NN IP: US still a safe haven

The global environment is still supportive for equities; the US remains a safe haven. We move financials to a small overweight and switch from staples into health care.

21.09.2018 | 12:30 Uhr

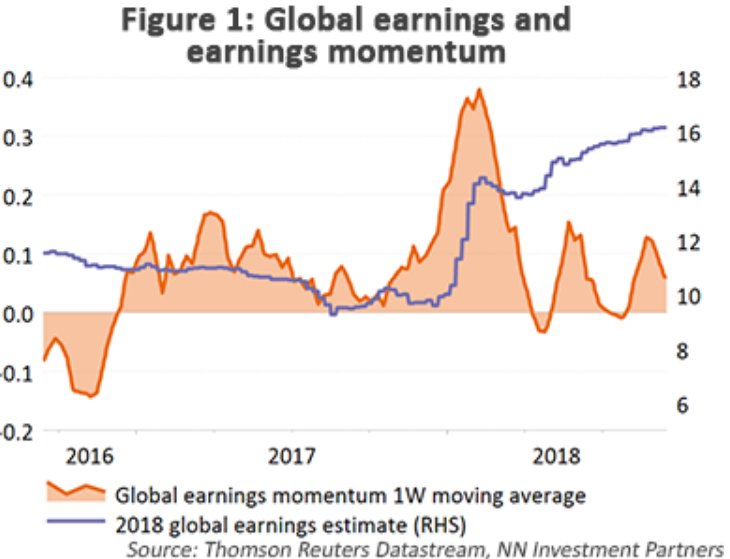

The global environment remains supportive for the equity market. Macro data point towards a period of consolidation at a healthy level. The corporate sector is in good shape. Earnings growth is expected to come in at double-digit levels over the next two years with further progress in profit margins.

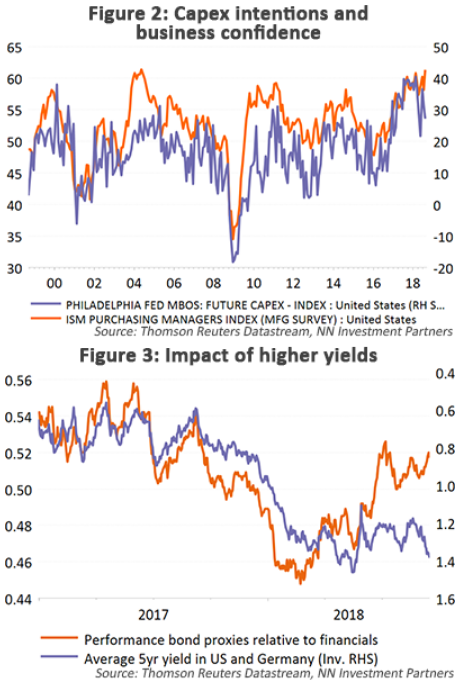

Central banks are on a gradual normalisation path, and as long as core inflation data do not jump higher, they will stay on this path, limiting the risk of a strong rise in bond yields. Trade remains a headline risk and is so far primarily a source of uncertainty and market volatility. As a result, the more vulnerable market segments, non-US equities and export-oriented cyclicals, are underperforming. The impact on the real economy is not being felt yet, as evidenced by high confidence indicators and capex intentions.

We currently maintain our regional preference for the US market, which we see as the safe haven market with the best relative corporate and macro fundamentals. However, we do not rule out the possibility of this preference switching 180 degrees if the trade disputes fade, emerging markets stabilize, growth converges and Eurozone political risks – such as those in Italy – diminish.

Change in sector focus towards financials and health care

This week we closed the Japan underweight. From a sector point of view, we keep the balance between defensive and cyclical sectors, but we upgrade financials from neutral to a small overweight. The sector has underperformed the global market and has recently decoupled from the trend in interest rates.

We attribute this decoupling to the negative impact on financials and on the Italian political uncertainty from events in emerging markets, especially Turkey and Latin America, both of which are important for Spanish banks. At the same time, we observe positive earnings momentum for the sector. Finally, relative valuations have fallen close to the lowest levels since the financial crisis.

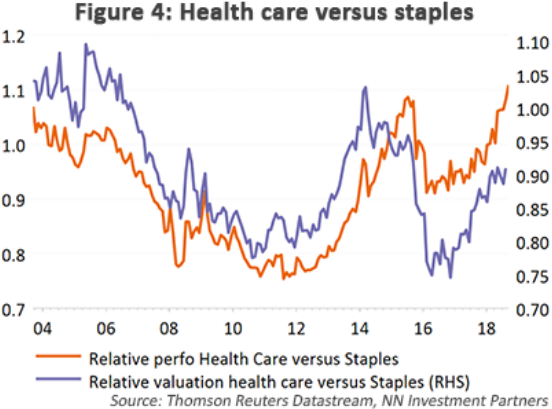

Within defensives, we switch from staples into health care. The latter shows better earnings growth and trades at a discount.

Diesen Beitrag teilen: