Schroder: What will drive eurozone earnings growth?

Macroeconomic news from the eurozone disappointed over the summer, but the region can count on plenty of other potential drivers of earnings growth.

09.09.2014 | 15:44 Uhr

There has been some downbeat macroeconomic news from the eurozone over the summer, notably the disappointing second quarter GDP print which indicated that the region’s growth ground to a standstill. The weaker data has forced the European Central Bank (ECB) into action, following up on the measures already announced in June. Interest rates have taken another small cut, now standing at 0.05% compared to 0.15%, and the negative deposit rate for assets held at the central bank has been lowered to -0.2% from -0.1%. Perhaps the most important news was the announcement that, as had been trailed, the ECB will undertake a programme to purchase asset-backed securities (ABS) and covered bonds. The news confirms - if confirmation were still needed - that the ECB is prepared to act to help boost the eurozone economy.

Sceptics may argue that even the latest measures announced by the ECB will not be enough to see sustained growth return in Europe. Certainly there are factors outside the ECB’s control – such as the situation in Ukraine – that may weigh on economic activity. Nevertheless, earnings in Europe have plenty of scope to play catch up with other developed markets, for example the US where earnings have surpassed their pre-crisis peak. It is important to bear in mind that economic growth is by no means the only source of earnings growth for corporates. There are a number of factors that should prove supportive for eurozone earnings growth, and correspondingly for share prices to advance.

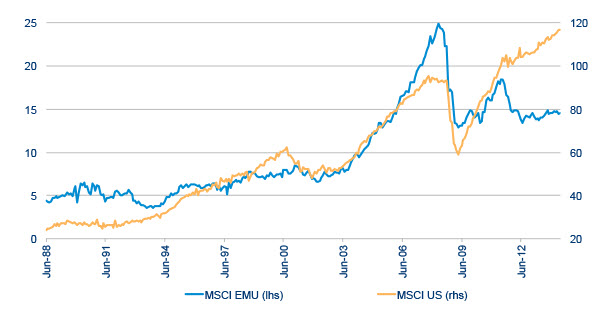

12 months forward earnings per share

Source: Datastream 30 June 2014

Firstly, the ECB’s actions ever since Mario Draghi’s famous ‘whatever it takes’ speech in July 2012 have served to push down sovereign bond yields and thereby reduce borrowing costs for corporates. Bond yields for a number of eurozone countries were already at multi-century lows and have fallen further in recent days. This provides a significant opportunity for companies to refinance their debt, or to borrow, at lower costs. In particular, utilities and telecoms have already seen the benefit from refinancing this year and there are many other sectors, such as real estate, which are also taking advantage of the opportunity to lower their costs.

Secondly, the ECB’s easing measures have in part been targeted towards weakening the euro, and in this they have so far been successful. The euro depreciated over the summer and, following the latest announcement, moved below $1.30 for the first time in more than a year. The weaker currency will provide significant support for Europe’s exporters, many of which suffered earnings downgrades earlier in the year as the relative strength of the euro proved a severe headwind. That should now turn around into a tailwind and be a source of earnings upgrades.

Thirdly, there is scope for substantial shareholder returns. There is around €600 billion on eurozone corporate balance sheets and a substantial portion of this could be returned to investors in the form of share buybacks or dividends. We saw that US share buybacks and dividends hit record levels in the first quarter of this year and there is the potential for eurozone corporates to follow suit.

Fourthly, there is the prospect of banking recovery ahead. This autumn brings a number of events that should further restore confidence in Europe’s banks and kick-start lending once more. Later this month comes the first of the ECB’s Targeted Long-Term Refinancing Operations (TLTROs), which will provide eurozone banks with up to €400 billion of cheap funding to lend on to the corporate sector. The structure of the TLTROs provides an incentive for banks to lend; firstly, the more they lend, the more funding they can receive; secondly, banks that can show growth in their non-mortgage lending balances will have four years to repay the loans, rather than two. Meanwhile, results from the ECB’s Asset Quality Review and Street Test will be available in mid-October. While some casualties are likely, we expect the process overall to be positive for the sector and to restore greater confidence in both equity and credit markets within the eurozone.

Notably, the ECB’s measures to ease monetary policy are coming at a time when other central banks, most notably the US Federal Reserve (Fed), are contemplating tightening. The Fed is likely to end its quantitative easing programme in October, just as the ECB is expected to launch its ABS purchases. The result should be further depreciation for the euro versus the dollar.

Taken together, the above factors offer the potential for corporates to grow their earnings regardless of the macroeconomic environment. Even if we assume zero economic growth in the eurozone, we think the factors mentioned could add some 10-12% to corporate earnings. A sustained economic recovery for the eurozone would of course be a further support and the ECB’s measures may well be effective in their aim of stimulating economic activity. Nonetheless the road to recovery could be a bumpy one, and in the meantime corporates have plenty of potential drivers of earnings growth that do not depend on the economic environment.

Diesen Beitrag teilen: