NN IP: Markets in panic mode

The political crisis in Italy has worsened and some markets moved into panic mode. Uncertainty related to Italy may linger for longer, but as moves have been extreme NN IP decided not to change their allocation stance yet.

04.06.2018 | 09:15 Uhr

Despite a supposedly slow start of the week with the US and the UK closed on Monday, all eyes turned quickly to the Italian saga. Over the weekend, President Mattarella blocked the appointment of Paolo Savona as Finance Minister due to his Eurosceptic credentials. The collapse of the populist coalition was taken positively by markets for a few hours. However, as soon as it became clear that the newly appointed prime minister, Carlo Cottarelli, would not gain enough support to run a technocratic administration, markets went on to panic mode. New elections seem unavoidable and fears that populists could become even more popular, combined with their harsher rhetoric on the Euro membership, took the centre stage.

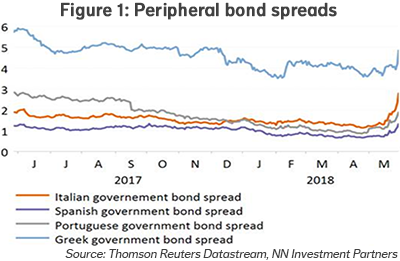

In just over two days, the 2yr Italian bond spread to Bunds surged 194bp to the highest level since August 2012 (349bp), while the 10yr spread widened 56bp to 289bp – the highest level since July 2013. There was some contagion to the rest of the periphery but not to the same extent.

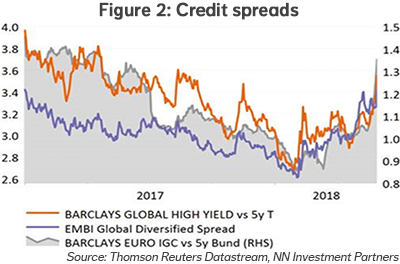

Italian and European bank bonds also experienced heavy losses during the turmoil, impacting IG credit and HY indices, indicated by higher spreads as illustrated in Figure 2.

Global equity and real estate resilient, Bunds strong

Global risk assets remained ‘relatively’ resilient given these extraordinary moves in the Italian bond market. Our overweight global real estate, for example, delivered a positive contribution over the week. Safe haven assets such as German Bunds or US Treasuries rallied on the back of these developments and the euro continued to weaken. Some of the moves seem exaggerated based on the underlying economic or political impact, yet this coincides with a period in which European macro data is generally weaker. This also brings into question whether the ECB will need to adjust its policy toolkit and for example keep QE open-ended for longer. We fear the uncertainty related to Italy will linger for longer, but as moves have been extreme we decided not to change our allocation stance yet.

Diesen Beitrag teilen: