UBS AM: US-Dollar depends on China

Erin Browne, Head of Asset Allocation, discusses the vulnerability of the broader emerging markets (EM) universe to rising US rates and US dollar strength, and the outlook for EM assets as Chinese growth slows.

24.08.2018 | 09:22 Uhr

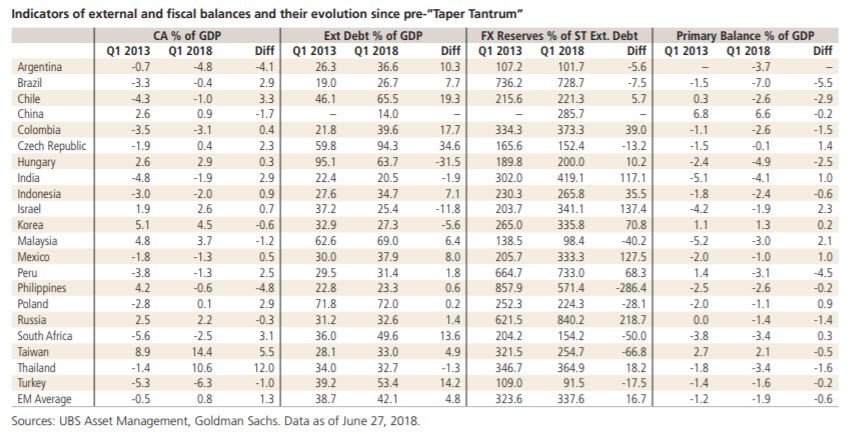

In expressing a positive view of emerging market (EM) equities in early July we highlighted the attractive valuations and improved fundamentals since the last time fears about tightening US dollar liquidity conditions prompted a major sell-off across EM assets: 2013’s Taper Tantrum. But despite these positives, we also highlighted that risks still remained to EM assets and currencies from rising US rates and a strengthening US dollar, heightened protectionism and a faster-than-expected China slowdown.

Since that update, all three of those risk factors have come more sharply into focus as the collapse in the Turkish lira amid heightened volatility across EM asset classes raise fears about a more sustained sell-off in EM assets.

Can the situation in Turkey really be categorized as idiosyncratic and Turkey-specific – or are Turkey’s problems the ‘canary in the coalmine’ ahead of wider EM contagion? This Flash Update seeks to address this important question.

Stronger USD, tighter financial conditions The US dollar remains absolutely fundamental to EM prospects. Historically the relative performance of EM equities has demonstrated a strong statistical relationship with the US dollar on a trade weighted basis. The principal reason is that the overwhelming majority of EM corporate debt is denominated in US dollars. But there are other factors too, not least the negative impact of a stronger dollar on global trade – particularly commodities – to which EM demand growth is highly exposed.

Since we last wrote about EM in early July the US dollar has continued to rise – up around 2% on a trade weighted basis since the end of June – and EM currencies, equities and debthave continued to fall. In our view recent US dollar strength primarily reflects that global growth has become increasingly desynchronized, with the sustained robustness of US demand standing in ever sharper contrast with the moderating growth profile of other major developed economies. The policy actions of major central banks are therefore likely to remain on similarly separate paths and we expect the US Federal Reserve to continue hiking rates, albeit gently, at a time when rate hikes and tighter conditions are still some time away for its major counterparts. Against this backdrop, it is not surprising that the trade-weighted dollar has continued to rise. For EM countries with significant external funding requirements and large current account deficits this backdrop is clearly far from ideal. In addition to Turkey, we would highlight countries including Argentina, Colombia, South Africa and Malaysia.

But the critical point is that EM overall is in much better shape than during the 2013 Taper Tantrum when similar fears arose about the impact on EM assets of tightening US financial conditions. Clearly, EM central banks also have tools at their disposal in the form of higher rates to respond to currency weakness.

So what is the outlook for the US dollar given the somewhat self-sustaining vicious cycle of USD strength and EM stresses? In our view, the critical factor is ex-US growth. China’s recent stimulus measures should cushion the economy, but will take time. Meanwhile, data in Europe and Japan have shown signs of stabilization after a weak second quarter – but are still notably weaker than the US. In the short-term, a strong US dollar is likely to ensure higher volatility in EM assets. Nonetheless, we believe fears about a step change in global financial conditions are overdone. Yes, the Fed is tightening. But it is doing so very slowly, with great transparency and with data dependence. Crucially in our view, real policy rates are zero. Meanwhile, the Fed has been unwinding its balance sheet precisely as it said it would a year ago, and may now end the process earlier than expected. What is very clear however is that that the Fed will maintain a significantly larger residual balance sheet than it did prior to the onset of QE.

Outlook for trade as protectionism escalates

On the trade front, President Trump’s initiation of a process to implement tariffs from 10%–25% on USD 200bn worth of Chinese goods is a credible threat. With ‘America First’ playing well to the US electorate, it seems unlikely that the US-China trade tensions at the center of investors’ concerns will dissipate before the US midterm elections in November. Nonetheless, we are also keenly aware how quickly investor sentiment can shift in either direction. At the time of writing,investor concerns about the impact of a protracted trade war between the US and China on Chinese growth and corporate profitability are high. Low level talks between the two sides are, in our view, a positive sign albeit a small one.

Away from US/China trade relations, we believe it is unlikely that the US will seek to repeal its trade agreement with Mexico and Canada, or that the US will impose additional tariffs on the European Union. On the negative side, EM export volume growth had already begun to slow down prior to the increase in trade tensions. In our view, the most likely source of this trend is China’s deleveraging and rebalancing process.

Den vollständigen Flash Commentary zu den Emerging Markets finden Sie hier als PDF.

Diesen Beitrag teilen: