NN IP: Equity Strategy - the dust has not settled yet

We expect political risk to continue weighing on Italian equities. So far, we see no visible impact on earnings growth expectations, although momentum is fading and the reward/risk ratio has deteriorated quickly in Italy.

08.06.2018 | 11:28 Uhr

For investors, the past week was a roller coaster, propelled by the gyrations in the Italian political scene. In the end, we went back to square one and ended up with a populist government. This may not be the best outcome, but it looks better than a powerless caretaker government that may have nourished the anti-establishment feelings even more and which could have spelled more trouble ahead. Many uncertainties remain, not the least with regard to the stability of this government, which looks an odd couple. The degree of confrontation with the rest of the Eurozone on immigration, reforms and public finance will be an important issue for investors to assess. It may well take until September, when the budget needs to be delivered before the first clash of the titans erupts. If the fiscal plans are implemented in full, the fiscal picture will worsen substantially and the debt path may be derailed. Rating agencies already warned for potential downgrades of Italian debt. Until then, a relative calm may rule but we still find it hard to think that under these circumstances Italian assets would outperform the rest of the Eurozone countries.

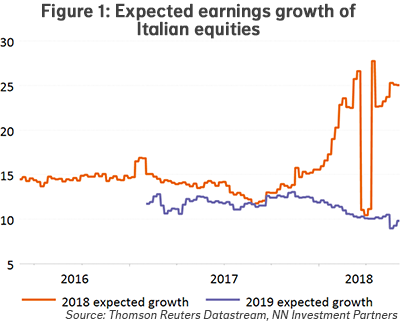

Up until now, we have not observed a big impact on corporate fundamentals. The earnings growth data remain at levels superior to the Eurozone average for this year and are in line with the average in 2019. Of course, given the approximately 35% weight of the financial sector in the universe, financial market volatility and soaring spreads could put financial earnings growth under pressure. Over the past week, earnings momentum (the ratio of upgrades versus downgrades) already fell back into negative territory.

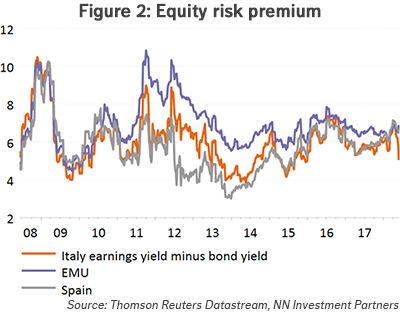

A second variable we look at is the evolution of the equity risk premium offered by Italian equities relative to other Eurozone markets and to its own history. As a proxy for this risk premium we looked at the difference between the earnings yield based on 2018 expected earnings and the 10-year government bond yield. This is shown in Figure 2. Whereas over the past 4 years the risk premiums of Spain and Italy were fairly similar, we start to see divergence between the two series. In fact, we even need to go back to 2010 to see the Italian risk premium below the Spanish one. This is entirely due to the rise in the Italian government bond yield. In case the political environment would deteriorate, leading to more financial market stress (higher BY, lower earnings growth in Financials), the gap would only get bigger. Historically, the reward-to-risk ratio has fallen to the lowest level since early 2016.

A third point is positioning. Based on data as of 30 May, positioning in Italian bonds and equities was still high with outflows just starting. We fear that there is still ample room for investors to switch out of Italian equities. We remain underweight and prefer other Eurozone markets.

Of course, Italian politics may also reflect on the Eurozone in general and expose its structural flaws at a time that it is already coping with disappointing macro data and a rising risk of trade protectionism (steel tariffs). In this respect, the summit at the end of this month will be an important checkpoint. Strengthening of the Eurozone institutions and more burden sharing amongst the members of the Eurozone is needed. We may also get a better view on the attitude of Italian politicians towards the rest of the Eurozone: constructive or confrontational.

A further strengthening of the US dollar could alleviate the headwinds for the Eurozone, but this is not strong enough an argument to become bullish. Above all, the Eurozone equity market is cyclical and tilted towards value, which generally performs well during periods of rising interest rates and accelerating earnings growth. If Italy choses the hard confrontation, the Eurozone equity market is unlikely to get any of these two tailwinds. We keep our neutral stance on the Eurozone and continue to underweight the Italian market relative to the core markets.

Diesen Beitrag teilen: