NN IP: A balancing act

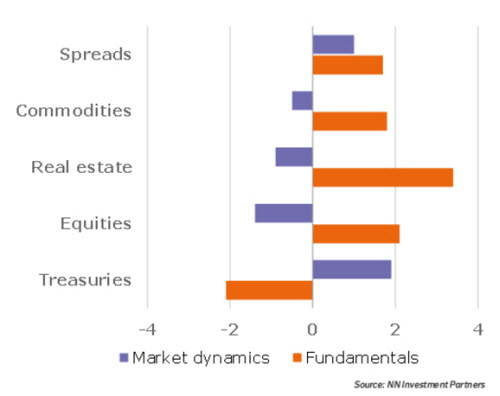

Generally positive fundamentals are being counterbalanced by negative market dynamics. We maintain our balanced stance with small overweights in real estate, commodities and spreads.

08.09.2017 | 09:13 Uhr

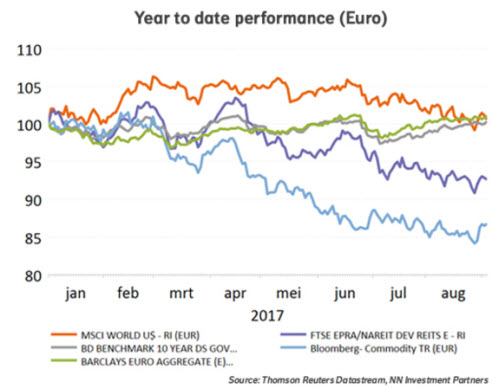

Over the past week, risky assets performed very well. Global equities were up 1.4%in euro terms, real estate 1.8% in euros and commodities 2.3% in USD. Spread products also performed well, with generally tighter spreads.

North Korea dominates the headlines but thus far investors take the view that the parties involved will remain sensible. Witness the limited impact in time and magnitude of these explosive events.

In our top-down assessment, we continue to observe an important distinction between the fundamentals, which are generally positive, and the market dynamics, which are negative. Spreads are the exception, with both the fundamentals and the market dynamics indicating a positive signal.

This week, many eyes will turn to the ECB meeting, where Draghi also has to perform a balancing act. Growth is strong but inflation remains well below target. The euro’s appreciation is an additional factor complicating things as this may affect inflation expectations.

Further out in September there is the Fed meeting, with the governors struggling with the same paradigm of good growth but too low inflation.

The German elections to be held this month would contain few surprises. The choice of the coalition partner could be important for the speed with which Eurozone institutions will be strengthened.

In the US, President Trump’s agreement with Congressional Democrats on a debt ceiling increase may have for now averted a government shutdown, but the three-month extension means markets will be faced with the same situation again in December.

Diesen Beitrag teilen: