Schroders: Electric cars to charge ahead

The number of nations announcing an end to petrol and diesel car sales is growing, prompting a major industrial shift towards electric vehicles.

24.08.2017 | 11:27 Uhr

In late-July, the UK government announced plans to ban the sale of new petrol and diesel cars in Britain from 20401. It joined the Netherlands, Norway, India, and France to become the fifth country to commit to selling only electric cars.

However, while it has yet to commit to an all-electric transport program, China leads the world in the field. In 2016, the country registered 350,000 electric vehicles, more than twice as many as the US. It has 150,000 charging stations with a further 100,000 coming this year. This will leave China with ten times as many charging stations as the US.

The US’ step back from Federal climate commitments may open the door for China to seize opportunities US businesses may be more likely to leave on the table. The Chinese five-year plan outlined the country’s ambitions by announcing plans to build a nationwide charging network, wide enough to support the demands of five million electric vehicles, by 2020. More recently, the country reaffirmed its commitment to decarbonisation after the US announced its withdrawal from the Paris Agreement.

Individual US states appear to see opportunity in the challenges. In June, California agreed an alliance with China to develop zero-emission vehicle technologies. The working group formed in that agreement stems from a partnership established in 2014 between UC Davis Institute of Transportation Studies and the China Automotive Technology and Research Center.

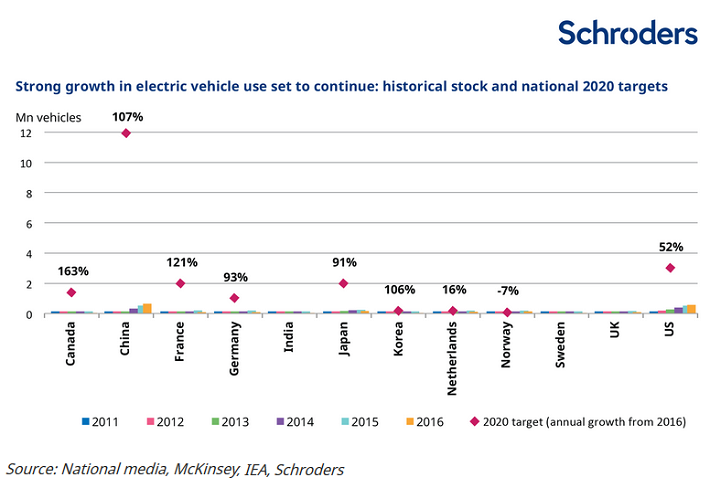

The landscape is not limited to the US and China, although those markets dominate the global market. The chart below plots the stock of electric vehicles in major markets, along with 2020 national growth targets. Collectively, those targets imply annual growth of 86% in sales through 2020, just below the 100% annual growth registered over the last five years.

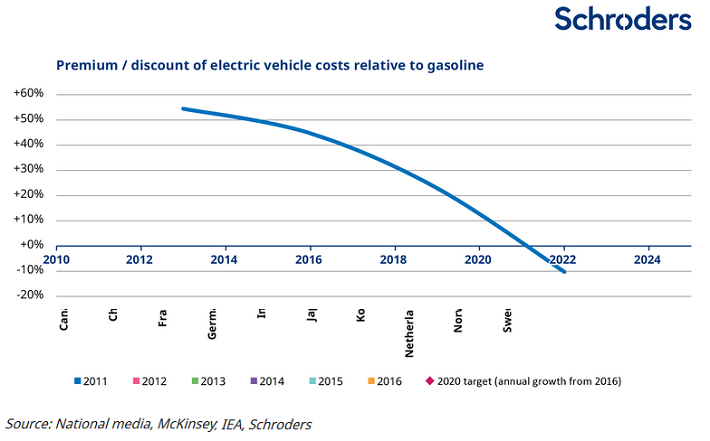

While the rates of growth implied are spectacular, growth is supported by fast improving economics. In many countries, attractive subsidies already make electric vehicles competitive with gasoline or diesel cars. Unsubsidised costs of ownership (the total cost to consumers over the vehicle life) looks likely to drop below traditional cars in the next few years, if they have not already done so.

The speed of change in the industry has not gone unnoticed by carmakers. The growing number of countries planning to phase out internal combustion engine vehicles effectively deters consumers from buying technology set to be redundant soon.

Many large manufacturers have therefore set aggressive targets. Volvo has announced its plan to cease production of all gasoline or diesel cars. Larger competitors BMW, GM, Daimler, Ford, Honda, Renault and Volkswagen have all set targets that will require an effective focus on electric powertrain technologies in their product development plans and product launches.

The car industry looks set to be fundamentally reshaped within the next decade, as resources are pulled from traditional gasoline and diesel technologies and redirected toward electric alternatives.

Der Artikel erschien am 23. August 2017 auf Schroders.com.

Diesen Beitrag teilen: