Henderson: The case for active managers

Nick Watson, Fund Manager within Henderson’s Multi-Asset Team, explores the strengthening case for allocating to actively managed strategies. While the team is able to allocate to passive and active vehicles, Nick explains that market drivers currently support the case for the latter.

03.03.2017 | 10:15 Uhr

The Multi-Asset Team at Henderson has the opportunity to invest across passive and active vehicles on behalf of our clients. We think that, after a period of muted relative performance from active managers amid the market distortions created by quantitative easing (QE), the outlook appears bright for experienced and talented stock pickers to add value going forwards.

The quantitative easing period

Lower cost passive investing strategies have undeniably reaped rewards during the post-financial crisis years.Super-easy monetary policy has propelled markets ever higher and this has meant a difficult environment for active stock-picking strategies when correlations increase and almost every asset rises.Clearly there have been successful strategies, particularly those invested in high quality growth stocks. However, in aggregate, the active management universe has had to fight hard to deliver outperformance. This is best observed in the highly competitive US equity market, where the majority of US large-cap managers have underperformed the S&P 500 index over the past three years net of fees (chart 1).

Chart 1: Active managers have struggled

Source: Morningstar Direct as at January 2017, Morningstar large-cap funds, S&P 500 Index, performance net of fees. US market shown here for illustrative purposes. Past performance is not a guide to future performance.

What comes next?

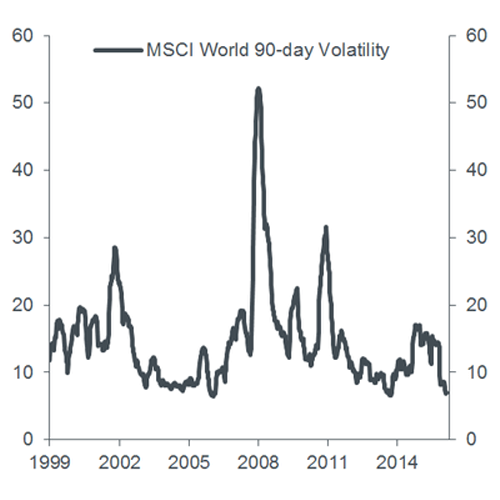

It is our view that the great monetary easing is over and growth is returning as a key market driver. As the influence of central bank intervention fades, markets are likely to see a pick-up in volatility which is currently close to all time-lows (chart 2) and also a fall in correlations within asset classes and indices. These characteristics should provide a fertile hunting ground for stock pickers to deliver differentiated performance as their identification of undervalued companies or underappreciated growth opportunities is more likely to be rewarded.

Chart 2: Equity volatility approaching all-time lows

Chart 3: Low inter-stock correlations offer opportunity

Source for both charts: Bloomberg as at February 2017. Past performance is not a guide to future performance.

The hunt for earnings

It is also important to consider current market levels in this argument, as the S&P 500 Index pushes on to all-time highs.

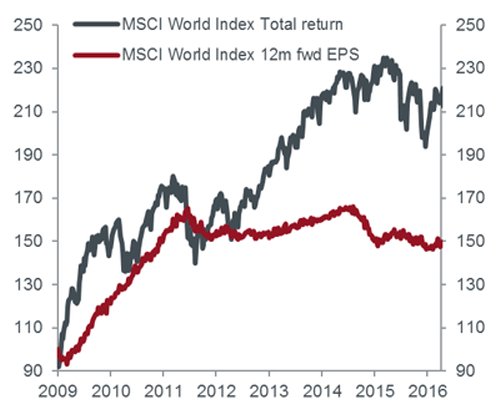

Global equities have seen a substantial rerating since 2011, but earnings growth over this time period has been very muted. Investors will be looking hard to identify growth in earnings that can justify current market levels.

This environment of elevated valuations and muted earnings growth presents a challenge for asset allocators, but it is also one where an active stock picker can potentially add value.This value can come both by identifying those successful companies that have an under-appreciated earnings profile on a bottom-up basis, but also by avoiding those expensive growth companies that appear fully priced for perfect earnings growth.

Chart 4: Global equity returns and earnings

Source: Datastream as at December 2016. Indexed to 100 at March 2009. Past performance is not a guide to future performance. Fwd EPS = forward price-to-earnings, a measure of the price-to-earnings ratio using forecasted earnings.

Lower absolute returns, more alpha?

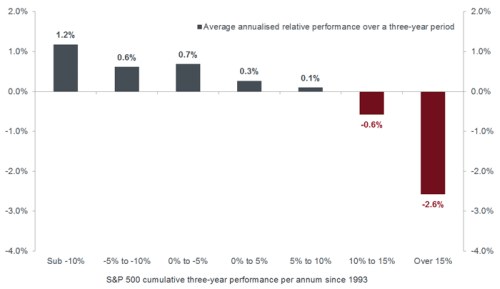

Overall given current market levels and valuations, it is hard to see the catalyst for another multi-year period of double-digit returns from developed market equities. This suggests the outlook for markets is likely to be one of increased volatility and lower returns that are harder to generate.An environment of lower and more volatile returns should provide attractive opportunities for those fundamental active managers who can forensically identify the corporate outlook for companies and navigate challenging markets appropriately. A more challenging market backdrop has historically coincided with positive relative performance contributions from active managers, even in the historically tough-to-beat US equity market, as shown in chart 5.

Chart 5: Active managers have historically added most value in low return environments

Source: Morningstar Direct, data from January 1993 to January 2017. Morningstar large-cap funds, S&P 500 Index, performance net of fees. Includes closed or merged funds. Chart is used for illustrative purposes only. Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Summary

In summary, we expect fundamentals-based investing to make a come-back as central bank interference recedes, volatility recovers to normal levels, and correlations fall. In this scenario equity market performance increasingly diverges across regions, sectors, styles and among individual companies, as investors are able to reassess and take advantage of fundamental opportunities.We continue to favour experienced fund managers across a broad range of styles and characteristics who continue to pick stocks on their fundamental merits. We are invested in those that we believe to be capable of delivering enhanced risk-adjusted returns typically over a three to five year time horizon. We are highly selective in the way we choose and blend our active funds as part of our overall allocation; we believe this should give our portfolios the best opportunities to deliver the performance our clients expect.

Diesen Beitrag teilen: