NNIP: Finding opportunities has become a challenge

We have turned neutral on government bonds and currently favour real estate. We remain neutral on commodities in light of negative market dynamics.

13.09.2018 | 15:04 Uhr

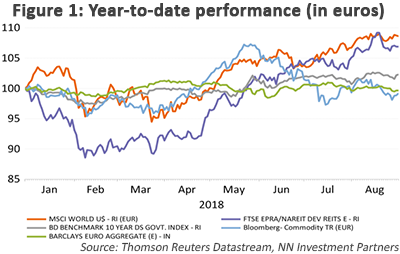

It has not been easy for asset allocators to find opportunities during the past few weeks. After a steep recovery in equity and real estate and initial signs of gains among commodities since late March, asset classes have become more range-bound lately. We have a neutral stance on most asset classes. Negative cyclical momentum indicators point to downside risk, but this is counterbalanced by a robust level of economic activity. Fundamental drivers (labour market, consumer confidence, credit supply) are still sound. Equity upside seems limited as long as trade tariff and EM political risks linger. We turned neutral on government bonds this week. Bund yields have stayed in a 30-50bp range for a while and we are now right in the middle. With the near-term paths of the ECB and Fed having been well-communicated, we don’t see a clear direction for now. Macro data are not giving clear signals and our analytical toolkit is spot-on neutral, both on the market dynamics and fundamental sides.

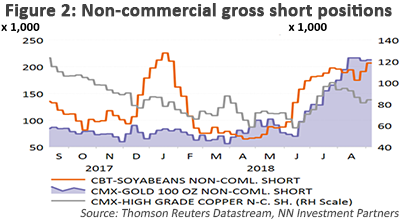

So far, 2018 has been another year of underperformance of commodities versus equities, mainly driven by the Trump protectionist crusade and the combination of USD strength and EM FX weakness. This has also led to negative market dynamics, mainly momentum and liquidity indicators. But we stick to neutral on commodities as a substantial share of risks appear priced and there is high investor short positioning on a broad scale.

The only asset class we like at the moment is real estate. Our quant signals are supportive, mainly driven by sentiment and momentum. Real estate still provides attractive yields and valuations while the asset class is relatively insulated from negative trade-war rhetoric. Economic growth is in a consolidation phase, which should still be good for real estate despite headwinds from online shopping and some recent softness in US housing data.

Diesen Beitrag teilen: