy is out of the woods. Fiscal policy would be the first policy tool deployed (Chairman Powell’s comments support this), but the Fed will play policymaker of last resort if the economy does not perform up to expectations and fiscal policy does not ride to the proverbial rescue. What is true for the Fed is also true for most other central banks. The risks are skewed toward further global easing in a bid to achieve inflation/employment mandates. Similarly, although economic data have been better than expected, economies are still operating at levels so far below what is normal that stronger data poses little threat to the accommodative bias.

We therefore see little risk of government bond yields rising meaningfully anytime soon. Recent rises in yields, we believe have been more technical in nature and/or related to shifting probabilities of who will be elected the next U.S. president. However, further declines in yields also seem unlikely, given that most central banks have now cut interest rates to as low as they feel comfortable doing. Nonetheless, further cuts and other policy innovations could still happen if there is a turn for the worse, so there is still a case, we believe, for owning high-quality government bonds as a hedge against further stress, even if much less than normal.

The perception that the Fed is likely to pursue an exceptionally easy monetary policy relative to others has caused a cheapening of the U.S. dollar. However, heightened global risk aversion in September caused the dollar to recover some. While we remain longer-term modest-dollar bears, we do not think there is enough clarity on relative economic performances and resolution of who will lead the U.S. to be highly confident the dollar will fall meaningfully in the near term. EM currencies continue to lag as EM growth lags that of developed market (DM) economies. Until this dynamic shifts it is premature to be overly optimistic on EM currencies except in specific situations.

We believe corporate credit, in particular investment grade, also remains very well supported by central bank actions, in particular purchase programs. However, this good news is increasingly factored into prices, with credit spreads at or below their long-term averages in spite of the still-challenging economic outlook. High yield also offers reasonable opportunities. The recent spread widening in September has improved its relative attractiveness. While we remain long, we will sell into meaningful rallies while also looking at meaningful backups in spreads to add to positions.

Emerging markets remain an enticing source of potential yield enhancement. The open monetary spigot in developed countries remain highly supportive for the asset class. However, considerable macro risks persist, with many emerging economies not performing better than their developed peers. Valuations have also richened, so while we do see opportunities in specific countries and situations, we exercise caution toward broad-based exposure to the asset class. Idiosyncratic opportunities remain the name of the game.

High-quality securitized products continue to quietly perform well, offering what we consider to be limited upside, given low yields and refinancing risk, but also limited downside, given central bank support. The low volatility outlook means the asset class is still attractive for portfolios, even if this means a lower level of expected return. Higher return opportunities exist in lower-rated securitized products, where spreads have retraced less, but fundamental risks are greater. In general, delinquencies have been far lower than initially feared.

Developed Market (DM) Rate/Foreign Currency (FX)

Monthly Review

In September, markets pivoted to a “risk-off” stance as markets saw several bouts of volatility caused by the upcoming U.S. presidential election, coronavirus, as well as other geopolitical events. Several developed market central banks met during the course of the month and gave markets an update on what to expect for the remainder of this year in terms of economic data and monetary policy. The global economic recovery appeared to stall as some stimulus package benefits expired or ran out. Ten-year yields across the developed markets fell, with the U.S. being the outlier as yields remained largely unchanged over the month.

Outlook

Going into the final quarter of 2020, we continue to expect monetary policy to remain accommodative and risky assets to be well supported across developed markets. In the near term, the U.S. election and an upward trend in cases in the coronavirus may cause continued volatility in the financial markets. Additionally, a Brexit agreement must be reached by mid-October if a deal is going to be completed by year end. While better-than-expected economic data may also push yields higher, this is likely to come mainly from a rise in interest rate risk premia, rather than higher central bank rate expectations. We expect the dollar to continue to weaken in the coming months versus other G10 currencies given how easy financial and monetary policy conditions are.

Emerging Market (EM) Rate/FX

Monthly Review

Global yields declined in September, with 10-year U.S. Treasury yields dropping by 2bp to 0.68%, and the yield curve flattened amid risk-off sentiment. September was the first month since this Spring during which risk aversion drove price action. Economic data lost some of the momentum built up over the summer, as rising levels of infection stoked fears of greater restrictions and the consequent economic damage. This put pressure on risky assets and pushed the USD higher, providing an unfavorable backdrop for emerging markets. From a broad market perspective, Venezuela, Suriname, Romania and Georgia were the best performers in September, while Venezuela and Suriname remain in deeply negative territory year-to-date. Conversely, bonds in Sri Lanka, Argentina, El Salvador and Ecuador were the worst performers. From a sector perspective, companies in the pulp and paper, transport, and diversified led the market, while those in the oil and gas, consumer, metals and mining underperformed.

Outlook

We remain cautiously optimistic on EM debt in the near term on the back of continued global monetary and fiscal policy accommodation. A continued rebound in China growth, to the extent that it spills over to the global economy, should also provide a further boost to risky assets, as well as any positive developments on COVID-19 treatments/vaccines. On the other hand, our relatively constructive view on EM assets in the near term is tempered by less compelling valuations, increased volatility due to the upcoming U.S. presidential election, and some setbacks on the fight against the pandemic, as evidenced in increasing case counts in Europe, and stricter lockdown measures imposed by several countries (though we think a return to all-out lockdowns is unlikely).

Credit

Monthly Review

Spreads were wider in the month. The key driver was the reduced positive momentum in the fundamental news coupled with the large supply post-summer. Economic data improvements started to slow (and in some cases missed expectations), no new monetary or fiscal policy support programs were added contrary to expectation (specifically of an additional U.S. fiscal package), coronavirus news was focused on increased second wave infections without any definitive news of a vaccine coupled with concerns over the outcome of the U.S. election.

Market Outlook

Looking forward, we see the September correction as a healthy rotation of risk during a period of heavy supply. Our base case reflects the consensus view that coronavirus is transitory and monetary policy is credit risk friendly, likely driving spreads tighter in the medium term, close to the long run average offering investors carry but limited capital gain.

Securitized Products

Monthly Review

September continued the Q3 trend where agency MBS returns were mediocre, while securitized credit spreads continued to tighten. Agency MBS were slightly weaker in September and essentially flat for the third quarter, supported by the Fed’s continued MBS purchases and constrained by prepayment risk. Depending on sector and rating, U.S. ABS spreads were unchanged or tightened in September. European RMBS spreads were largely unchanged in September, but have almost fully recovered to pre-COVID levels. Aircraft ABS, non-performing loan RMBS and CMBS backed by hotels and shopping centers continue to lag behind auto and credit card ABS and single family rental CMBS.

Outlook

Agency MBS look fair at current valuations and should continue to be supported by the Fed’s purchases. We particularly favor To-Be-Announced (TBA) securities in lower coupon 30-years (2% and 2.5%), where the roll offers additional value due to the Fed purchases and prepayment concerns are less pronounced. We expect the U.S. housing market to remain stable and non-agency RMBS to continue performing relatively well from a credit perspective in Q4. Additional monetary and fiscal stimulus continues to help the situation, and is very supportive of many securitized assets.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: