NN IP: The US is in the driving seat

Divergence in macro surprises between the US and the Eurozone is not reflected in 2019 earnings estimates.

14.02.2019 | 15:22 Uhr

The upward trend in equities continues, with the US again in the leading role. The Eurozone and Japan are lagging behind, spooked by waning growth prospects and political uncertainty. Both regions are also vulnerable to escalation of the US-China trade war. In the Eurozone, Brexit is an additional challenge, with the 29 March deadline rapidly approaching. With regard to the trade war, the market consensus is that at least a partial deal will be concluded or that the 1 March deadline will be extended to allow for further discussions. A comprehensive deal that includes tackling the structural issues on intellectual property and the transfer of technology would be a positive surprise for the market. A breakdown of talks and the introduction of a 25% tariff on Chinese imports into the US would be seen as very negative. Overall, we think the balance of risk is even.

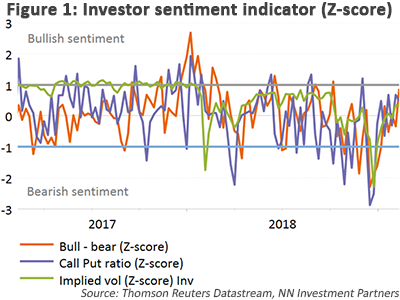

Investor sentiment remains very cautious, with high cash levels, the lowest equity allocation since September 2016 and a preference for defensive over cyclical sectors, as seen from the monthly institutional investor survey conducted by Bank of America Merrill Lynch. A similar conclusion can be drawn from the institutional flow picture, with just one tenth of Q4 outflows having been reversed in January. Moreover, our liquidity and flow signal for global equities remains slightly negative.

These findings contrast with the more positive sentiment illustrated by the bull-to-bear ratio, which measures sentiment among US retail investors. In addition, shorter-term market-based indicators like the Volatility Index (VIX) and the put-to-call ratio indicate a fair degree of investor optimism (without being at contrarian levels).

Upgrade US to overweight following positive macro surprises

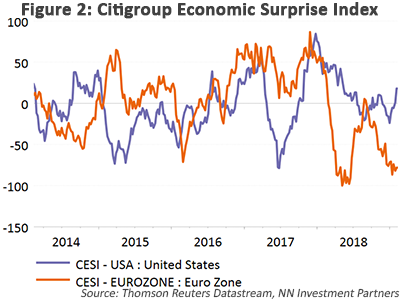

This week, we upgraded our position in US equities from neutral to a small overweight, as a result of several observations. First, macro-economic surprises are positive and have risen rapidly since the beginning of the year. The perceived risk of a recession has also decreased, owing to the Fed’s U-turn on monetary policy. This stands in stark contrast to the Eurozone, where data continue to come in below expectations. Italy is in recession and Germany has also slowed faster than expected. The last time we had a similar configuration was in Q4 2014. At that time, the US market only began to underperform Eurozone equities when US macro data started to surprise on the downside in early 2015. This was also the most recent period in which Eurozone equities meaningfully outperformed US equities.

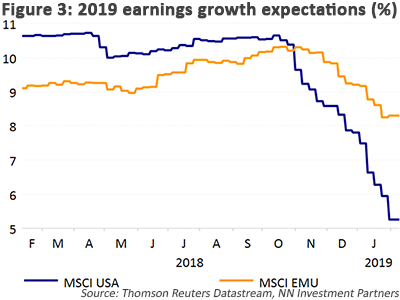

This divergence in the macro outlook is not yet reflected in 2019 earnings estimates. For US companies, the expected growth rate decreased from 10.5% at the end of Q3 to 5.3% at the end of January. For Eurozone companies, earnings growth was revised down from 10.2% to 8.2%, which seems too mild a slowdown, given the downward trend in Eurozone macro data. Perhaps this trend will accelerate in Europe as companies report their Q4 earnings and outlook. In the US, the earnings surprise data are stabilising after a weak start. The average surprise is around 4%, a clear improvement on a couple of weeks ago, when it was closer to 1%.

Diesen Beitrag teilen: