NN IP: Driving in poor visibility

Market visibility is obscured by inconclusive macroeconomic data, seasonal effects and political uncertainties, yet risky assets are maintaining this year’s positive trend.

21.03.2019 | 10:16 Uhr

The continuing positive trend in risky assets highlights investors’ faith in positive outcomes for pressing but uncertain issues like the UK’s planned exit from the European Union and especially trade talks between the US and China. A deal by the end of next month could boost trade, reinforcing our overweight stances in emerging market assets.

Current economic data continue to lack a clear direction, and visibility is further blurred by the Chinese New Year and its seasonal effects, the government shutdown in the US and the high levels of uncertainty related to Brexit and US-China trade. Nevertheless, risky assets have maintained their positive trend that began around Christmas. Investors remain willing to look through the weakness in global trade data and the downturn in PMIs, pinning their hopes on a favourable US-Chinese trade deal by the end of April and some sort of resolution to the Brexit question. With regard to the weak Chinese data, markets seem to believe that a recovery is in the making behind the New Year clouds, although opinions about the effectiveness of China’s policy stimulus are more divergent than those about the likelihood of a trade deal.

Setback for May’s Brexit deal

In the UK, Brexit negotiations remain in disarray following the

announcement by John Bercow, Speaker of the House of Commons, that he

would not allow Prime Minister Theresa May to put her withdrawal deal to

a third vote without substantial changes. May had been planning to put

the matter to Parliament for a third time in advance of the 21 March EU

summit, with the intention of requesting a short-term “technical

extension” if the deal passed. Although the third vote on the deal was

scuppered, it was confirmed this morning that she has pressed on with

the request for a short extension, with a view to obtaining approval for

her deal before the clock runs out.

EU looks likely to grant extension

We believe that the UK will receive an extension from the EU, although

this may not provide time for the UK to revise its negotiating stance if

no deal is agreed. Germany and other large EU member states have

expressed an overt willingness to be flexible and could exert pressure

on smaller countries. Moreover, a no-deal exit on 29 March would be in

no one’s best interest, so we think the UK and EU will reach some kind

of extension agreement and thus avert catastrophe. Still, the

often-turbulent Brexit process has made it clear that no option, however

perilous, is off the table.

Markets anticipating a US-China trade agreement

In contrast to the unfolding Brexit drama, US-China trade negotiations

are taking place quietly behind closed doors. Information is gradually

leaking out, though, which helps us assess the chances of a deal and how

it might look. A key observation is that the market has been pricing in

a growing likelihood of a meaningful agreement. We can see this in the

sharp recovery among the most global-trade-sensitive segments in

financial markets since November. A good example is the performance of

emerging Asian export sectors, relative to the broader emerging Asian

equity market.

Trump needs a deal

Investors took last week’s news of the postponement of a possible

Trump-Xi summit well, which points to a widespread trust that a deal is

in the making. We would also cautiously agree with the assessment that

neither China nor the US can afford a collapse of the trade deal in the

final stages of the talks. In China, the economic damage would become so

extensive that the authorities would be forced into a new, more

aggressive round of monetary stimulus that could jeopardize the progress

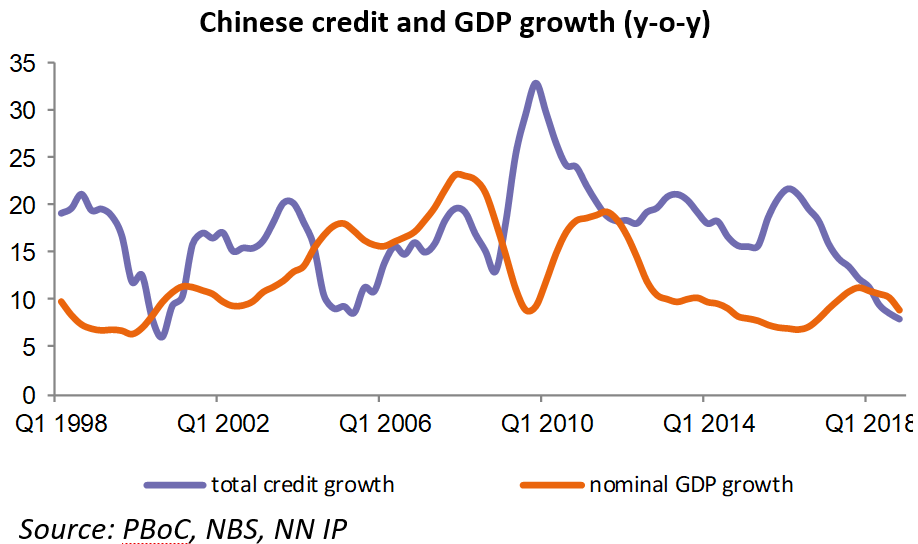

made in reducing financial system risk (see chart). In the US,

President Trump needs a deal to prove that he is a good negotiator. Such

a success would serve to counterbalance the increasing pressure on his

position from the Robert Mueller investigations and lack of progress in

his domestic political agenda.

New laws support reports of China concessions

More concretely, US negotiators mentioned in the past weeks that the

Chinese government is making concessions on intellectual property rights

protection and forced technology transfers. These comments became more

credible with last week’s adoption by the National People’s Congress of

the Foreign Investment Law and the Patent Law, which partly deal with US

complaints about market access and intellectual property rights.

China’s earlier promises to substantially increase its purchases of

American goods should also pull the US negotiators closer to a positive

verdict.

Deal likely by end-April

All in all, we believe a meaningful deal will be struck by the end of

April. Some loose ends are likely to remain, such as disagreement about

foreign market access in specific Chinese sectors, state support for

Chinese companies, US market access for Chinese technology companies and

the Chinese currency regime. But a deal should remove much of the

immediate uncertainty for Chinese export companies and help world trade

growth to partly recover. A resulting improvement in global PMIs and

expectations for growth should help to sustain risky assets. With this

in mind, we are holding on to our overweight positions in emerging

market equities and bonds.

China stimulus boost could start in Q2

Another key reason why we see value in EM assets currently is the

Chinese policy stimulus, which should contribute to a growth recovery in

China and elsewhere in EM from the second quarter onwards. Chinese data

in recent months have pointed to a worsening of the growth slowdown,

mainly due to trade uncertainty and weakness in the manufacturing

sector. Most worrisome were the manufacturing PMI (another decline below

the neutral 50 mark), import growth (-5%) and industrial production (a

full percentage point lower). One number that was clearly disappointing

was the drop in broad credit growth, from 7.9% in January to 7.3% in

February. At the same time, we saw some evidence of a pick-up in housing

activity and a clear expansion of infrastructure investment growth,

particularly in railways.

Seasonal effects

All these numbers should be taken with a grain of salt, however, due to

the seasonal effects linked to the Chinese New Year. Every January and

February, the visibility of Chinese data is low. The best advice is

usually to wait for the March data to draw conclusions about the state

of the Chinese economy. The problem now is that the whole world is

anxiously watching China for evidence of policy stimulus and its

effectiveness. We cannot really afford to wait until mid-April, when the

March numbers will be published, to take a view on Chinese growth. So

we try to assess the data of the past months as accurately as possible,

taking into account the seasonal distortions and making use of

non-Chinese data that contain information about Chinese demand. We also

incorporate knowledge and experience from the past about Chinese

stimulus programmes.

Growth in Chinese domestic demand, credit likely in coming months

From the measures that have been implemented so far – tax cuts, public

investment schemes, higher loan quota for local governments, to mention

the most important ones – we can deduce that domestic demand growth

should start rising in the coming months. More specifically, broad

credit growth should increase by several percentage points, back to low

double-digit levels. Whether overall Chinese economic growth will also

bottom out depends on the outcome of the US-Chinese trade negotiations.

Asset allocation

Our confidence in a trade deal, in combination with a pick-up in Chinese

domestic demand growth driven by the current stimulus programme, is

reflected in our overweight in Chinese equities. This position has been

working well since we opened it in the last week of January. As said

earlier, our overweights in EM stocks and bonds are partly linked to our

constructive China view as well. On a higher level, we remain rather

cautious on global equities and have kept a neutral position, mainly

because of short-term technical factors.

Nevertheless, our asset allocation carries a positive risk tilt, via an overweight in spreads and an underweight in Bunds. We increased both positions from small to medium this week. Bund yields are currently at low levels reflecting growth worries, which appear a bit exaggerated to us. Long-term inflation expectations have fallen significantly and we see potential for a mild normalization in line with the positive momentum in macro surprises in the Eurozone. On the credit front, support from central banks and the ongoing search-for-yield theme underpin spread markets. Flows remain supportive, especially for the investment-grade segment.

Diesen Beitrag teilen: