Morgan Stanley IM: Let the Good Times Roll! But for How Long?

What a difference a few days make. 2022 ended with a bear growl. Bond returns were deep in negative territory for December and for the year, as were U.S. equities.

22.02.2023 | 08:06 Uhr

Here you can find the complete article

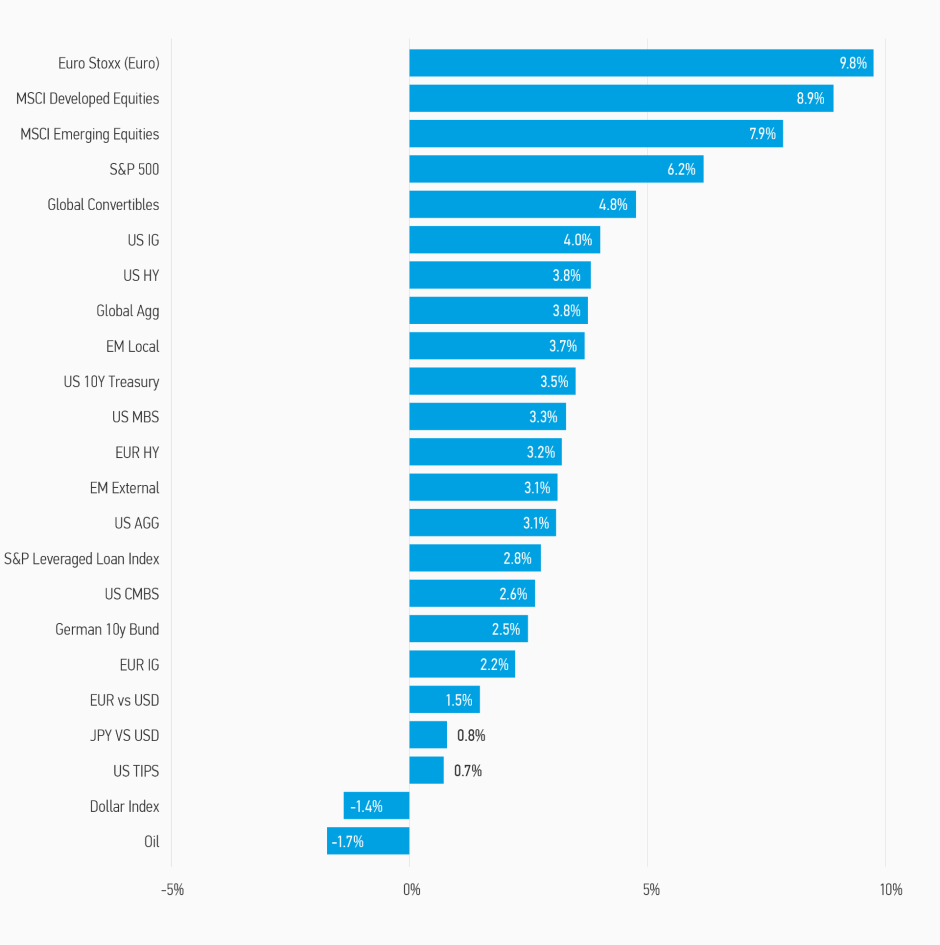

Move forward 30 days to the end of January and bonds are generating 4% returns while the S&P 500 index was up over 4.5%, recouping most of December’s losses. Indeed, after yields rose dramatically in December, bond markets made a U-turn and fell dramatically in January. Markets do not simply change direction this abruptly without a reason, and in this case, there were many.

irst and foremost, the absence of central bank meetings gave markets some freedom to examine the state of the global economy and assess where it stood after the aggressive 2022 rate hikes. Additionally, central banks, by and large, did not come out with hawkish actions or comments in January. Surely, the pace and magnitude will slowdown, reasoned the market. And the market was proven right in early February when both the U.S. Federal Reserve (Fed) and the Bank of England (BoE) reduced the size of rate hikes from 50 basis points (bps) to 25 bps. While this outcome was market consensus, it validated the idea that monetary policy will be less of a drag on economies and markets in 2023. As such, volatility fell, supporting the idea that risk premiums could fall and support risk assets. As volatility diminished, the U.S. dollar continued to fall as the need for safe havens diminished and the economic outlook improved outside the U.S., particularly in Europe and in emerging markets.

Second, fundamentals generally went the right way. Inflation came down significantly in the U.S. Goods price inflation was negative. The U.S. housing market continued to weaken. The business outlook, as summarized in the ISM manufacturing and service sectors, pointed to outright recession. And the labor market seemed to be loosening, e.g., deceleration of wage and employment growth, a key factor in reducing service sector inflation. Yields had reached levels that suddenly seemed attractive if fundamentals were likely to continue to improve and generate one of the rarest of beasts, a “soft” economic landing. A big change from 2022 when markets bounced like a pin ball between the walls of fear of recession and inflation.

Third, FOMO—fear of missing out—certainly played a role, especially as fundamentals looked like they had turned the corner. After the dire financial performance of most financial assets in 2022, the danger of missing out on a bull market (bear market correction) must have been on people’s minds. After all, the best performing asset (outside of commodities) was U.S. dollar cash. Not a stretch to surmise that the investment community was likely long this asset coming into 2023. So, technical conditions played a role as markets rallied over the month. Short covering by speculators and the reduction of underweights by institutional and retail investors helped drive markets higher.

In summary, January was a gangbuster month for financial markets. A lot of fear and loathing evident in December disappeared allowing bonds, equities and non-U.S. currencies to rally. The continued decline in volatility was a key factor in allowing bond yields to fall, equities to rally and credit spreads to materially tighten. In fact, we believe the only way to square the circle of these asset returns is to suggest the market was both oversold, under owned, and a “soft” landing was coming, obviating the need for much more central bank tightening.

DISPLAY 1: Asset Performance Year-to-Date

Diesen Beitrag teilen: