NN IP: The Korean known unknown

Risk appetite recovered rather quickly from last week’s hit caused by the increased tensions between the North Korean regime and US President Trump. We did not see compelling reasons to reduce our allocation towards risky assets.

17.08.2017 | 14:42 Uhr

The spectre of a military confrontation on the Korean Peninsula raised its head last week and sent shivers through global asset markets. While this concern can probably be best described as a “known unknown” it still has the ability to derail risk appetite when it gains prominence, which last week’s “fire and fury” comments from President Trump achieved.

While the eventual outcome remains an open question, the fact that the situation has not immediately deteriorated further has been enough for risk appetite to recover and markets to regain their footing. There are always a number of these known unknowns with us at any point in time, generally in the background but liable to push forward at any moment. While they can seem daunting when they take centre stage, we also need to keep in mind that in most cases, in the words of the ancient Sufi poets, this too shall pass.

It is well accepted that new and vivid information has a disproportionate influence on how people form views or opinions. When an issue such as the potential for a military conflict arises we tend to exaggerate the immediacy of the threat, and therefore react in ways that are not proportional to the actual threat. Of course, if the worst were to happen and the bad outcome were to occur, then it would have been right to act first and ask questions later.

When dealing with these events it is essential to have a framework for assessing the risk, and an anchor to prevent emotions from running away with the day. That is why we have a process to routinely ask questions of ourselves about uncertain events, and how we assess the probabilities around those events. One of the questions we have been asking this year is “What is the probability that an international power undertakes military action against North Korea in 2017?” Strategists and portfolio managers submit their probabilities on a weekly basis and we track this, and other questions, over time.

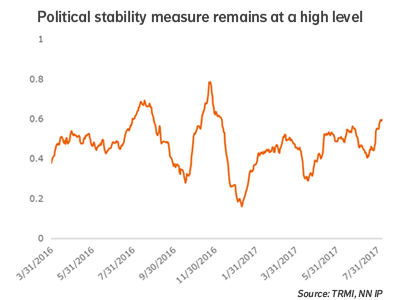

When new information becomes available, it will be incorporated into the new forecasts and the probabilities updated. This is an evolutionary process that takes account of what has gone before and adapts as the environment changes. We also track the evolution of sentiment towards concepts such as political stability and use these to judge what type of environment we are in. A negative shock in an environment of heightened uncertainty, or already fragile risk appetite, can have a much larger impact than when the environment is more benign.

Putting these two elements into practice over the past week meant that we did not see compelling reasons to reduce our allocation towards risky assets. Our own assessment of the probabilities did increase over the week but not materially, and certainly not to a point that would motivate us to act. In addition, our sentiment measures of political stability have remained at a high level after recovering from the start of the year. Putting it all together, the spike in risk aversion last week, due to an uptick in geopolitical tension, is likely to be temporary and for us not a reason to become more defensive in our positioning.

Asset Allocation One area where we have actually seen an improvement in our signalling set is in relation to Real Estate. It has been a difficult year so far for the asset class with investors worried that a move to higher yields would negatively impact returns. In addition, the rise in e-commerce, particularly in the US, has seen investors adopt a more cautious stance towards the retailing sector.

This has left investors with low allocations to the asset class at a time when the fundamental outlook for the labour market, corporate profits and retail sales all remain positive. We have recently witnessed a shift in flows back into the asset class and at the same time our behavioural signals for the asset class have also improved. We have therefore upgraded Real Estate from a neutral position to a small overweight.

The macro environment remains characterised by solid, broad based growth, although the growth is stable rather than accelerating. Inflation remains low which is puzzling to central banks and keeps them on a cautious path. In this environment we maintain our underweight to Treasuries as Fed policy normalisation is expected to be followed by the ECB.

Spreads, Commodities and now Real Estate are overweight to reflect the positive growth environment, with Equities at neutral for now given some weakness in our short-term indicators.

Diesen Beitrag teilen: