Janus Henderson Investors: UK employment rise no obstacle to rate cut

UK rate cut sceptics argue that a rise of 135.000, or 0.5%, in the number of employees in the three months to November from the prior three months signals a strong labour market and will give MPC doves a reason to climb down.

23.01.2020 | 08:34 Uhr

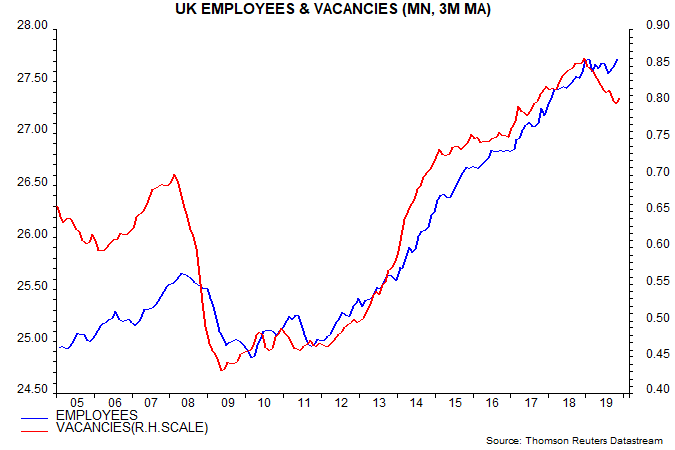

This increase, however, merely reverses a decline earlier in 2019 – the November three-month level was unchanged from February. The stock of vacancies recovered slightly in the three months to December, which appears to reflect a sharp jump in December alone, but the signal for employment prospects remains negative – see first chart.

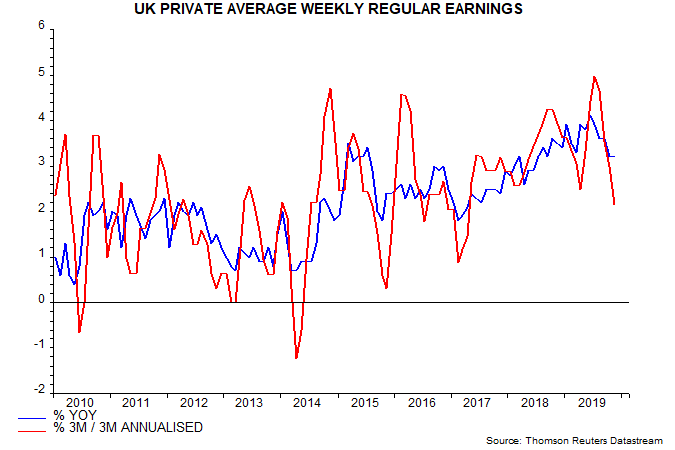

MPC members may be more impressed by confirmation that private sector earnings growth has peaked – second chart.

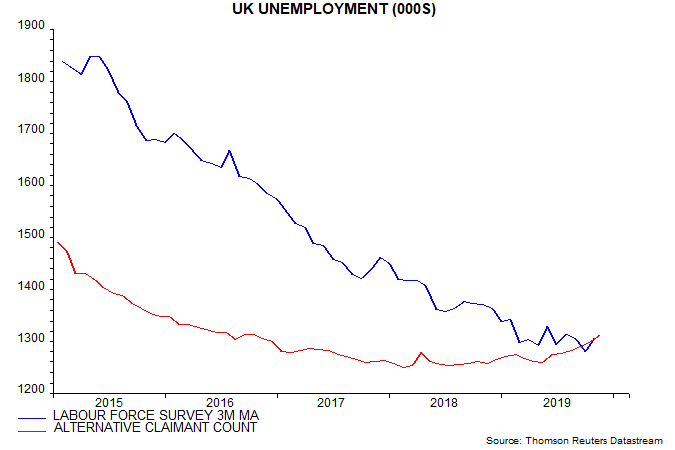

The labour force survey measure of unemployment has moved sideways since early 2019 but the “experimental” alternative claimant count, which attempts to track the number of jobless benefit recipients by adjusting for the roll-out of universal credit, continued to rise into November – third chart.

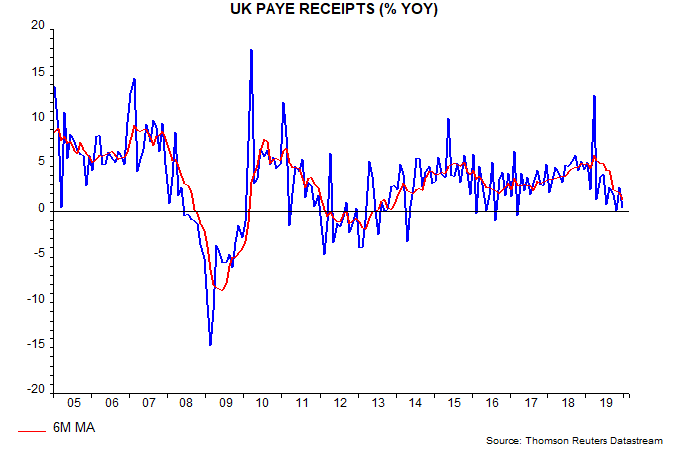

Today’s public finances release for December provides further evidence of significant labour market cooling, with pay-as-you-earn tax receipts, smoothed over six months, showing the slowest year-on-year growth since 2013 – fourth chart.

Diesen Beitrag teilen: