NN IP: Walking the tightrope

In our top-down assessment we continue to observe the same important distinction between the fundamentals which are generally positive, and the market dynamics which are negative. The latter withholds us from adding further to risky assets at this stage.

14.09.2017 | 15:42 Uhr

A good week for risky assets

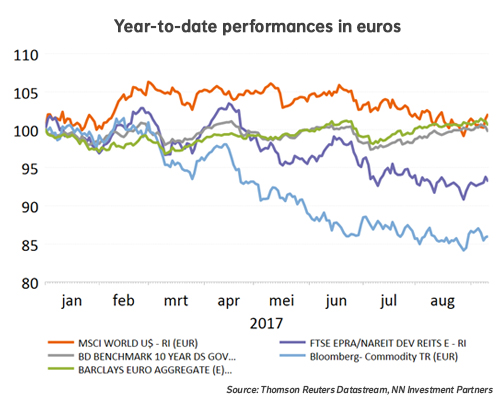

It was another good week for risky assets. In euro terms, equities rose by 1.5%, real estate by 0.7%, bond spreads came in and treasury yields rose, both in the Eurozone and the US. In the US the debt ceiling can was kicked down the road until December and North Korea did not push the button once more as some feared last weekend. The ECB meeting did not contain many surprises. The bias was slightly dovish with the ECB acknowledging the impact of the strength of the euro on inflation expectations. Our base case is that QE will be extended by at least another six months at a pace of EUR 40 billion per month. A first interest rate hike is not expected before Q2’2019. But currencies are a source of volatility.

We prefer to wait for a better moment and a turn for the better in the behavioural dynamics.

Next week we have the meeting of the Fed, where the central bank will likely announce the start of its balance sheet reduction. We expect three rate hikes until the end of 2018, which is a tad more dovish than we expected before. The German elections later this month are expected to contain few surprises. Only the choice of the coalition partner could be interesting and important for the speed with which Eurozone institutions will be strengthened.

Diesen Beitrag teilen: