Morgan Stanley IM: From Solvency to Stimulus - What a Policy Shift Could Mean for Fixed Income Investors

Despite low levels of interest rates, there are many investment opportunities for 2021, but only if you know where to look.

25.01.2021 | 08:15 Uhr

Here you can find the complete article.

Synchronised global monetary policy in 2020 that lowered interest rates and supported higher quality assets became the anchor to a fixed income allocation and led to straightforward returns in these asset classes. 2021 is likely to be less linear; therefore less rate sensitive assets may perform better as the global economy is expected to recover. Finding idiosyncratic opportunities and asset selection based on valuation may drive alpha and performance in the year ahead.

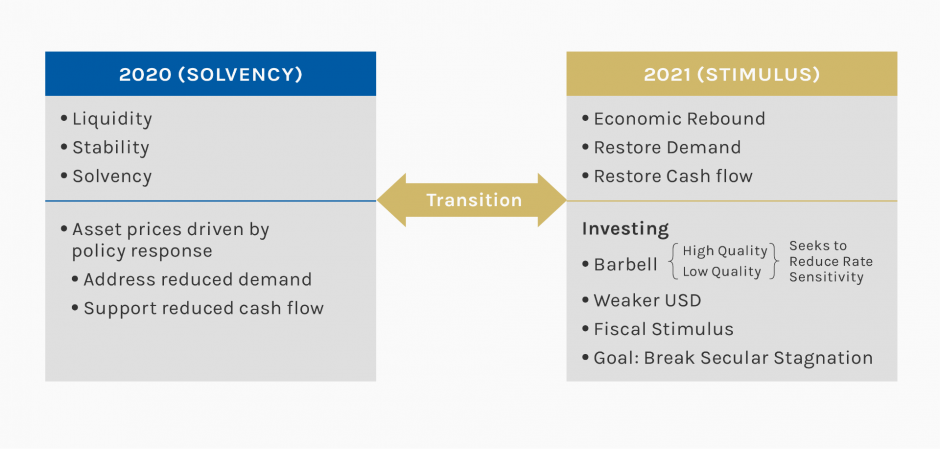

2020 vs. 2021: A Policy Shift from Solvency to Stimulus

Asset prices in 2020 were driven primarily by policy rather than economic fundamentals. Economic fundamentals deteriorated significantly in 2020 because of the COVID-19 pandemic that resulted in lockdowns that in turn led to a sudden drop in cash flows and sharp slowing of economic activity.

The policy response to this was massive. For example, the combination of monetary and fiscal policy amounted to 45% and 44% of GDP in the U.S. and Eurozone respectively.1 This was also true globally as large sums of liquidity were injected into economies through monetary policy easing, central bank balance sheet expansion via quantitative easing (QE) and Pandemic Emergency Purchase Programs (PEPP) and fiscal easing. The coordinated response stabilised markets by easing financial conditions, mainly targeted at high quality fixed income assets, but which ultimately spilled over into credit and equity markets (Display 1).

Source: MSIM, December 2020

Put simply, 2020 was thematically about policy that supported solvency to reduce the risk of longer lasting credit impairment for corporations. For example, the U.S. QE programme included investment grade corporates and was complemented by the Payroll Protection Programme for individuals. The goal for policy makers was to “ring-fence” solvency risk and prevent a spillover into more severe credit impairment. Credit impairment needed to be addressed first because if it was not contained, then it could have longer lasting effects that would reduce the potential for a stronger and faster recovery.

Switching gears, 2021 is thematically about stimulus and economic recovery. We believe policy will still be a key driver but the difference is that economic demand is restored along with cash flows driven by economic stimulus. There is so far an agreement amongst U.S. political officials to deliver a fiscal package of $900bn, but there may be even more stimulus ahead. This is critical because we estimate it will add about 2.75% to annual baseline consensus expectations of 3% GDP growth for a total of 5.5% - 6% for 2021 GDP. This will help close the gap to pre-pandemic trend growth; restoring aggregate demand and cash flow to the broader economy. However, a large gap will still exist as the U.S. may remain below trend growth even with a possible sharp growth rebound in 2021, which means pro-cyclical stimulus will need to be extended into future years until demand catches up with supply and the gap is closed.

INVESTMENT IMPLICATIONS – A BARBELL APPROACH:

What worked well in 2020, i.e. investing in high quality and interest rate sensitive assets, may not work as well in 2021 during economic recovery. The reason is that interest rates may not fall materially and may even rise modestly in 2021.

In order to compensate for the change in direction of rates from lower to flat or higher, one needs to incorporate fixed income assets whose performance is more tightly connected to narrowing credit spreads. One may even consider adding a portion of lower credit quality assets as a way to increase exposure to an economic recovery and also help reduce interest rate sensitivity. This is in addition to holding high quality assets to balance the risk of increased credit risks—what we refer to as a barbell strategy.

ROTATIONS & DISLOCATIONS: We believe there are many idiosyncratic opportunities that exist across the global fixed income market. This is why valuation and asset selection is critical to incorporate into the investment decision making process and construction of a portfolio. Rotating away from assets that became fully valued in 2020 and replacing them with assets that may have room to increase in value will be essential to driving alpha in the year ahead.

2021: Our Best Asset Allocation Ideas for Fixed Income Investors

Key components of our asset allocation decisions are derived from our view of a procyclical and synchronized global economic recovery. However, asset selection and idiosyncratic factors also need to be taken into consideration when constructing a portfolio. Broadly, our best ideas are mainly sourced from the following areas:

- SECURITISED ASSETS. We have a positive bias towards residential-related securitised credit. The underlying fundamentals of the U.S. housing market are solid and we expect the housing market to remain stable into 2021. Positive supply and demand dynamics, declining delinquency rates and low interest rates keeping houses affordable despite a 5-percent rise in national home prices are supportive factors.2 BBB-rated and other more credit-sensitive securities have lagged in the recovery. Although the broader equity and corporate credit markets have largely priced in an economic recovery, the securitised markets are priced with more economic caution. Hence, we believe the current securitised market opportunity remains compelling on a risk-adjusted basis. Due to the strong housing fundamentals discussed, we have a positive outlook for residential-related securitised credit non-agency RMBS, residential related ABS and CMBS, particularly in the U.S. Consumer credit, office CMBS and multifamily housing are attractive sectors.

- EMERGING MARKETS. A procyclical global backdrop of steady, extended monetary accommodation, prospects of a large-scale deployment of COVID-19 vaccines by 1H21 and fiscal stimulus in the U.S. that may support global growth should boost the growth-sensitive segments of this asset class. Therefore, we believe owning HY credit and long EM FX vs. USD via positioning in local currency high-yielders should outperform IG, which has less of a valuation cushion. EM credit has also lagged the recovery and is poised to perform well in what we expect to be a procyclical global recovery. Technical factors also enhance our optimistic case for EM debt next year. In particular, an increasing EM-DM growth differential and a continued search for yield prompting investors to riskier segments of fixed income, should drive inflows back into EM.

- HIGH YIELD CREDIT. We find the best valuations to reside in U.S. high yield but with the caveat that we expect returns to be driven by beta-compression. That is we expect a compression in yields across BB, B and CCC rating cohorts. We look for value investments based on bonds that have lagged but are likely to perform better in a cyclical recovery. We see idiosyncratic opportunities that are name and credit specific to likely generate the most alpha.

- HIGH QUALITY. Owning high quality and more interest rate sensitive fixed income is part of our tactical barbell approach. This includes adding U.S. Treasuries, Australian and New Zealand government bonds upon an expected back-up in yields during 1H21. However, we do have some aversion to owning highly rated IG credit and will look to reduce exposure. This is because credit spreads in this area have already meaningfully narrowed. In fact, we expect to shy away from A-rated corporates with high cash balances because there is risk that M&A activity in this cohort could weigh on valuations. We would prefer owning a combination BBBs with solid fundamentals and U.S. Treasuries as a preferred risk allocation, for example.

- CONVERTIBLE BONDS. We believe convertibles are attractive to add to one’s asset allocation based on valuation and diversification. Our view for a procyclical recovery is likely to support riskier asset prices and may benefit convertible bonds as well. In addition, convertibles tend to perform well as volatility rises, which can act as a diversifier to long credit positions that are inherently short volatility through default risk premiums. Heavy supply technicals have also helped keep convertible bond valuations comparatively low versus equities, thus providing an opportunity to own optionality through the convertible markets at more attractive valuations.

Conclusion

Monetary and fiscal policy is likely to play an important role in asset performance in 2021, as it did in 2020. The key difference is that policy support will accompany an economic rebound (pro-cyclical) in 2021 versus offsetting an economic deterioration (counter-cyclical) as it did in 2020. The goal of policy is to ensure that the economic rebound is big enough and lasts long enough to produce enough aggregate demand to close the output gap and engineer a return to trend growth. This process is unlikely to be smooth and asset prices and interest rates will fluctuate along the way. In this environment, we believe active management, security selection and valuation are all necessary components in constructing a durable fixed income asset allocation.

1 Source: Federal Reserve, European Central Bank. Data as of November 30, 2020

2 Source: S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, as of November 30, 2020

RISK CONSIDERATIONS

There is no assurance that a Portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the Portfolio will decline and that the value of Portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this Portfolio. Please be aware that this Portfolio may be subject to certain additional risks. Fixed income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Mortgage- and asset-backed securities are sensitive to early prepayment risk and a higher risk of default, and may be hard to value and difficult to sell (liquidity risk). They are also subject to credit, market and interest rate risks. Certain U.S. government securities purchased by the Strategy, such as those issued by Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. It is possible that these issuers will not have the funds to meet their payment obligations in the future. High-yield securities (“junk bonds”) are lower-rated securities that may have a higher degree of credit and liquidity risk. Public bank loans are subject to liquidity risk and the credit risks of lower-rated securities. Foreign securities are subject to currency, political, economic and market risks. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed countries. Sovereign debt securities are subject to default risk. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Restricted and illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). In addition to the risks associated with common stocks, investments in convertible securities are subject to the risks associated with fixed-income securities, namely credit, price and interest-rate risks. In general, equity securities’ values also fluctuate in response to activities specific to a company.

Diesen Beitrag teilen: