NNIP: The profit cycle: Where are we?

The US earnings cycle may be near its peak but could hold steady at current levels for some time. We have more confidence in the Eurozone earnings cycle.

18.05.2018 | 11:21 Uhr

Sometimes the equity market reacts in unusual ways. During the latest earnings season, markets hardly reacted at all. This was not because earnings were disappointing; on the contrary, US earnings surprises (+7.3% on average) were the most positive in three years and the absolute growth number (+24%) was the best since 2010. All sectors did better than expected and in the technology sector the beat ratio was a stunning 95%. Corporate guidance was strong, with more than twice as many companies providing positive guidance as negative guidance, the highest figure in 14 years.

It may look strange that the market responded as it did. The reaction to corporate results was asymmetric. The reward for better-than-expected results was less than the punishment for worse-than-expected results. This looks like a typical late-cycle phenomenon. Investors are looking for signs that the earnings cycle is near its peak. In absolute earnings growth this is not unreasonable, given the artificial rise caused by the cut in the US headline corporate tax rate from 35% to 21%. Next year growth will fall back towards single-digit territory. We consider this type of earnings growth as low-quality, which is reflected in the decline in the forward PE ratio in the US from 19 to less than 17, although this is still above the average of the past 15 years (15).

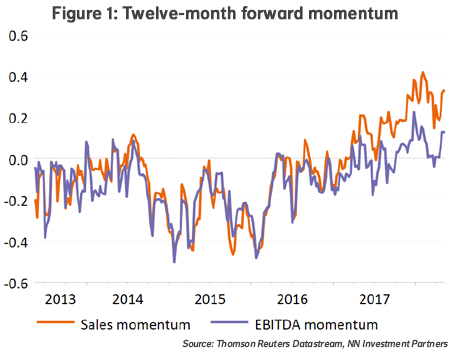

At the same time, elements that indicate that we are late-cycle but not down-cycle is the observation that since mid-April, the momentum in sales and the momentum in gross operating profit are accelerating again. We must not forget either that wage growth is muted, despite the unemployment rate falling below 4%.

In addition, earnings in the energy sector could increase further if the rise in the oil price persists, and the IT-sector is still in a positive trend with positive sales and earnings momentum. Financial sector earnings will be a wild card. This sector produced excellent first-quarter results, but several banks were cautious with regards to the flattening of the yield curve and lower trading income. A continued appreciation of the USD would also be a headwind for this earnings cycle, as would a further escalation in trade protectionism.

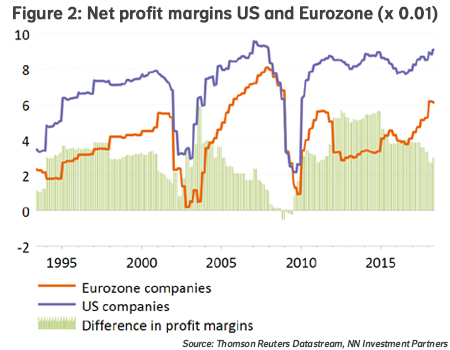

We are more relaxed on the Eurozone earnings cycle. Compared with the US, we see further scope for margin improvement. The financial sector may benefit from a steeper yield curve and positive loan growth. The graph below illustrates the difference in profit margins between the US and the Eurozone. There is still room to catch up for the Eurozone.

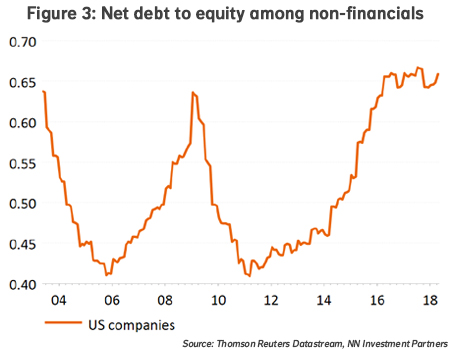

An interesting element to monitor will be the use of repatriated cash of US companies. They can use it to increase capex, to pay dividends, do buybacks or to reduce debt. Given the late point in the earnings cycle and the observation that corporate (non-financial) indebtedness has risen to cycle highs they should opt for the latter.

Diesen Beitrag teilen: