BNP Paribas: Digesting risks from Italy, global growth and EM

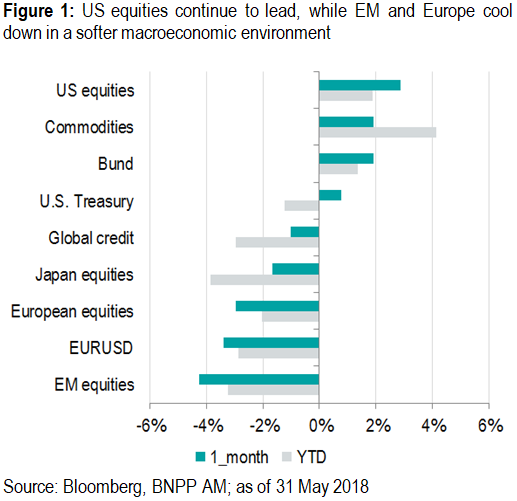

Markets were hit by shocks coming from three sources in May: an escalation of political risk related to Italy, weakening growth (notably in Europe); and a stronger USD, which led to stress in emerging markets.

05.06.2018 | 12:37 Uhr

Global equity market performance was mixed in May with the US up by about 2.3%, driven by the information technology sector. Financials and insurance, on the other hand, finished below where they had started the month as the rise in US yields slowed down around mid- May after reaching a seven-year high. European equities underperformed, especially in the eurozone, with the EuroSTOXX 50 down by almost 4%. This followed a strong performance from April to mid-May. European equities were hit by an escalation of political uncertainty in Italy which was compounded by ongoing concerns about weakening growth in the euro area.

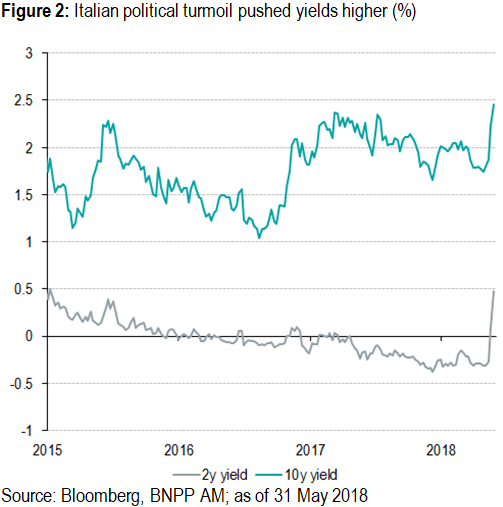

Financial markets adopted a risk-off attitude, selling EMU ‘peripheral’ bonds in favour of the safety of core government bonds. This was especially true for Italian bonds: they sold off sharply, while German Bunds rallied, pushing the spread to 266bp, a level not seen since 2013. The flight-to-quality impacted government bonds across the EMU periphery, causing spreads to widen. On the macroeconomic front, activity indicators lost some momentum, but remained strong. The manufacturing PMI, for instance, fell to 55.5 after peaking at 60.6 last December.

In currencies, the US dollar index climbed further, up by 2.5% over the month. This reflects diverging growth prospects and interest rate differentials between the US and the rest of the developed world. The Japanese yen and the Swiss franc also benefitted from safe haven demand at the expense of the euro and sterling. EM currencies suffered due to higher US yields and a stronger dollar. External vulnerabilities in Argentina and Turkey caused their currencies to fall significantly.

In commodities, crude prices extended their year-to-date rally only to give back part of those gains towards the end of the month. Weaker crude prices and safe haven demand led to lower UST yields in the second half on the month. Gold fell slightly over the month despite the rise in market stress, mainly due to a stronger USD.

Italian political risks escalate

The results of the Italian general election were inconclusive, leaving the anti-establishment parties League and Five Star in a position to form a government which could command a majority in parliament. Initially, markets had doubts about this possibility as both parties had campaigned on juxtaposed programmes and League was committed to a centre-right coalition. President Mattarella’s discussions with various politicians and parties eventually led to League and Five Star agreeing a joint platform and nominating Giuseppe Conte their candidate for prime minister.

The prospect of such an administration unsettled markets as the incorporation of League’s flat 15% tax rate and Five Star’s universal income policy would inevitably lead to a clash between the new government and the EU Commission over fiscal policy. The market’s nervousness was further compounded when President Mattarella vetoed the coalition’s nomination of Paolo Savona as finance minister and the PM designate returned the mandate to the president.

Savona had explicitly discussed the option of Italy leaving the euro, which raised concerns for President Mattarella as he considered that such a policy option had to be campaigned on in an election. The president then mandated Carlo Cottarelli to lead a technocratic administration. This triggered considerable political turmoil and led to a sharp sell-off in European equities and a significant widening in BTP spreads over core bonds (Figure 2).

Late in May, President Mattarella restarted talks with League and Five Star to see if an alternative nominee for finance minister could be found. Markets’ initial fears calmed down, but overall, the risk of political uncertainties leading to further volatility remains high.

Over the next few months, markets are likely to remain volatile given the uncertainty associated with the new anti-establishment coalition given the potential for clashes with the EU authorities and fiscal policy excesses.

Fore the full asset allocation please click here.

Diesen Beitrag teilen: