Janus Henderson: Strong earnings suggest Chinese bull market has further to run

In this update, Charlie Awdry and May Ling Wee, China portfolio managers, discuss the reasons behind the continuation of the Chinese bull run this year and why they think it may persist for longer than many expect.

25.08.2017 | 11:53 Uhr

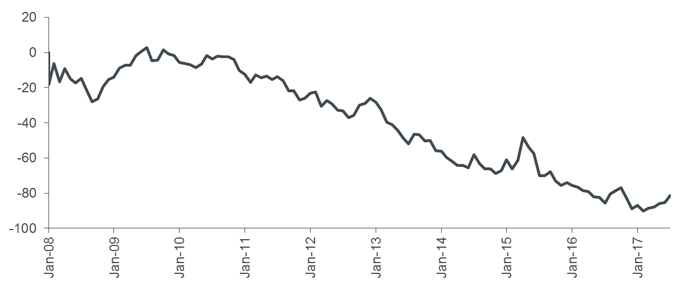

Chinese equities have continued to rally into the second half of 2017 but what is notable is that China is beginning to outperform other markets such as the S&P 500 in the US (in dollar terms) − see chart. One of the reasons for this is the better-than-expected macroeconomic backdrop, including sustained strength in the economy, since the second quarter of 2016.

China vs the US – relative performance improving?

Source: Bloomberg, Janus Henderson Investors. MSCI China vs S&P 500 index price returns, monthly data January 2008 to July 2017. Past performance is not a guide to future performance.

A firmer yuan

At the start of the year, one of investors’ lingering concerns was whether the yuan would weaken but, to the delight of sterling and dollar-based investors, it has not. Intervention by China’s central bank to maintain stability of the currency, combined with the weaker US dollar, increased optimism on the economy and receding concerns about capital outflows, have all helped the yuan to appreciate since the end of May. As a result China’s foreign currency reserves have been steadily rising, reaching $3.08 trillion in July.

Strong corporate earnings driving returns

Last year, the corporate interim results season in August proved to be a positive catalyst for Chinese stock returns and we think there is a good chance of a repeat performance in 2017. The August 2017 earnings season shows signs of being strong, with a number of positive profit alerts over the month. These profit alerts were announced by companies operating in sectors of the old economy in China, such as materials and industrials, which in recent years have fallen off investors' radars. Strength in corporate earnings in these sectors has been driven partly by higher demand but also an improving business environment as the Chinese government enforces measures to curb heavily polluting sectors and illegal activities.

In our portfolios, Alibaba and Tencent (internet), China Lodging Group (budget hotels), as well as Ping An (insurance) are examples of companies that have recently reported strong profit growth and whose shares are performing well. Additionally, broker analysts often understate the amount by which profits move for a given change in revenue – both on the way down and up. They are generally more optimistic and often start the year with strong forecasts that they then have to cut. While this is occurring in markets such as India, the opposite is happening in China in 2017 – analysts are generally revising earnings forecasts for Chinese equities upwards.

Let the good times roll?

In our view, the profit cycle is likely to drive the economic cycle for longer than many expect. Increasingly, drawn by the strength in performance, investors are looking with more interest at the investment case for China and there are signs of an increasing appetite for Chinese equities. In June, Hong Kong saw the first properly “hot” (strongly oversubscribed) initial public offering (IPO) of this bull market with Wuxi Biologics rising 37% on its first day of trading. When these hot IPOs become commonplace we will begin to be more circumspect on our market outlook, but for now we see this as a positive indicator that the current bull market in Chinese equities may be far from mature. Moreover, President Xi will be looking to maintain economic and political stability in the lead up to the Party Congress later in the year where the performance of the government over the past five years will be assessed, new policies and goals announced and senior leadership appointed. This combination of supportive factors suggests to us that the Chinese equity bull market has further to run.

Diesen Beitrag teilen: