Morgan Stanley IM: Oh, What a Month, Quarter and Year!

The tectonic plates of inflation and recession collided in June with recession winning, at least for now. Economic data continued to underperform, surprising to the downside in general, with central banks continuing or even intensifying their hawkishness.

27.07.2022 | 09:35 Uhr

Here you can find the complete article

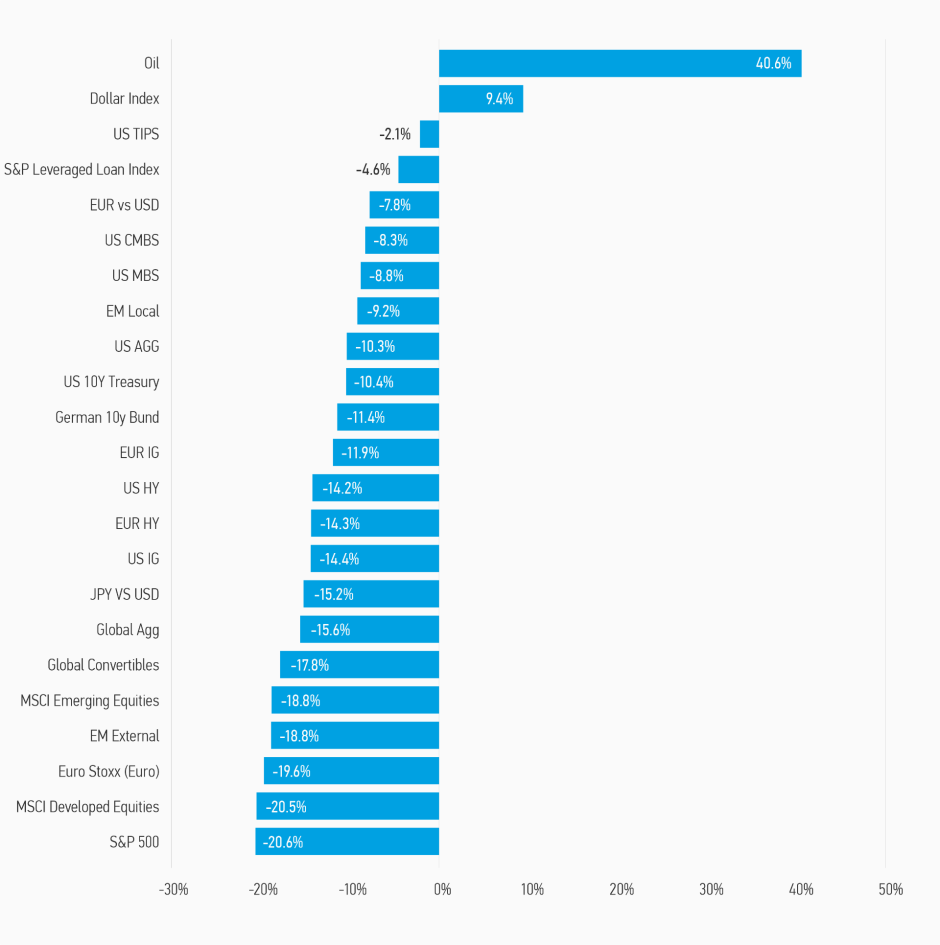

As a result, financial market performance in June and year to date cannot be characterized as anything but historic; unfortunately, historically bad! Indeed, global credit markets have experienced their worst first half performance on record. June bond returns ranged from -0.88% for U.S. Treasuries to -9.19% for emerging markets (EM) external high yield, pushing year-to-date returns into double digit negative territory.1 What is truly astonishing about 2022 has been not just that all fixed income returns have been deeply negative but that the dispersion of returns has been so small. In EM, high grade and high yield returns have been -19.69% and 20.96% respectively while U.S. High Yield has returned -14.04% while U.S. Investment Grade returned -14.39%.2 It has not mattered how you managed credit versus duration risk, both have been equally bad. In this risk-off context, it is not surprising the dollar rose substantially, confounding many long-term dollar bears.

Government bond markets were not exempt from the volatility, but hope did materialize mid-month as yields fell. First, U.S. Treasury 10-year yields rose 62 basis points (bps) in the first 14 days of the month as high inflation prints (May U.S. Consumer Price Index release printed 8.6%, higher than expected) and Fed hawkishness (larger than expected 75bps rate hike and a substantial increase in their “dot plot”) pushed the Fed’s median rate forecast to 3.8% for end-2023. Then, they rallied 46bps over the remainder of the month as recession fears rose substantially and, remarkably, the market began to price out rate hikes the Fed had just penciled in. Even with recession probabilities rising significantly, government bond yields still went up over the month. Tightening expectations fell even more significantly in Europe, with expected rate hikes reduced 60-90 bps across the ECB, Swedish and Norwegian central banks. Whether or not this is warranted remains to be seen, emphasizing, once again, the importance of central bank policy outcomes for the months ahead.

DISPLAY 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of June 30, 2022. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions

Credit markets did not like either scenario (inflation or recession) so underperformed the whole month: U.S. IG spreads widened 25bps while U.S. HY spreads widened 163bps. European bonds did even worse with governments tracking Treasuries weaker and European corporates doing worse.2 The European energy crisis continues to drive inflation higher, with no respite in sight, leaving the European Central Bank (ECB) with little room to maneuver. However, recession fears came to dominate inflation worries and despite inflation making new highs in Europe (and likely to continue to do so over the third quarter) German 2-year yields fell 58bps over the second half of June, mirroring U.S. Treasury performance.

The roller coaster is keeping volatility high. The collapse in commodity prices in recent weeks reflects market sentiment shifting away from inflation hedges and towards growth hedges (government bonds). The market now prices inflation will be back below 2% by 2025 in both the Eurozone and the U.S. For the first time this year, government bonds began to behave as a hedge to cyclical risk, with developed market government bonds rallying as credit markets sold off. Of course, this improved performance hinges critically on reduced central bank hawkishness, leading to investors pricing less rate hikes across the yield curve. Whether or not this is justified remains to be seen as core inflation has yet to convincingly peak and turn down. No doubt, the significant drop in commodity prices (assuming it persists) should reduce headline inflation in coming months (outside of Europe) and also, perversely for the economic pessimists, boost consumer and business sentiment, reducing the probability of recession.

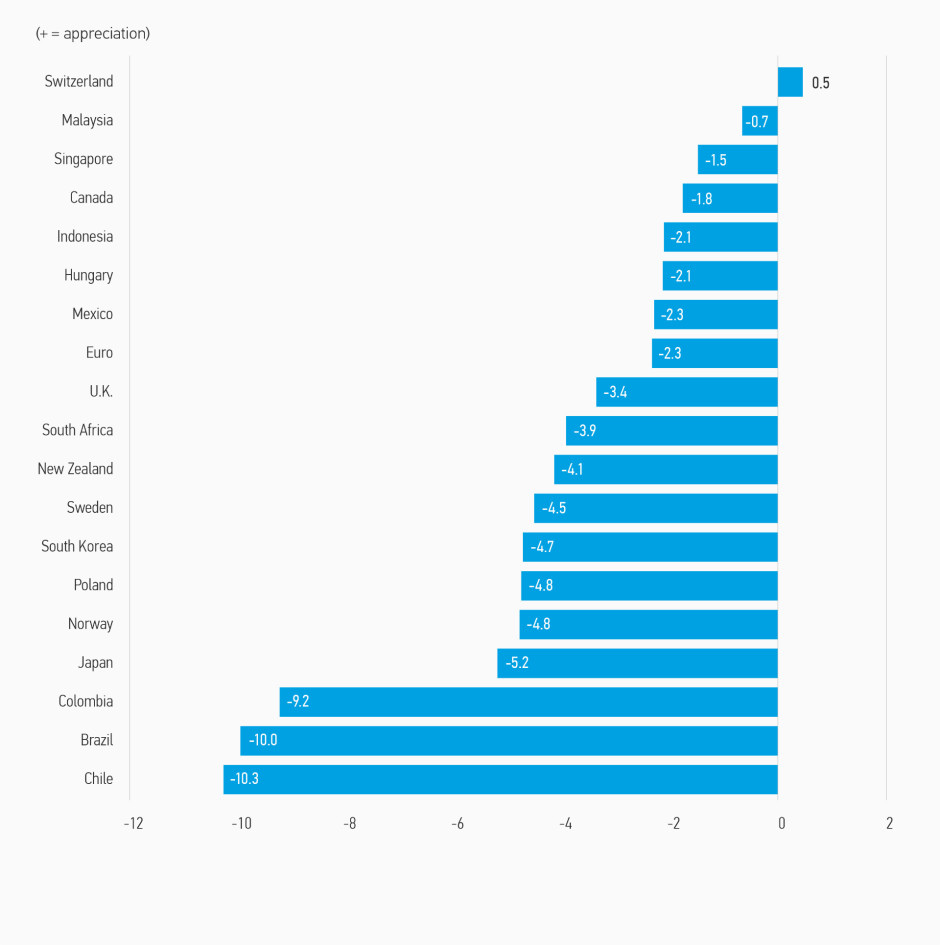

DISPLAY 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of June 30, 2022.

DISPLAY 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of June 30, 2022.

Fixed Income Outlook

June market performance emphasized once again the unusual time we live in. Volatility continues at levels rarely seen over the last two decades, with markets zigging and zagging between inflation and recession fears. Clarity remains lacking as to where economies and markets will eventually end up, but we do know some things. Despite fears of recession, the U.S. labor market and household income growth remain solid. June’s labor market report released on July 8th emphasized the continuing strength and resiliency of job growth. Indeed, no recession is imminent with monthly job growth of 300,000+. As a comparison, for the decade 2010-2019, U.S. job growth averaged less than 200,000 per month. Job growth, which further squeezes a tight labour market, will, we believe, make it very difficult for inflation to come down. Moreover, to slow inflation meaningfully, real rates need to rise. While they have risen substantially from the beginning of the year, it is not yet obvious, despite weakening data, that they are high enough to slow wage growth and the housing market, two key drivers of core inflation.

The market’s fading of the Fed’s “dot plot” peak of the Fed funds rate and the fading of inflation risk (falling forward inflation rates) is ambitious to say the least. Falling inflation means growth slows below trend and unemployment rates rise. So far, the growth slowdown could just be a midcycle adjustment from unsustainably rapid growth in 2021 (in both nominal and real terms). It is also possible that inflation remains elevated if the economy is weakened; i.e, a stagflationary scenario, which means the Fed is reluctant to stop tightening. As such it is premature to believe the slowdown occurring will continue or be significant enough to return inflation to the Fed’s target. Inflation could be stickier than the market thinks. Similar situations exist in Europe and Asia. While we may see inflation peak this summer, in year-on-year terms, it implies the Fed is unlikely to ease as fast as market optimism suggests (2023 rate cuts). Moreover, although economic conditions look more challenging for Europe given the energy situation, the dramatic repricing of rate hikes (lower) in June also looks aggressive. Inflation in Europe shows no sign of peaking (even if most of the rise is due to supply chain/energy issues). Unless the Eurozone economy slips into recession, market forecasts of less ECB rate hikes look premature, which will likely put upward pressure on European bond yields as well.

Central banks are hawkish for a reason. Inflation in most emerging markets continue to make new highs, even though they began raising rates sooner than advanced economy central bankers. This may imply that there is more tightening to come in advanced economies rather than suggesting EM central banks are nearly done. Despite evidence that growth in manufacturing has slowed significantly, the service sector of economies, as evidenced by June’s Institute for Supply Management service sector report, remains in strong expansionary territory. Anecdotal evidence from the travel industry still points to robust pent-up demand for consumer services alongside labor shortages, suggesting service sector inflation will be hard to suppress. If Covid does not come back to derail this recovery, it will be a challenge for disinflation in the goods sectors to be powerful enough to lower inflation sufficiently to halt central bank tightening anytime soon. On the positive side, there is evidence that supply chain logistics are improving, albeit slowly, which should bode well for improved access to goods and lower prices.

Corporate bond performance is also likely to be volatile. Both IG and HY markets reflect expectations that bad news will continue to arrive (weaker earnings, weaker economy, tighter monetary policy). Spreads have moved above the levels normally associated with a healthy economy, meaning they price in a meaningful probability of a recession relatively soon. But there is unlikely to be a recession this year, given the momentum in labor markets and healthy household and corporate balance sheets, implying that credit markets are undervalued relative to current fundamentals. But increasingly restrictive monetary policy means growth will continue to be under pressure. Q2/Q3 reporting will be key in understanding the robustness of business models to input cost inflation and a slowing economy. We continue to be cautiously optimistic on credit given the cheap to current fundamentals but our expectation of deterioration. We still think a soft landing is likely (although less likely than three months ago) with supply chains improving, commodity prices down and central banks not rushing to raise rates once neutral/slightly restrictive levels are achieved.

Emerging Markets continue to struggle, but opportunities are arising as there are now countries that price in meaningfully probability of default where we believe it is unwarranted. While EM is likely to struggle as long central banks remain on their current hawkish trajectory and inflation stays high, valuations increasingly price in a highly negative outcome. With risk premiums now generous in some countries, we will look to opportunistically buy, but the asset class still lacks a catalyst to spark a rally.

The U.S. dollar, usually a good barometer of the economic and financial outlook, continues to flash warning signs. It tends to be strong when things are going wrong and there is meaningful downside risk, or when things are too good, inflation is high, and economies need to slow. Well, currently these are the two scenarios most priced into financial markets, meaning the dollar goes up continually. A soft landing, slower growth, lower inflation, no recession is the scenario where the dollar is likely to fall from its clearly lofty levels. While that remains our baseline scenario, it remains a hope rather than a fact.

In summary, portfolio positioning remains cautious. Valuations are more attractive, opportunistic buying makes sense, but risks remain, mostly on the inflation front and central bank reactions to it. We continue to fear inflation more than recession.

Developed Market Rate/ Foreign Currency

MONTHLY REVIEW

Developed market rates were exceptionally volatile in June as the market responded to continued upside inflation surprises, hawkish central banks but then also weaker economic growth data. Initially, rates climbed sharply in response to central banks raising rates more than expected and promising to continue tightening. However, weaker economic activity data then caused yields to fall in the second half of the month as central bank expectations moderated, although 10y government bond yields still ended the month 10-20bps higher. Given higher rates and growth concerns, risk assets in general performed poorly. Medium term inflation breakevens fell below central bank target levels even though inflationary pressures remain strong.3

OUTLOOK

Given that inflation has yet to disappear despite growing recessionary concerns, the focus remains on central banks: how aggressively and for how long will they keep hiking? Their current rhetoric remains hawkish, but this may change if economic growth slows further. Overall, we see developed market rates remaining volatile given the uncertainty but expect yields to trend higher as long as recession is avoided.

Emerging Market Rate/ Foreign Currency

MONTHLY REVIEW

The selloff in emerging markets debt (EMD) continued through the month. The corporate index within the EMD universe was the best performing, although notably negative during the period. Investors are beginning to more seriously consider the potential for recession in the near term and EMD markets will not be spared.4

OUTLOOK

We are optimistic on EMD as valuations appear to be compensating investors generously for the risks. The macroeconomic environment is challenging for all areas of capital markets, but it appears EM investors have already priced this more than most. Inflationary pressures, and corresponding central bank reactions, remain the most important factor for the asset class among other factors such as commodity prices, the evolving effects of the war in Ukraine, and China’s zero-Covid policy. We expect markets to place an emphasis on differentiation amongst countries and credits.

Corporate Credit

MONTHLY REVIEW

The May-end rally proved transitory, and weakness returned in June. The Bloomberg U.S. Corporate Index and the Bloomberg European Aggregate Corporate Index both widened over the month. Energy, equities, and commodities finished lower, reflecting the increased expectations of recession/economic slowdown. News continued to be dominated by a deterioration in fundamental expectations.5

Concerns over elevated inflation, the aggressive policy response and rhetoric central banks and growing recession fears contributed to the second worst one-month return for high yield in more than 10 years, second only to March of 2020. The June spread widening was second only June 2008, according to JPMorgan.6

Global convertibles fell for the eighth consecutive month in June, as the dual threats of rising inflation and looming recession spooked global markets. As the convertible market has shifted down steadily, bonds are now sitting on bond floors and accordingly asset class performance in June was more in line with credit than equities in a risk-off month: the Refinitiv Global Convertibles Focus Index was down compared to MSCI Global equities and the Bloomberg Global Credit index.7

The senior corporate loan market also sank in June, though it remained strong relative to other asset classes.8

OUTLOOK

Looking forward we see investment grade spreads offering attractive valuations that are inconsistent with the fundamentals we see at the individual firm level. Potential catalysts for a rally include Q2 results which confirm issuer performance is stronger than market pricing suggests, or a change in macro sentiment where the risk of a recession is reduced.

We remain cautious on the U.S. high-yield market as we enter the third quarter of 2022. Volatility across risk markets has continued to increase and there is little to suggest the environment for high yield will be become materially more supportive over the near-term. While we have continued conviction in the loan market’s relatively healthy credit picture, the geopolitical situation in Europe clouds the outlook.

Securitized Products

MONTHLY REVIEW

Recession fears caused securitized credit spreads to widen further in June across all mortgage and securitized products, and demand remains tepid overall. Supply is also tapering off as new loan origination slows, and secondary trading activity has also declined. Agency MBS spreads widened further in June and have now widened in 5 of the 6 months in 2022. U.S. Non-agency RMBS, CMBS and ABS spreads all widened substantially again in June, but fundamental credit performance remains healthy overall. European securitized markets spreads also widened though the housing market remains strong.9

OUTLOOK

Credit spreads for many securitized sectors have returned to levels last seen at the depths of the pandemic, but credit conditions are materially better today. We believe the majority of spread widening is due to supply-demand dynamics, with near record Q1 issuance and tepid demand, due to interest rates rising, rather than fundamental credit concerns. We remain constructive on securitized credit and believe sector and security selection will become more important in the coming years if the economy softens.

Risk Considerations

Diversification neither assures a profit nor guarantees against loss in a declining market.

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in a portfolio. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Certain U.S. government securities purchased by the strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. High-yield securities (junk bonds) are lower-rated securities that may have a higher degree of credit and liquidity risk. Sovereign debt securities are subject to default risk. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. The currency market is highly volatile. Prices in these markets are influenced by, among other things, changing supply and demand for a particular currency; trade; fiscal, money and domestic or foreign exchange control programs and policies; and changes in domestic and foreign interest rates. Investments in foreign markets entail special risks such as currency, political, economic and market risks. The risks of investing in emerging market countries are greater than the risks generally associated with foreign investments. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, and correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Due to the possibility that prepayments will alter the cash flows on collateralized mortgage obligations (CMOs), it is not possible to determine in advance their final maturity date or average life. In addition, if the collateral securing the CMOs or any third-party guarantees are insufficient to make payments, the portfolio could sustain a loss.

Diesen Beitrag teilen: