Morgan Stanley IM: Fear and Hope – Soft vs Hard Landings

Markets continue to be buffeted by high levels of volatility driven by shifting fears of recession and inflation. This roller coaster of a month resulted in very diverse financial market performance.

04.07.2022 | 08:12 Uhr

Here you can find the complete article.

In the U.S., the month started off where April ended: higher yields, wider credit spreads, weaker equities as inflation fed tightening fears dominated. But by mid-month, slowdown fears (growth surprises became negative) increased, which pushed yields lower across U.S. Treasuries, reduced rate hike expectations by about 25 basis points (bps) and helped equities rebound. By the end of May, U.S. Treasury 10-year yields were down about 9 bps and the S&P 500 equity index essentially unchanged, after being down almost 6% mid-month. With a more dovish U.S. Federal Reserve (Fed) outlook (on the back of growth fears) the U.S. yield curve steepened.

Price action in the rest of the world’s bond markets was not so benign. Yields in Europe rose significantly with German 10-year yields up 18 bps. It was quite noticeable that in countries where monetary policy hawkishness weakened to some degree, bond markets did OK; but in those countries where central bank hawkishness was maintained or intensified, bond yields continued to rise over the month.

Inflation data continue to show little signs of slowing sufficiently for central banks to relent on hiking plans. Fed rhetoric remains one of “expeditiously” getting rates normalized while, for example, European Central Bank (ECB) members continue to harp on the need to quickly exit negative interest rate policy. As such, May was unusual in that U.S. rate expectations softened (taking out one anticipated rate hike) relative to those in the rest of the world. The Bank of Canada was particularly forceful in its comments about the need to do “whatever it takes” to get inflation down sooner rather than later.

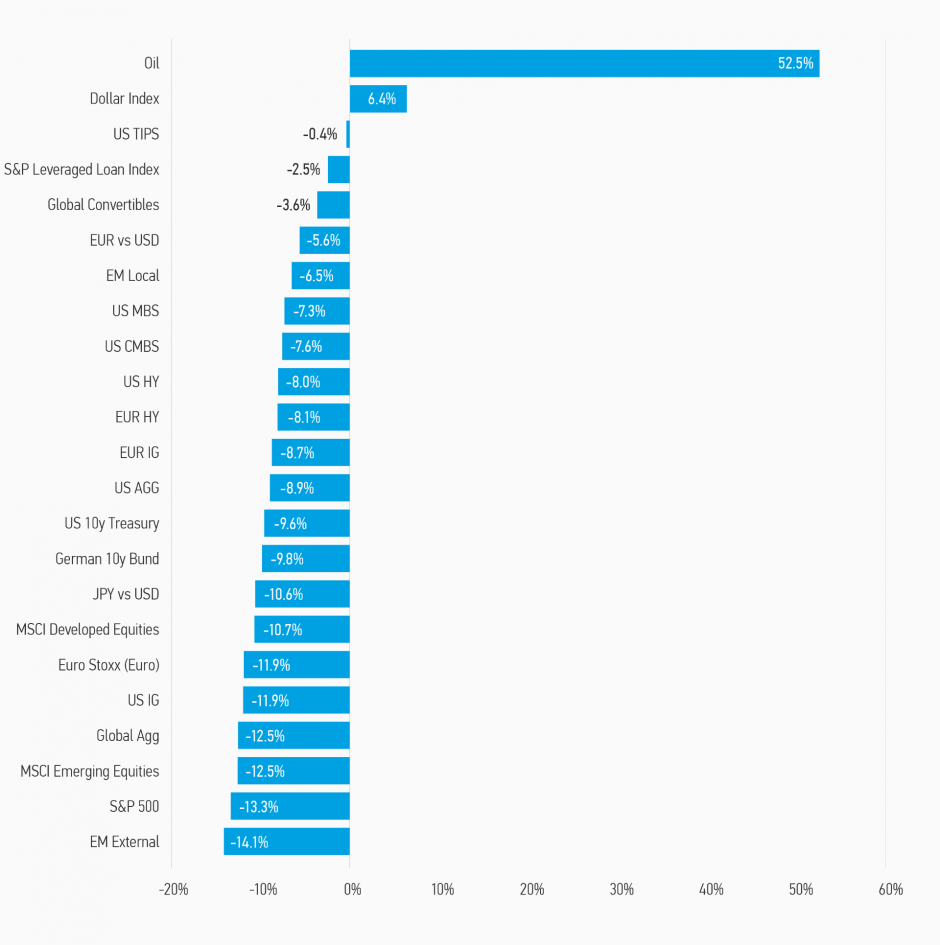

DISPLAY 1: Asset Performance Year-to-Date

Note: USD-based performance. Source: Bloomberg. Data as of May 31, 2022. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

Perceptions that inflation had peaked, economies were slowing, and the Fed was unlikely to raise rates by more than priced into yield curves gave a fillip to markets, especially once U.S. Treasury yields moved over 3% on May 5, a level perceived to be a bridge too far (for the health of the economy). The mid May rally in U.S. yields was somewhat anomalous, suggesting it is unlikely to continue. During the month, real yields rose as nominal yields fell, implying a decline in inflation expectations. Nominal and real yields are usually highly positively correlated. It is also counterintuitive given the upward pressure seen in commodity prices (particularly oil and food) to think inflation expectations should improve so significantly. As such, we were not surprised that the rally in 10- year U.S. Treasuries ran out of steam around the 2.75% level.

These relative central bank assessments drove fixed income returns. U.S. Treasuries and U.S. dollar bonds eked out positive returns for the month, while in general, fixed income returns were negative outside the U.S. High yield corporates continued to sell off, not benefiting as much from an easing of Fed hawkishness. Indeed, while anticipating lower short rates is good for bonds, higher real yields and lower inflation is not for lower quality issuers. Euro-denominated corporate bonds (both IG and HY) put in a very poor performance on the back of increased ECB hawkishness, higher yields and poor inflation data.

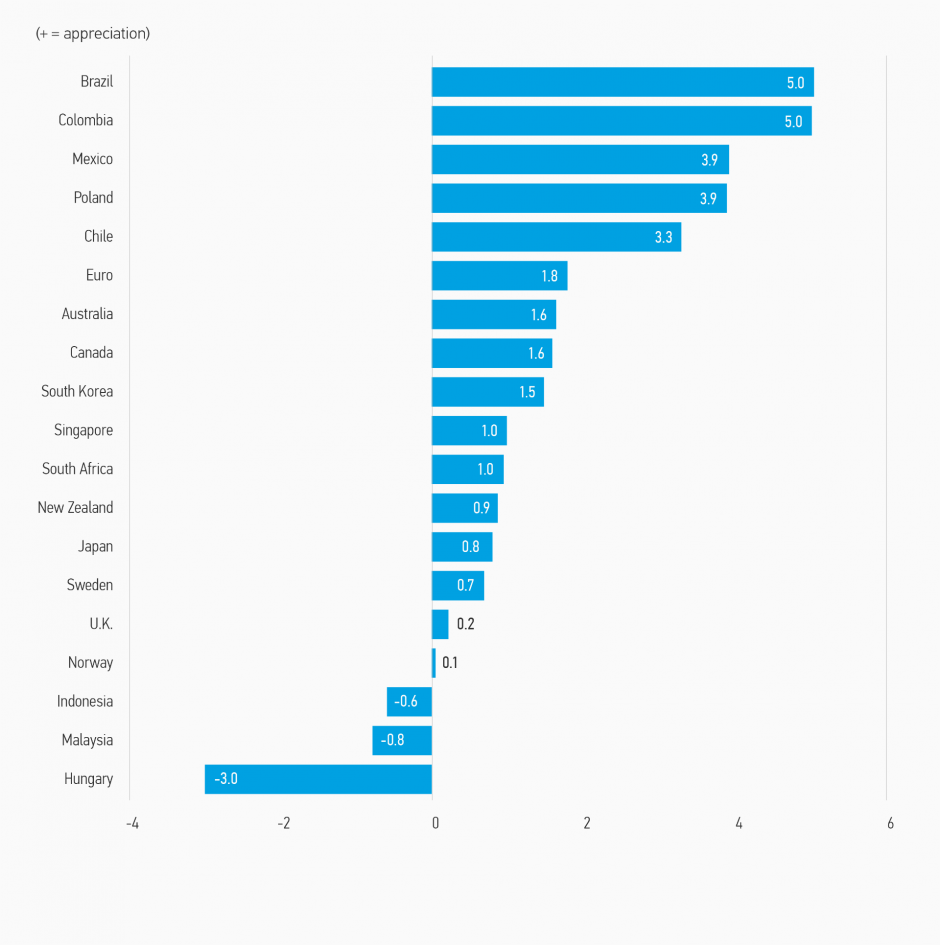

DISPLAY 2: Currency Monthly Changes Versus U.S. Dollar

Note: Positive change means appreciation of the currency against the USD. Source: Bloomberg. Data as of May 31, 2022.

Emerging market debt (EMD) returns were very diverse in May. External markets underperformed as spreads did not recover as well as credit markets. However, local markets did well, putting in one of the better returns across asset classes as EM currencies strengthened on the back of optimism that peak Fed funds rates were discounted. Another key differentiator has been external conditions whereby commodity exporters have generally benefited from high and rising commodity prices while commodity importers are suffering worsening trade balances.

DISPLAY 3: Major Monthly Changes in 10-Year Yields and Spreads

Source: Bloomberg, JPMorgan. Data as of May 31, 2022.

Fixed Income Outlook

Unfortunately, volatility is unlikely to go away. Even though most of the bear market in rates is likely behind us, upward pressure from high (even if falling) inflation and rate hikes will keep bond yields elevated. Central banks are highly likely to deliver what is priced into yield curves. Chairman Powell has reiterated multiple times the need to “normalize” rates “expeditiously.” We take that to mean moving the Fed funds rate to a minimum of 2.5% this year with risks skewed higher. Once the Fed gets rates to the 2.5-2.75% zone, the pace of rate hikes is likely to slow but continue. The extent of the move beyond “normal” will be highly data dependent, meaning how the economy is performing in late summer and early fall. If growth continues to slow; labor markets loosen, softening wage growth. Most importantly, if inflation is moving lower, the Fed can slow the pace of tightening, protecting economic growth. However, it is not clear at all if these conditions will be met. Thus, the concern remains that the probability of the Fed lifting its terminal rate forecast at the June Federal Open Market Committee (FOMC) meeting is significant, which could easily upset markets.

Central banks in general remain on a hawkish trajectory, even those in countries that have already experienced significant rate hikes. New Zealand’s central bank, one of the first to raise rates last year, was expected to announce a slowing or ending of its hiking cycle. Instead, it doubled down, saying overdoing it (in terms of rate hikes) was less risky than doing too little. Similar sentiments appear to be becoming the majority sentiment at the ECB where inflation has continued to surprise to the upside while economic growth has NOT taken as big a hit as was expected pre-Russian invasion of the Ukraine. Expect more hawkish rhetoric and actions by central banks.

Central banks are not acting without reason. May data for business confidence, labor markets and consumer spending was resilient. Yes, in some cases like the U.S. Institute for Supply Management (ISM) data, results were weaker than expected, but they remain at robust levels and, we believe, are likely to stay firm as strong labor markets, strong income generation, healthy balance sheets and high savings keep service sector spending strong. It is difficult to see meaningful falls in inflation with economic fundamentals so solid. While goods producing sectors have peaked in terms of growth, services still have upside potential. We remain more wary of inflation than recession.

The ending of Covid restrictions (at least for now) in China should also be a positive for the global economy with demand effects outweighing supply side improvements. If so, this will be another reason to expect commodity prices to remain firm, increasing the difficulty of central banks to bring down inflation, especially with household and corporate fundamentals so strong.

The outlook for corporate bonds is mixed. The simple metric is: hard landing bad; soft landing good. While we wait to see which one wins out, spreads should remain in recent ranges (+120 – 150 bps on U.S. IG index, somewhat higher on high yield, +350 – 550 bps). Volatility amongst companies and sectors is likely to remain high as companies navigate high inflation and supply/ input challenges (and of course ongoing corporate disruption). Recent spread widening in April/May took spreads into recession-like territory (+150 bps). This proved too wide given continued economic resilience and higher absolute yields. On the other hand, corporate results are unlikely to improve significantly, leaving IG spreads stuck between where they began the year and May wides. We still like credit for their carry, see opportunities in idiosyncratic situations whereby some companies have been unduly punished in the April/May sell off.

Emerging Markets (EM) was a tale of two markets in May. Local outperformed with external lagging significantly. Local returns were boosted by strong EM FX performance. Lower rated external EM continues to struggle with high energy and food inflation, undermining fiscal balances and economic growth. With several frontier economies on the verge of or restructuring, risk remains there as well. Countries that benefit from high oil and food prices have performed well. Country level analysis will be vital to uncover value as we expect markets to place an emphasis on differentiation amongst countries and credits. EM is likely to struggle as long as Developed Markets (DM) central banks remain on their current hawkish trajectory and inflation stays high. EM external looks reasonably attractive but lacks a catalyst to spark a rally.

Developed Market Rate/ Foreign Currency

MONTHLY REVIEW

Broadly, the move in DM rates was mixed, occurring on a country-by-country basis. Central bank policy and indications from policy members drove much of the monthly moves, with a more dovish Fed bringing down most U.S. rates, while surprisingly hawkish sentiment from the ECB, Bank of England (BoE), and Reserve Bank of Australia (RBA) led to selloffs elsewhere. Markets started pricing in more growth/recession concerns, leading risk assets to sell off and causing a more typical negative correlation between risk assets and U.S. Treasuries to appear, with Treasuries attractive as a safe haven asset.1

OUTLOOK

Central banks are still forced to navigate a tough situation to achieve a soft landing that will cool inflation without pushing the economy into a recession. While the slight decline in U.S. Consumer Price Index (CPI) may indicate that the economy has pushed past the peak, the key will be how long, and how high, inflation will remain.

Emerging Market Rate/ Foreign Currency

MONTHLY REVIEW

EMD segments were mixed in May with the local index achieving positive returns primarily due to broad currency strength, while average spreads on the hard currency indices—both sovereign and corporate—widened, leading to muted performance. Outflows continued from the asset class as a whole and across both local and hard currency funds.2

OUTLOOK

Valuations appear to be compensating investors well at these levels while areas of opportunity remain. Inflationary pressures will likely continue for both developed and emerging markets in the near term as energy and food prices remain elevated. As such, Fed tightening remains a notable concern, but markets appear to be appropriately pricing in that risk. Country-level analysis will be critical in uncovering pockets of opportunity within this diverse universe.

Corporate Credit

MONTHLY REVIEW

For much of the month, continued concern over the impact of inflation, interest rates and tightening liquidity on corporate and consumer health weighed on risk sentiment.3

As such, corporate credit sectors underperformed. Investment grade credit spreads widened slightly in May, with Europe notably underperforming the U.S. The high yield market experienced pronounced weakness for the balance of May before rallying aggressively in the final days of the month. Global convertibles fell again in May as well, underperforming both equities and bonds.4

The senior corporate loan market also sank in May.5

OUTLOOK

Looking forward we see spreads rangebound. Markets are supported by more attractive valuations and strong corporate results, yet constrained by continued macro uncertainties, and weak technicals given the lack of demand while market volatility remains high.

We are cautious on the high yield market. The high yield market experienced significant pockets of volatility this year and there is little to suggest the environment for high yield will become materially more supportive over the near term. While we have continued conviction in the loan market’s relatively healthy credit picture, the geopolitical situation in Europe clouds the outlook.

Securitized Products

MONTHLY REVIEW

Recession fears caused securitized credit spreads to widen further in May while government-guaranteed agency MBS tightened. Agency MBS bounced back and outperformed both U.S. Treasuries and credit assets in May, however, Agency MBS spreads are still materially wider than pre-pandemic levels as the market is pricing in the end of quantitative easing and likely the beginning of quantitative tightening. U.S. non-agency Residential Mortgage-Backed Securities (RMBS) spreads widened further across nearly all residential sectors over the month. U.S. ABS spreads were also wider in May, but fundamental credit performance remains strong.6

OUTLOOK

We believe the securitized market still offers a unique combination of low durations, attractive yields, and solid credit fundamentals. We remain constructive on securitized credit and believe sector and security selection will become more important in the coming years if the economy softens. We remain cautious on agency MBS and interest rate risk.

Diesen Beitrag teilen: