NN IP: Dovish ECB is creating a Goldilocks environment

The earnings season is developing well in the US, but is more mixed in Europe. We downgrade emerging markets from a medium to a small overweight.

08.11.2017 | 13:46 Uhr

The equity outlook has clearly improved over the past week. The earnings reports indicate strength and the corporate guidance is positive. More than half of the S&P500 members have published and three out of four companies did better than expected. The average earnings beat is around 5% on revenues that are 1% better than expected. This is better than earlier in the season. The biggest driver was the technology sector, but financials, energy and consumer goods also did well. Not surprisingly, these are all cyclical sectors.

In Europe, the picture is less convincing. Only half of the companies beat the consensus estimate and on average results were fully in line with these expectations. Energy and technology were the two strong holders, while telecom and health care disappointed.

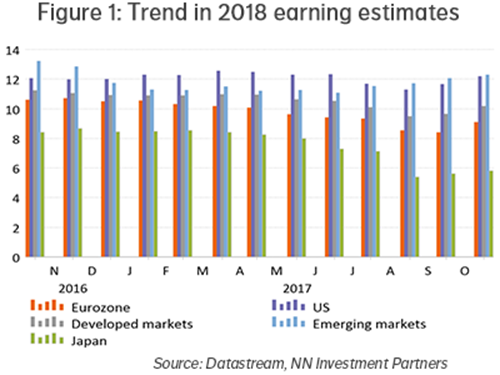

Global earnings momentum has strengthened again and is positive across all regions except the Eurozone, where one of the headwinds is probably the strengthening of the euro, although this trend seems to have stopped by now. We would not be surprised to see momentum for Eurozone companies also moving in positive territory. For 2018, the earnings outlook is very promising, with double-digit growth expected both for developed as well as for emerging markets.

A second positive element came from the ECB. Draghi’s message to continue QE at a reduced EUR 30 billion a month until September or longer if necessary, combined with strengthened forward guidance on rates, was clearly considered a dovish surprise. This puts ECB uncertainty off the table for some time.

A third element is linked to the economic data. The surprise indicators, especially for the US market with the strong GDP figures (3% QoQ annualized in Q2) coupled with increasing consumer confidence and a further increase in the Eurozone confidence indicators (IFO and economic confidence) are worth mentioning. So, strong earnings and macro data coupled with a dovish ECB in addition to the even more dovish BoJ comes close to an environment some of us would describe as Goldilocks.

On the political front, the tensions in Catalonia cooled down over the weekend with the central government taking over powers from the regional government and calling regional elections on 21 December. The Spanish equity market recovered and is back above the levels that prevailed before the referendum. Some volatility could return depending on the news flow once we are closer to the election date. Should independence parties PDeCat and ERC lag behind in the polls, as is now the case, Spanish equities could further recover relative to the rest of the Eurozone.

This is not to say that the environment is without risk. A big source of uncertainty is the appointment of the next Fed chair. If the rumours are to be believed, the race is down to two candidates: Powell or Taylor. The former is the candidate of continuity who would not represent a major break with Yellen-Fed. The latter is the hawkish candidate who advocates a more rule-based approach with less of a focus on the Fed put-option. This would likely lead to a higher risk premium for risky assets. A decision on the appointment could come as soon as today.

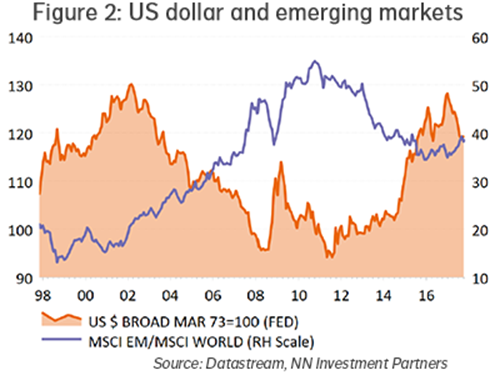

In view of the strength in developed markets and the risk of external pressure coming from a stronger USD or a more hawkish Fed appointment, we reduce the overweight in emerging markets from medium to small. Figure 2 illustrates this inverse relation. The high consensus positioning in EM is also a point of attention. An overweight is still justified in view of the strong earnings prospects and attractive valuation. The region quotes at a substantial 25% discount based on 12-month forward earnings.

Diesen Beitrag teilen: