Morgan Stanley IM: European Short Duration – An asset class for an uncertain world

Market moves in 2022 have shaped a strong argument for short duration fixed income solutions: 2022 saw government bond yields move sharply higher, credit spreads widen above long-run averages, and yield curves flatten. This was driven largely by persistently high inflation and hawkish central banks, who delivered multiple base rates hikes in an attempt to tame inflation.

09.02.2023 | 07:02 Uhr

- The prospect of less hawkish central bank policy should be supportive for short duration assets in 2023: With signs that inflation could be trending lower, policy and short-term interest rate uncertainty is expected to decrease as Central Banks pivot to a more balanced policy mix focused on growth and inflation.

- Historically, higher yields have provided investors a much better starting point to generate positive absolute returns: We believe higher yields should provide investors with more ‘carry’ and a better cushion against further credit spread widening and/or interest rate volatility. In addition, both government and credit curves flattened in 2022. The net result is that short duration high quality bond yields are at levels that can help meet investor goals without the need to extend duration or increase credit risk.

- Corporates entering 2023 from a strong position: Issuers are going into the year with defensive business models, strong liquidity, optimised costs from the covid era, and leverage that recognises the risk to profitability in 2023. We do not expect a spike in default rates.

- Credit Valuation: The widening of credit spreads in 2022 reflects the widening of swap spreads as well as weaker credit markets. We expect credit spreads to remain range bound above long run averages reflecting current macro uncertainties. Tighter swap spread and carry should be a driver of returns with government bond yields and credit spreads at attractive levels. Expect sector dispersion and outperformance from financials

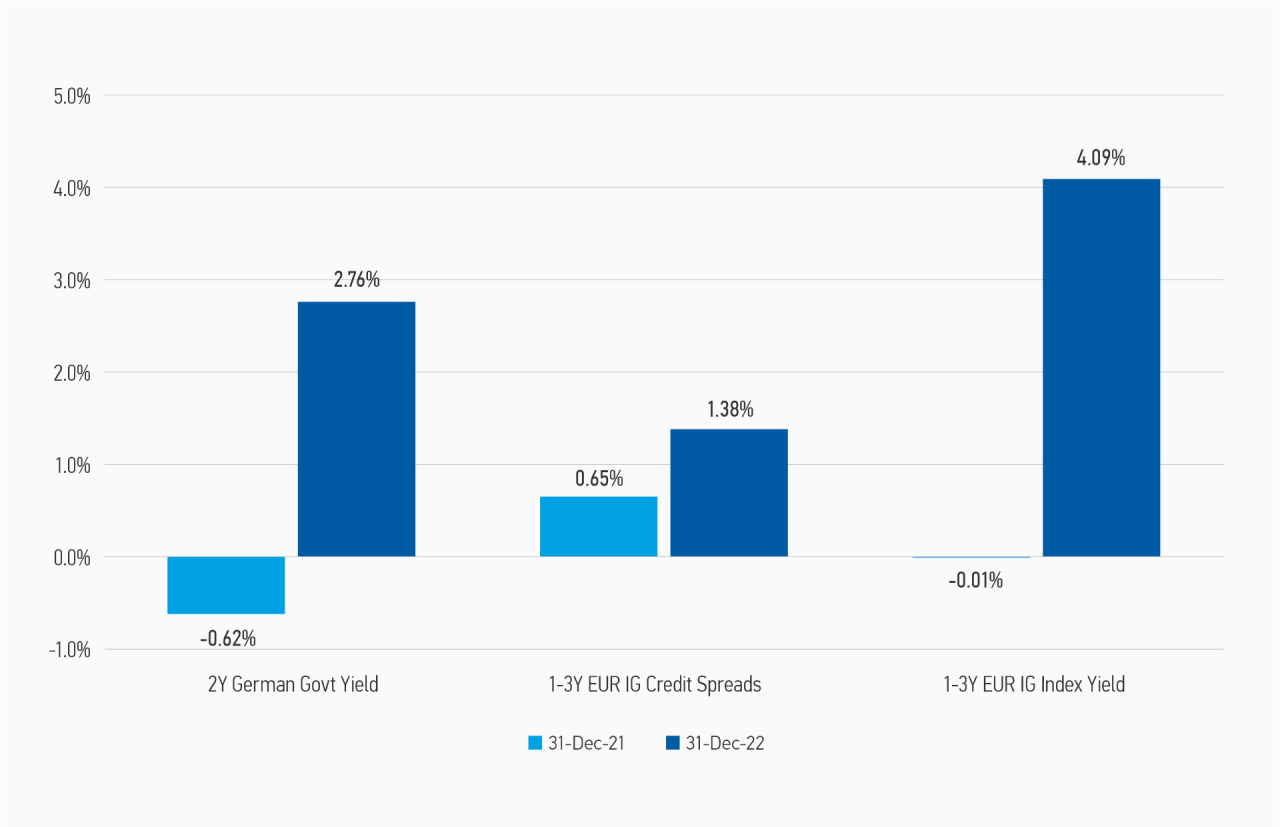

2022: A sharp rise in yields

After more than a decade of low inflation and low growth that allowed for 'easier' monetary policy (low/negative interest rates coupled with quantitative easing programmes), central banks were forced to aggressively tighten monetary policy in 2022 in response to persistently high, supply-side driven inflation. The subsequent market moves in government bond yields and credit spreads have shaped a strong argument for short duration fixed income strategies.

The yield on a 2-year German government bond was 338 basis points higher, rising from -0.62% to 2.76%. The credit spread of the Bloomberg 1–3-year EUR investment grade corporate index rose 73bps from 65bps to 138bps. The yield of that very same index rose 4.1%, increasing from -0.01% to 4.09% (see Display 1)

DISPLAY 1 2022: Sharp move higher in short duration yields

Diesen Beitrag teilen: