Morgan Stanley IM: Welcome to the Multi-Stage Life

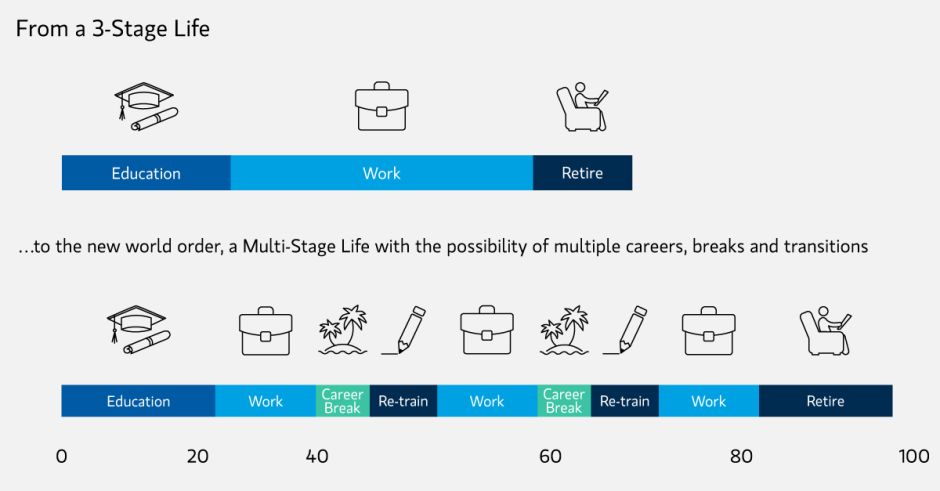

For the last 100 years or so, life in the developed world has fallen neatly into three distinct stages: We begin in full-time education, move into full-time employment and then, when we are able to, we retire.

02.03.2023 | 06:12 Uhr

Here you can find the complete article

This linear life sequencing has brought with it an element of certainty and predictability by binding people into age cohorts: Those in the youngest generation were learning; those in their early 20s to 65 were working; and those 65 or older were basking in their golden years.

However, as explained by professors Lynda Gratton and Andrew Scott in their widely acclaimed work The 100-Year Life, longevity is dismantling this notion of a three-stage life and challenging many of the fundamental assumptions that determine how we structure our lives.

Making sense of the new world order

If current life expectancy trends continue, most children born in the developed world today can expect to live for more than 100 years1. This shift in longevity is not a new or recent phenomenon: Since the middle of the 19th century, technological advancements, improving health care systems and higher incomes have seen average life expectancy increase at the rate of roughly two to three years every decade.2 For younger generations, this lengthening of life may yield substantial gains, but the gift of time is not solely a gift to youth: On average, we are all likely to live longer and in better health than our generational predecessors.

The problem is few pension pots are substantial enough to support an extended retirement. For younger generations in particular, living longer requires an acceptance of working longer — likely into one’s 70s or 80s. In order for this employment period to be sustainable over a stretched period of time, existing structures will need to be replaced with something more flexible, personalised and responsive; a multi-stage life where individuals may experience a number of careers, breaks and transitions over the course of their existence (chart 1). In this redesigned social construct, education won’t end at 21 and retirement certainly won’t begin at 65.

Chart 1

More transitions, new sequencing possibilities and new life stages divorce age from stage, disrupt traditional consumption habits, weigh on lifestyle choices and create new opportunities. We think these changes are likely to be broad-based across generational cohorts. The question for us as investors is: Which companies and industries are well placed to withstand and capitalise on the material long-term behavioural and lifestyle changes that a multi-stage life might bring about?

Change is already underway…

The last couple of decades have borne witness to a paradigm shift across different industries, as a transforming customer profile has forced companies to be increasingly nimble, prioritise their digital and online presence, and satisfy consumer demands for transparency and sustainability — all while managing tightening cost pressures on their bottom line, particularly important in the current macroenvironment. While these changes have disrupted different industries in different ways, broadly, they can be separated out into the following:

- The accelerated adoption of the internet and the digitalisation of data, involving artificial intelligence (AI), automation, robotics, virtual and augmented reality (VR/AR), the Internet of Things (IoT) (e.g., cloud infrastructure, smart homes/cities, etc.) and other emerging technologies.

- The increasing importance of transparency, as consumers have come to acquire more substantial knowledge around the products and services they consume. Younger generations such as Generation Z, roughly defined as the demographic born from the mid-1990s to the early 2010s, have been dubbed “researchers ‘to the point of interrogation’”3, with one study citing that around 65% of Gen Zers investigate the origins of anything they buy.4

- Shorter product cycles, as individuals have access to on-demand information, backed by companies’ ability to quickly reflect changing consumer preferences through enhanced supply chain management and IT infrastructure.

- A change in distribution models (towards direct-to-consumer and online channels),offeringnew touch points with customers and a seamless transition between virtual environments and traditional brick-and-mortar.

- Clearer positioning on purpose, as customers seek brands that signal values aligned with their own, rather than solely considering price and/or quality.

Diesen Beitrag teilen: