Morgan Stanley IM: Where do we go from here?

Our shift to a “Goldilocks” soft-landing view continues, supported by recent macro data releases, moderately slowing growth and rising confidence that inflation will move lower, allowing policy relief. Read why we believe this supports our view of maintaining positive equities.

18.01.2024 | 08:00 Uhr

The positive momentum in global equity markets continued in December, as the December Federal Reserve meeting added a new layer to the rally, with updates driving a more dovish interpretation of the 2024 policy path. The S&P 500 (USD) Index returned 4.5%,1 while the MSCI Europe (EUR) Index returned 3.7%1. Regionally, the US has outperformed ex-US markets in local currency in both November and December. US outperformance is partially offset on a dollar basis, with the dollar weakening alongside lower US rates. While Europe has underperformed the US in 2023 and more so since May, the region has held up somewhat better than might be expected considering the macro data for Europe continues to disappoint. Support is likely coming from both falling rates and relatively undemanding valuations. Japan’s equity markets have generally shown relative outperformance, offset by weaker currency through most of 2023. That said, it failed to keep up with the US rally in both November and December on both local and dollar comparisons, with the MSCI Japan Index (JPY) returning -0.5%1. The MSCI Emerging Markets (USD) Index posted a return of 3.9%1. However, China remained a notable underperformer amongst regional equities by year-end, as investors continue to recognize the headwinds from the property downturn and grow less confident in the government’s ability to support growth in the near term.

The US 10-Year Treasury yield fell by 50bps from November end, ending the month at 3.87%2. Volatility remained range bound as the VIX ended the month at 12.52, slightly lower than the previous month end.

The shift to a “Goldilocks3” soft-landing view continued into December with rates falling, equity markets rising, sector performance once again skewing cyclical, and equity style factors skewing closer to a risk-on pattern. At the core of the Goldilocks view is rising confidence that inflation will move decidedly lower, allowing policy relief without meaningful growth disappointment – a disinflation driven policy easing story, rather than a growth driven policy easing story. While there remains much to debate about the outlook heading into 2024, recent macro data releases have supported the Goldilocks view. On the inflation front, the data has skewed softer than expected and shown disinflation progress.

The other key component of the Goldilocks story is resilient growth. Real personal spending data shows still healthy consumption. Resilient consumer spending rests primarily on a still healthy labor market, where nonfarm payroll data continues to show solid gains.

While the focus on disinflation progress and resilient growth was consistent in November and December, the December Fed Dot Plot4 showed more cuts than consensus expected in 2023. US Federal Reserve Chairman, Jerome Powell noted both that rate cuts were discussed in the recent meeting and that these cuts were beginning “to come into view”. The markets took this as a signal that the Fed was somewhat less cautious than previously expected as it pertains to success on the inflation outlook, and more focused on not letting real rates slip higher as inflation falls. This translated to another step lower in rates and another step higher in equity markets. This remains consistent with the Goldilocks focus, though we see some shifting in risk scenarios. The resultant easing in financial conditions likely serves to further reduce downside risks, but it may also increase the risk that too resilient growth results in inflation.

Investment Implications

As we have discussed in the last couple monthly updates, our base

case has shifted more confidently to soft landing in the approach to

2024. From a positioning perspective the key translation of this view

has been maintaining our overweight to equities. Having already added

duration (moving from underweight to neutral), we maintained this in

December, seeing a positive risk-reward based on where rates stood

relative to our medium-term expectation for the US 10-year yield of

3.5-5.5% and believing fixed income presents a better hedge to equity

risk entering 2024. While our conviction on a soft landing base case has

been well supported by recent data, both equities and rates have moved

considerably in the last couple months with implications for the balance

of risk/reward entering 2024. The macro-outlook supports positive, but

below trend earnings growth and valuations likely serve as a constraint.

We continue to look for investable opportunities as we head into the

new year.

We did not change any of our tactical views over December. However, for our volatility-targeting portfolios, where appropriate we have been making minor adjustments to align the equity exposure with the proxy benchmark.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

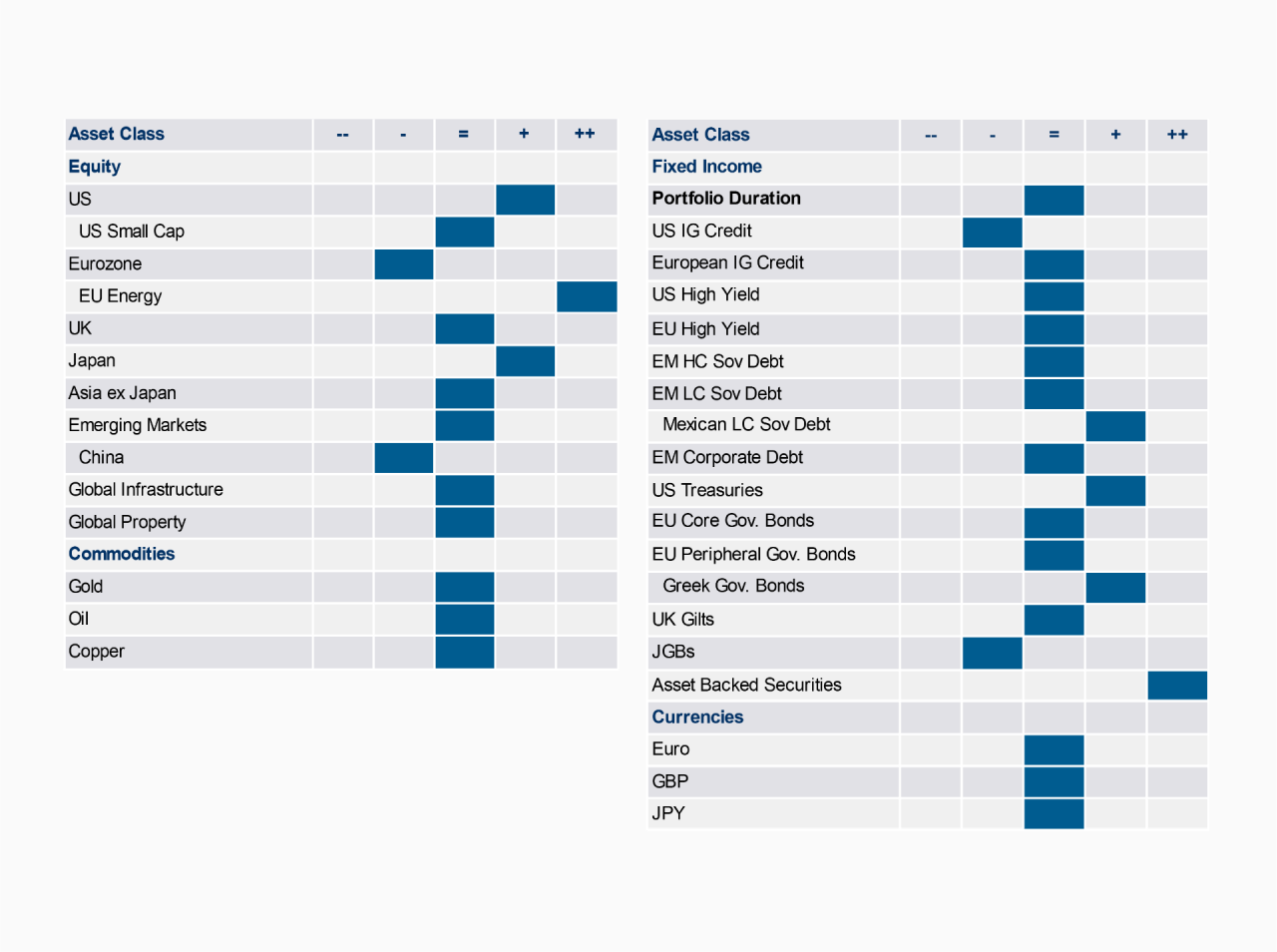

Tactical Positioning

We have provided our tactical views below:

Diesen Beitrag teilen: