Schroders: Three is the magic number (for this year)

In the monthly round-up of our asset allocation views, we discuss the three factors which will determine whether the reflationary environment continues. The most obvious answer is “inflation”. One indicator which suggests that growth (and therefore inflation) could surprise on the upside, is that global trade has been picking up.

24.01.2018 | 12:34 Uhr

For 2018, “3” is the magic number for a reflationary environment to continue.

- Growth: we expect global GDP growth to remain at roughly 3% over the next two years. Last quarter we highlighted the potential for the US Congress to surprise on tax reform and this has proved to be the case but we would fade any fiscally-induced excitement at this point as we don’t expect US companies to fully spend the benefits of their tax cut.

- US 10-year Treasury yield: based on our models, US equity valuations are sustainable as long as the US 10-year yield does not go above 3%. This would require inflation to remain subdued.

- Inflation: as we believe that technological disruption and aging demographics are suppressing inflation, we expect an upper limit of “3%” to hold and for the process of monetary normalisation to be gradual. Against this backdrop, valuations become a speed limit for returns over the medium term but we think a period of lower returns is more likely than an imminent bear market.

What could upset the apple cart?

The most obvious answer is “inflation”. One indicator which suggests that growth (and therefore inflation) could surprise on the upside, is that global trade has been picking up.

Another risk comes from wages. Although wage growth appears to have been unresponsive to tight labour markets so far, research by the Federal Reserve suggests that the Phillips curve is non-linear and when the unemployment rate falls below a certain threshold the relationship between unemployment and inflation will re-assert itself and core inflation will begin to rise.

When we model these two scenarios (“trade boom” and “inflation accelerates”) our global inflation forecast rises from 2.3% to over 3%. From an investment perspective, given market pricing, this outcome would cause volatility in the government bond markets but would also present an opportunity for more cyclically-exposed, value–driven areas of the equity markets to outperform.

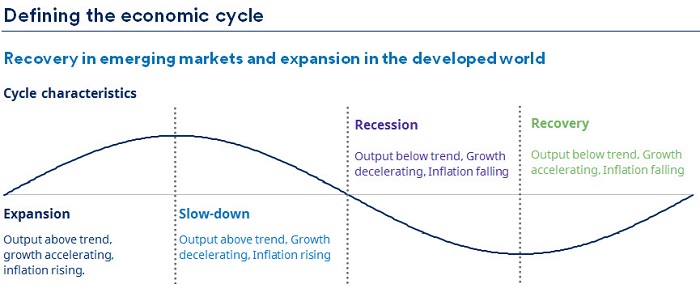

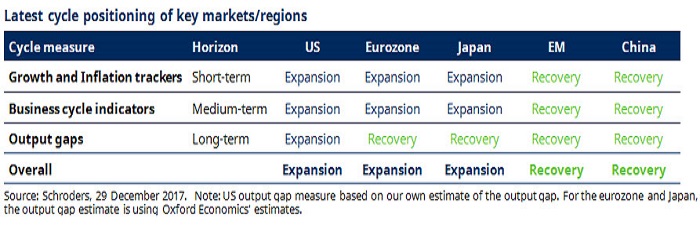

A disappointment on the growth front would be more concerning for us. Developed economies are currently in the “expansion” phase, which is characterised by output above trend, growth accelerating and inflation rising. This phase of the cycle is typically benign for equities. The next phase of the cycle is the “slowdown” phase and this is the worst phase for returns.

The challenge is that, at first, the slowdown phase typically feels alright – output is still above trend and, although growth is decelerating, it is still positive. But by this phase equity return expectations and valuations are elevated, leaving room for disappointment and negative returns. For now the traffic light is still green but there are three trends we are watching:

- The authorities in China and US are withdrawing liquidity. Although policy normalisation is appropriate at this stage of the cycle, there is always the risk of tightening liquidity too quickly.

- Yield curves are flattening, which suggests that bond markets are starting to price in slower growth. This is somewhat at odds with the optimism reflected in equity market valuations.

- Our expectation is that the US dollar is likely to remain weak as the rest of the world is catching up with US growth. If we are wrong and the US dollar strengthens, however, this would put pressure on Chinese growth and would tighten liquidity.

All in all, we continue to be positioned for a reflationary environment with an emphasis on emerging market assets which look relatively cheap. At some point in 2018 however, synchronised global recovery will morph into concerns about synchronised liquidity withdrawal. The real surprise for 2018 could be that we end the year with government bond yields lower than today.

Diesen Beitrag teilen: