NN IP: Poor politics, strong markets

Despite political risk rears its head from time to time, equity market volatility remains rather low. This is merely a result of the Goldilocks environment equities are in, as economic data keep coming in strong and the corporate earnings outlook is benign.

24.08.2017 | 14:25 Uhr

Overall volatility remains low despite political noise

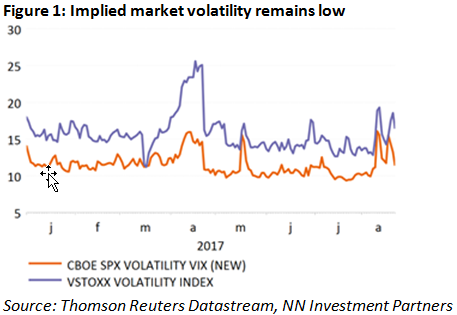

Equity markets are demonstrating a large degree of resilience with regard to persistent political and geopolitical tensions. Except for two short spikes (related to North Korea and US domestic politics), implied volatility for the S&P 500 has remained low. Likewise, the negative market reaction was short-lived on both occasions.

In the past, a growing number of market watchers would have called this low-volatility environment a sign of investor complacency and advocate scaling back risk. This year, being too focused on this factor would have led to missed opportunities or worse, if speculating on a rise in volatility, to important losses.

We attribute this resilience to the goldilocks environment we are in. Economic data are strong and global growth has been revised up. The August Flash PMI data for the Eurozone and Japan were above expectations. At the same time, inflation remains puzzlingly low and the strong link between employment and wages, the so-called Philips-curve, looks broken. For central bankers this means they have the luxury of being able to adopt a very gradual approach towards monetary tightening. In the Eurozone, the appreciation of the euro is an additional factor to watch closely. It could imply an even more gradual path by the ECB than anticipated a couple of months ago. We might hear more on these topics during the annual gathering of central bankers at their Jackson Holy symposium that starts today.

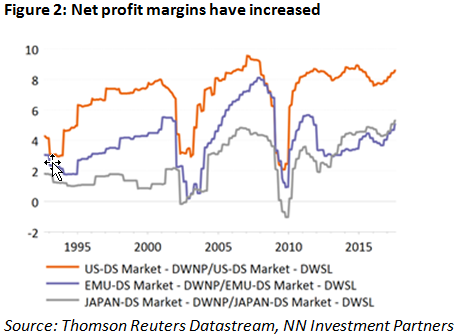

Companies expected to increase dividends

On balance this is good news for corporates. Global earnings growth has turned positive and the outlook for the rest of the year and 2018 is encouraging. Thanks to the acceleration in global growth and the lack of cost pressures, margins have ticked up. Earnings momentum is positive although it has faded over the past quarter. Especially European earnings estimates are downgraded, most likely a direct impact of the strength of the euro. Emerging market, US and Japanese earnings momentum remains positive. This earnings profile is certainly a factor that keeps investors confident in holding on to their equity holdings and to buy on dips, should these occur.

Companies are also cash rich and their balance sheets are in decent shape. Coupled with the earnings outlook this is good news for a further improvement in shareholder remuneration. Even if the dividend pay-out ratio is currently somewhat above its long-term average, we do expect that companies will rise their dividend in line with earnings, implying 10%+ dividend growth over the coming period. The current trailing dividend yield is 2.4% globally and even 3.1% for Eurozone companies. Compared to corporate bond yields these are attractive levels. In this point of the business cycle equity dividends are a better income proposition than corporate bonds, which on top of that will lose over time the tailwind of the ECB bond purchasing program.

Another reason that explains the low volatility is the drop in correlation amongst the return of individual companies and sectors. Idiosyncratic issues are currently more important than the top-down macro events that dominated over the past 9 years.

All in all, the environment remains very much of the goldilocks variety, which explains the resilience of markets to political risk events. The biggest danger could lie in a policy mistake by central banks, but it has to be said that investor confidence in them is high. However, we should keep in mind that we are only one misinterpreted central bank comment or meeting away from a taper tantrum.

Over the past week we did not make any changes to our allocation. This means that we have a preference for emerging market equities over developed market equities. The former receive additional support from a softer US dollar. Within developed markets our preference for non-US markets remains in place, although we believe the valuation to growth trade-off has become more balanced between the US and the Eurozone.

Diesen Beitrag teilen: