NN IP: Equity Strategy

The US equity risk premium looks too low relative to the one in the Eurozone, when we take into account the earnings growth potential of the Eurozone, the increased risk of US policy disappointment and potential investor inflows into the Eurozone once the French elections have passed.

07.04.2017 | 09:10 Uhr

US equities should discount more policy execution risk

The past week was uneventful. Nevertheless, in euro terms the global equity market rose over 2.5%, helped by a weakening of the euro against the other major currencies. In local currencies, the Eurozone outperformed and year-to-date the Eurozone has beaten the US market by 1.5 percentage point. We believe this trend has further to go.

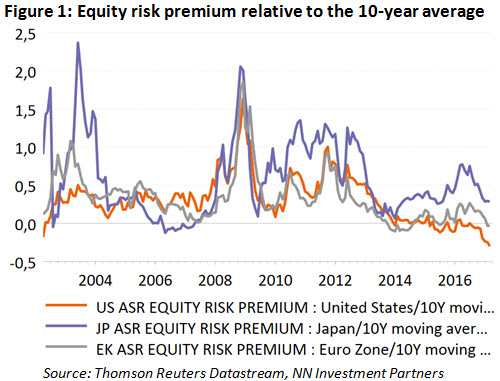

We recently strengthened our relative trade US versus Eurozone by downgrading the US to a medium underweight and upgrading the Eurozone to a medium overweight. The latest catalyst for a change was the failure of president Trump to repeal Obamacare, despite a republican majority in both the House and the Senate, which illustrates the gap between words, election promises, ideas and actual policy making. This has cast more doubts on the effectiveness of the current US administration with regard to his other plans. Indeed, up until today the market is – apart from good macro data – also underpinned by the scope of tax reform, more deregulation and infrastructure spending. We do not say that these elements will not happen, but the proof of the pudding is in the eating and thus far we did not see much convincing acts of policy on this front from this administration. Execution risk is for real and should in our view be accounted for by investors through a higher equity risk premium. However, reality is very different. The US equity risk premium (ERP) has fallen back to the lowest level since 2010, 30% lower than its 10-year average and only 60bps above the "Goldilocks-levels" of 2003-2007. This stands in contrast with the levels we observe elsewhere. Figure 1 illustrates the discount relative to the 10-year moving average in the US, Japan (far above average) and in the Eurozone (around average).

Eurozone profit margins have much room to recover

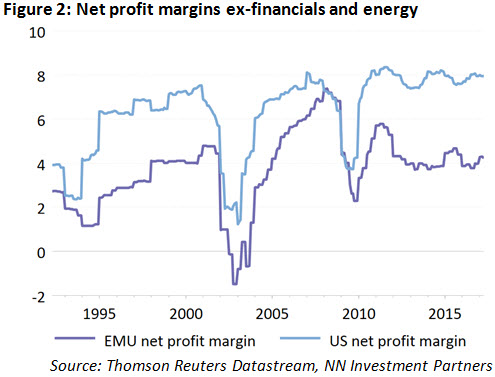

Houseview14 2017 Equity Strategy The US and the Eurozone are also at different points in their earnings cycle. This is illustrated in Figure 2 by looking at recent margin developments. Corrected for the financial sector and the extremely volatile energy sector, we observe that the current gap in profitability is the highest in 20 years. In addition, the US is back at its historic highs, whereas Eurozone margins have hardly recovered. The latter are still 300bps below pre-crisis levels, primarily as a result of the double-dip recession in 2012 caused by the euro crisis. However, there is currently no objective reason why margins in the Eurozone should not move back to these pre-crisis levels, unless one believes that Eurozone growth will never reach previous levels anymore and companies cannot improve their productivity any further. In short, we believe that Eurozone earnings can start to outgrow US earnings over the coming years. This should be reflected in a narrowing of the valuation gap (ERP) between the two regions.

Waiting for the French elections

Of course, the earnings and valuation pictures look favourable but the political uncertainty in the Eurozone weighs on foreign investor enthusiasm. First, there are the French presidential elections on 23 April and 7 May. The polls are indicating a run-off in the second round between Macron and Le Pen, which would be won by a wide margin by Macron. Obviously, polls can be wrong and a tail risk outcome cannot be fully excluded. At the same time, equity investors do not seem worried as the French market has kept pace with the rest of Euroland. We may see some hedging as the event nears, but once passed and provided it is not the worst outcome for markets, non-Eurozone investors may step up their regional investments. It does not stop with the French elections, however, although these are probably the most important ones. In September there will also be elections in Germany to decide whether Angela Merkel or Martin Schulz will become the next Chancellor. Some people hope for a new pro-European centre-left German-French axis of Macron and Schulz. Finally, the biggest challenge remains Italy. A date for new elections has not been fixed yet and it might well be only in 2018 that the Italians go to the ballot box. However, anti-Europe parties are popular in Italy and too big for comfort.

All in all, the US equity risk premium looks too low relative to the one in the Eurozone, when we take into account the earnings growth potential of the Eurozone, the increased risk of US policy disappointment and potential investor inflows into the Eurozone once the French elections have passed.

Diesen Beitrag teilen: