BNP Paribas AM: The US tax reform an the effect on the markets

US tax reform re-emerged as a market topic last week, taking a front-and-centre position as Congress and the Trump administration revealed first drafts. Financial markets welcomed the nascent plans, but investors should be cautious.

05.10.2017 | 08:56 Uhr

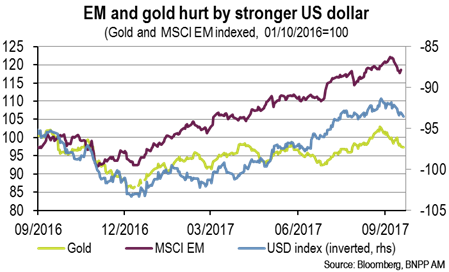

Several months of negotiations will likely be needed for the details to be agreed on and any tax cuts will be implemented. Still, the outlines caused the US dollar to strengthen and the yield curve to steepen, which supported shares in US small caps and financials. US Federal Reserve chair Yellen commented on inflation, indicating the Fed would look through recently weak numbers and stick to the path of monetary policy normalisation, pushing Treasury yields higher. This environment hurt emerging market stocks as well as gold, making them this week’s main underperformers.

In politics, a restive weekend in Catalonia, where central Spanish authorities sent police to halt what they had declared an illegal independence referendum, could mark the start of a constitutional struggle between the region and Spain and spell further difficulties for embattled Prime Minister Rajoy. In a context of Britain’s efforts to leave the EU and rising populism in Europe, a decision by Catalans to persist in a breakaway from Spain could have unexpected ripple effects on financial markets, in particular for the euro. Earlier in the week, Japanese Prime Minister Shinzo Abe called snap elections, trying to regain political power after his popularity was hit by several scandals, but got a fillip recently on the back of Abe's strong stance on North Korea. At this point, he should not have any difficulties being re-elected, although Tokyo’s popular governor has joined a new party which is gaining in popularity and could challenge the hegemony of the ruling LDP.

Will US tax reform bring the Trump trade back again?

The Trump administration’s long-awaited framework on simplifying the tax code contained few surprises. The mains points are a proposed cut in corporate tax from 35% to 20%, relaxed rules on writing down capital expenditure, a one-time tax for companies repatriating offshore profits and a tax cut for individuals. Details were scant and the plans are subject to discussion with Congress, which should mean that implementation will be unlikely before year-end.

Despite these uncertainties, market participants reacted positively to these announcements. As we have pointed out in previous weekly comments, the Trump trade (centred around pro-growth measures by the government) had been completely reversed for most asset classes, setting the scene for a positive surprise. The mere start of talks on tax between Congress and the Trump administration was enough to resuscitate the Trump trade.

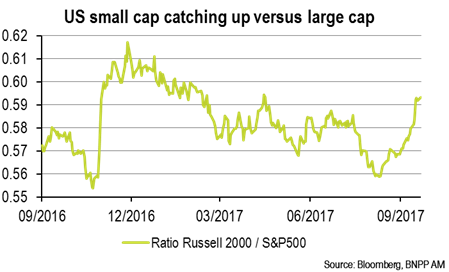

The resultant gains by the US dollar hurt large-cap stocks, which typically depend more on exports, and caused small-cap indices such as the Russell 2000 to outperform. Further momentum for the Trump trade came from news of a tough tariff imposed by the US on Canadian jet-maker Bombardier for alleged unfair subsidies.

US Treasuries suffered over Yellen’s speech on inflation, with investors interpreting her comments as more hawkish. She warned that the Fed should be “wary of moving (rates higher) too gradually”. She pointed out the tightening job markets and the risk of the central bank ending up behind the curve as well as “increased leverage and other developments”.

The comments lifted the implied probability of an interest-rate rise in December to about 70%. This hawkish turn may be reinforced in the coming weeks depending on the announcement of Yellen’s successor at the Fed, probably before the end of the month. One candidate could be former Fed governor Kevin Warsh. He has fiercely criticised unconventional monetary policy and could accelerate policy normalisation, sparking a bond sell-off were he to replace Yellen.

Asset allocation: Long US small caps versus large caps

We took a long position in US small caps versus large caps last week. The trade is in line with our positive view on the US dollar. A weak dollar benefited US large caps more than small caps, but as the currency starts to rebound amid an improving US economy and with the Fed more on firmly on the road to monetary policy normalisation, this trend should reverse. Such an about-face would favour small caps, which are typically more domestically focused and would suffer less than large caps were the dollar to rise further. Further support for small caps comes from Trump policy hopes. Market participants had priced out the Trump trade, but we expect it to regain momentum, in particular in the case of tax reform. If implemented, the indicated corporate tax cut should favour small caps since many large caps tend to pay a lower tax rate already.

We are underweight duration, particularly in European bonds, as we expect the ECB to be one of the first major central banks to place greater emphasis on prudent management of financial markets.

On real estate, European stocks have rallied significantly this year, while US real estate has lagged. This encourages us to maintain our overweight in US real estate as we expect this divergence to reverse over the coming months amid a pick-up in demand for US real estate.

Diesen Beitrag teilen: