Henderson: Property may be out of fashion, but not out of return potential

Guy Barnard, Co-Head of Global Property Equities and Pan European property equities manager, provides an update on the European property market, his current views and where he believes the best value opportunities exist.

16.05.2017 | 12:39 Uhr

The European property sector delivered positive returns in the first four months of 2017, with stocks in Switzerland, Germany and Spain making the most gains. 2016 year-end results proved positive, with further evidence of strong valuation gains in markets such as Germany and Sweden. Improving economic growth is also leading to increased occupational demand and feeding through to rental growth in an increasing number of sectors, such as Spanish and German offices. In the UK, according to property consultants IPD (Investment Property Databank), UK capital values grew again in March, marking a sixth consecutive month of positive capital growth since ‘Brexit’. This highlights the current disconnect between pricing in the physical property market and the pricing of listed shares.

Still-attractive prospects

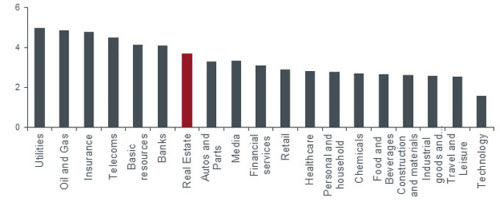

Despite a range of supportive factors, European assets and the property sector continue to be out of fashion with investors. With listed real estate stocks continuing to trade at a discount to net asset value (NAV), it remains an attractive option for investors to buy property through shares. While growth driven by yield compression is moderating, we still forecast circa 5% asset value growth this year*, albeit with wide divergence by country and sector. More importantly, the income streams of the property sector remain incredibly robust; we anticipate the sector’s current dividend yield of almost 4% (see chart) will grow by 7% p.a. for the next two years*.

*Henderson Global Property Equities Team forecasts may vary and are not guaranteed.

Estimated 2017 dividend yield for STOXX Europe 600 by sector

Source: Factset, at 10 May 2017. Forecast yields may vary and are not guaranteed.

Maintaining our conviction and positioning

• Europe − capital appreciation

It is anticipated that the pace of capital growth from European commercial property will slow down in 2017. However, in our view there will be further asset value appreciation in sectors such as Continental retail, French and Spanish offices, Scandinavia, and German residential and commercial landlords (eg Aroundtown Properties). We also expect a gradually improving macroeconomic environment to be supportive of a gradual return to rental growth.

• Europe − income growth

From a listed market perspective, we have typically sought exposure to those companies best placed to grow their income streams, through a combination of being in attractive geographic locations and sectors, where the balance of supply and demand favours landlords. This has led us to continue to favour markets and sectors such as German residential and commercial, prime shopping centres, Sweden, and recovering markets such as Spanish and Paris offices.

• UK

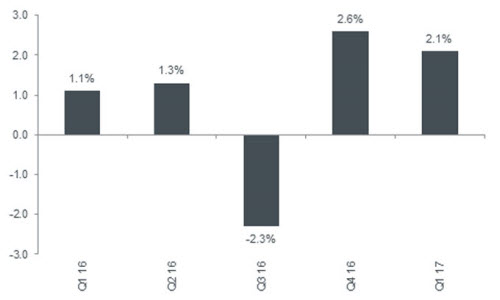

The UK property market proved far more resilient following the ‘Brexit’ result than expected by most. Although capital values fell between July and September, they have been rising steadily since (second chart). A weak sterling, lack of distressed sellers, and policy action taken by the Bank of England, have all supported the market. Although we expect further capital declines in certain parts of the market driven by a weaker rental outlook, sectors such as industrials look set for continued capital growth, in our view.

UK All Property total return by quarter

Source: IPD UK Index at 31 March 2017. Past performance is not a guide to future performance.

We remain cautious given ongoing ‘Brexit’ uncertainty. That said we are still seeing value in many UK property stocks, which continue to be heavily discounted despite high quality assets and balance sheets. Our focus remains on areas of structural growth such as industrial, self-storage (eg. Safestore), student accommodation, and residential land outside London. This, coupled with some selected value names such as UK regeneration specialist St. Modwen Properties, and convenience shopping centre owner Capital & Regional, we think, provides a well-balanced exposure to the market.

Summary

Although the European political backdrop may create more volatility in equity markets this year, we continue to believe that real estate’s offer of an attractive income yield with predictable growth characteristics should be able to deliver attractive returns to investors. Furthermore, while market-wide capital growth is likely to slow in 2017, there are pockets of growth that we can target at a country, sector or city level. As such, we believe the stocks held in our high conviction portfolios continue to offer attractive prospects, either from a growth, value or income standpoint.

Note: references made to individual securities are for illustrative purposes only and should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

Diesen Beitrag teilen: