NNIP: Improving behavioural dynamics

There is a broad-based improvement in behavioural indicators for risky assets despite the impact of trade fears on the market; we maintain our preference for equities.

13.08.2018 | 11:55 Uhr

In the tug of war between an escalating trade conflict between the US and China on the one hand, and the strong corporate fundamentals on the other, the latter seems to have gained the upper hand over the past couple of weeks. Equities and real estate continued to work their way higher and fixed income spreads consolidated their gains of July.

However, this does not mean we are in a full risk-on environment. Underneath, we see some interesting developments. The equity market gains are confined to the US market while the other regions struggle to make progress. The safety bet is still at play in those regions. Within sectors and outside of technology, only health care and staples beat the market average. Below the surface we have observed a shift away from cyclical towards defensive sectors over the past period. And it is in this context that we must read the strong performance of real estate.

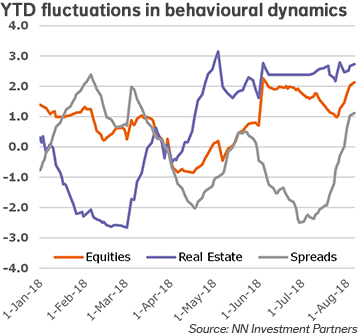

AA Figure 1 Clearly, fears of the negative impact of a trade conflict on growth have an effect on the market. This growth reassessment is also measured by our global cycle indicator, which looks at a broad range of forward-looking indicators. This index has recently come down, signalling a deterioration in the trend. The absolute level of activity indicators continues to point towards consolidation at a healthy level. However, it is less strong than it was, a factor we closely monitor to judge our medium overweight in equities. For the time being we are sticking with it for behavioural reasons.

Indeed, an interesting observation is the broad-based improvement in the behavioural indicators for risky assets. This is illustrated in the graph.

In all three cases – equities, real estate and spreads – the improvement is driven by sentiment, price momentum and the liquidity & flow component.

This week, we made no changes in our TAA. We have a medium overweight in equities and a small underweight in treasuries. We are neutral commodities, real estate and spreads. Within real estate, we introduced a regional overweight in US and Eurozone real estate at the expense of UK real estate.

Diesen Beitrag teilen: