BNP Paribas AM: Bullish risk assets despite the february scare

January’s rise in US Treasury yields in January ended up hurting risky assets in mid-February. In that context, market participants are asking themselves whether equities can rally as the US Federal Reserve continues to tighten its monetary policy and as government bond yields rise further.

07.03.2018 | 13:49 Uhr

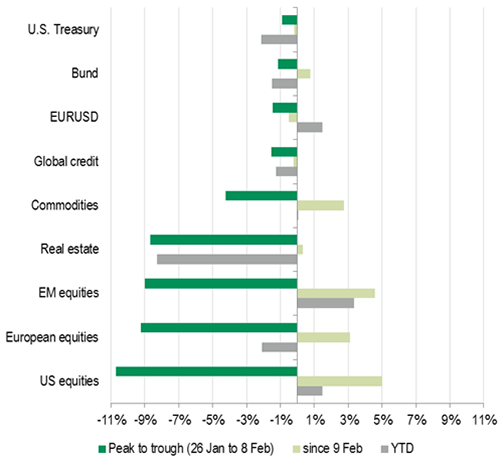

February started with a sharp correction in equity and volatility markets. This was mainly driven by technical rather than fundamental factors as we explained in our previous monthly. As a consequence, the fall was rather sharp, but also short-lived. The S&P 500 index, along with other major equity indices, started to rebound on 9 February. This bounce has been progressive, but also unequal between markets. US equities recovered about half of the ground lost, while European and Japanese equities lagged. Looking at the year-to- date (ytd) performance, US equities are still up while European stocks are down (see Figure 1). Emerging markets on the other hand were hit to a lesser extent by this technical correction and are still benefiting from a weak dollar. Latin America in particular has been performing strongly, up by more than 8% so far this year, with a complete recovery of the early February correction.

Figure 1: Partial rebound for risk assets, but bonds and rate sensitive assets lag

(Source : Bloomberg, BNPP AM)

Inflation scare: A modest pick-up rather than a take-off

One of the themes the market has been exploring in recent months is inflation acceleration. The reflation theme is visible in our positioning across assets, including stretched shorts in rates and longs in energy (see below). Interestingly, equity markets appear to be taking the inflation narrative more light-heartedly as positioning there remains rather constructive. In our opinion, there are two important aspects to analyse: the cyclical dynamics of inflation and the structural ones.

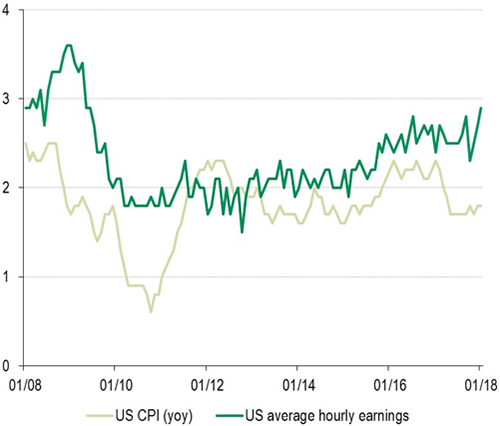

Firstly, we note that the recent readings on US core CPI and average hourly earnings are by no means a game changer (see Figure 2). After months of negative surprises on US core inflation dynamics, it is only natural to expect positive surprises coming from these drivers:

USD weakness lifting imported goods prices (thus, apparel was one of the biggest contributors to the uptick)

base-effects from one-off price cuts in communication (Verizon plan) fading away in the coming months

the secondary effects of hurricane damage (e.g. used car prices rose).

With this in mind, we have been anticipating a modest pick-up in US price dynamics in the short term which, however, is not to be confused with a take-off in inflation.

Figure 2: US CPI and hourly earnings remain modest despite positive surprises (% YoY)

(Source : Bloomberg, BNPP AM)

Secondly, it is important to remember some of the structural reasons why inflation in the US and in the advanced economies generally has been low and is likely to remain subdued in the medium term: technology, globalisation and demographics to name a few. In a recent paper, the IMF found that roughly half of the decline in the share of national income paid to workers since the 1980s was due to technology1 alone. With automation and artificial intelligence on the verge of spreading across an ever-increasing number of sectors in the economy, it is hard to argue that disinflation is now behind us.

Can equities rally in fed tightening cycles?

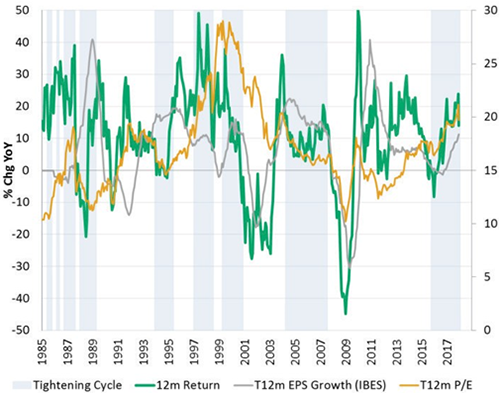

We address this issue by looking at the pattern of US equity returns during past Fed tightening cycles. Figure 3 shows annual returns for the S&P 500 together with valuations (12m forward PEs) and earnings growth.

Figure 3: US equities typically do well in Fed tightening cycles

(Source: Bloomberg and Factset, BNPP AM)

Three important points stand out. First, equity returns are generally positive during tightening cycles. Second, P/E ratios may expand initially, but tend to compress as the cycle progresses. Finally, earnings growth is generally positive as the Fed tightens. This is because the key driver of returns shifts from multiple (P/E) expansion to earnings growth. This is consistent with a more mature business cycle where economic growth is strong and supports corporate profits despite rising interest rates.

The full Asset Allocation you will finde here.

Diesen Beitrag teilen: