Morgan Stanley IM: Fiscal Stimulus Around the World

After months of market jitters, rallies and global growth concerns, fiscal stimulus could provide a boost that puts the economy on the road again.

15.04.2019 | 11:11 Uhr

Weakness in financial markets has generally led central banks to adopt a more dovish attitude, most notably reflected in the recent US rate hike pause. However, we believe that fiscal stimulus programmes, many of which include large infrastructure spending initiatives, could be key to reducing the risk of recession in the near term. We expect further fiscal stimulus announcements from China, the US and the Eurozone, meaning that by the second half of 2019, we could see a cyclical upswing in infrastructure investment, which would go into 2020.

China: Let the building begin

China’s long-term goal of reducing leverage and improving industries’ efficiencies has resulted in an economic slowdown and rising unemployment. The situation has been exacerbated by trade tensions with the U.S., leading to some signs of social unrest. In part to alleviate any potential tension, the Chinese government has started stimulating in a significant way, showing a strong commitment to stabilising their economy in the short term.

To jump start the economy China is initiating a two-pronged fiscal stimulus programme focused on tax cuts and local government debt financed infrastructure projects. We expect the augmented fiscal deficit, which includes local government financing vehicles and other off-budget activity, to be 1.5%1 higher than 2018.

At the same time, we have seen significant monetary easing, such as reserve requirement ratio (RRR) cuts and more targeted credit support to the private sector. If China’s recent push on both the monetary and fiscal fronts helps it stabilise at the announced 6% to 6.5%2 expected growth rate for 2019, then this should filter through to the rest of the world, particularly to Asia ex-Japan.

United States building bridges?: Bipartisan support for infrastructure

With a divided Congress, the U.S. is in a political stalemate. But one of the areas where a bipartisan agreement seems possible is infrastructure spending. Due to decades of neglect, U.S. infrastructure is in desperate need of an upgrade, garnering a D+ rating from the American Society of Civil Engineers in 2017.3 Infrastructure spending would likely create jobs and improve the economy. It could also reduce transportation costs and increase safety, leading to higher profitability for businesses, which would then have the wherewithal to boost investment.

President Trump proposed a $1.5 trillion infrastructure package in 2018, intended mainly to modernise aging roads, bridges and airports. The Democrats have disclosed their own plans to spend $500 billion over 10 years, focused on infrastructure that would reduce fossil fuel dependence.

The most promising means of paying for an infrastructure package would be raising the gasoline tax—which has not been raised since the Clinton administration—by 25 cents per gallon over five years. Other avenues for funding include increasing the deficit, cutting other areas of the budget, a vehicle mileage tax or a financial transactions tax.

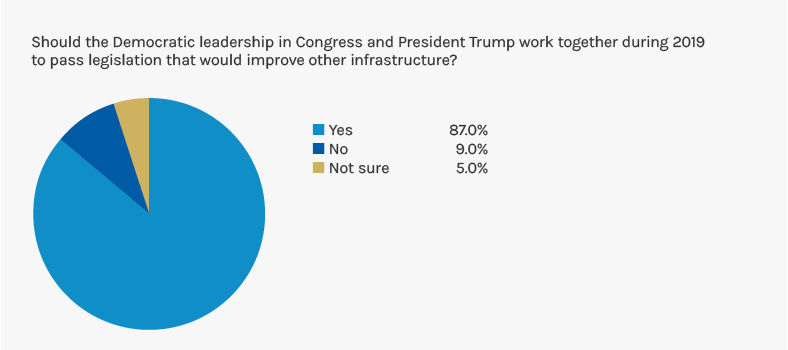

While the two parties’ plans differ in detail, there is already powerful voter support from both Republicans and Democrats for passing an infrastructure bill in some form (Display 1). With support at 87% from likely voters,4 we expect a joint bill will be introduced in May.

U.S. voters approve of infrastructure spending

Europe: Stimulus led by Italy and Germany

In the eurozone as a whole, fiscal stimulus for 2019 is nowhere near that of China or the U.S., but it is nevertheless expansionary. With ageing infrastructure across the Continent, European governments look like they will adopt stimulus programmes of approximately $47 billion cumulatively.

Our belief is that these eurozone stimulus programmes are in part a reaction to the rise of the populist parties in countries like Italy. Populism has led to a rebellion against austerity. It also appears to have pushed more mainstream political parties towards greater spending to improve their economies—and protect their political positions.

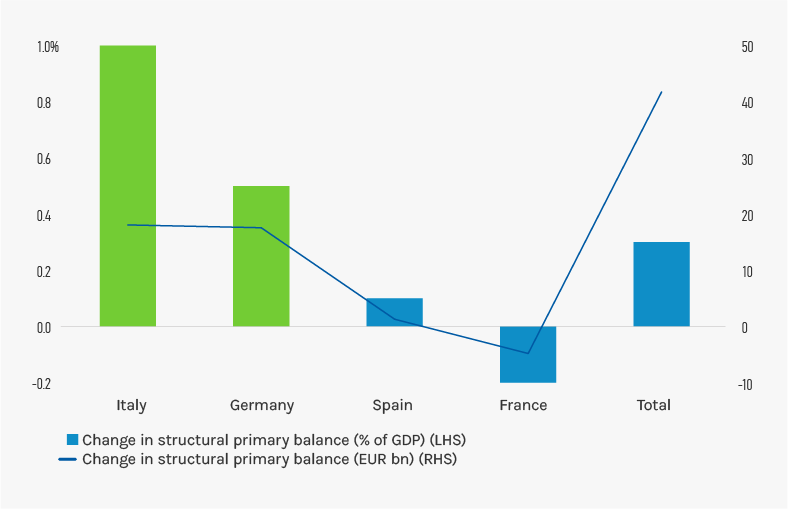

Spending levels differ significantly among eurozone countries. Italy has increased its structural primary surplus the most, by €18 billion (Display 2). Germany has been running a surplus, so it has more leeway to stimulate. By contrast, France and Spain have come under political pressure to abandon their attempts to keep deficits below the 3% threshold. The French government was forced by protesters to scrap some planned tax increases, and the Spanish government failed to get its budget through parliament. Such pressures may result in more expansionary measures, so we may actually see the net number surpassing the projected $47 billion.

Big spenders: Italy & Germany

Japan: Infrastructure spending to offset VAT

Japan will raise its VAT from 8% to 10% in October 2019 to help finance ballooning social security costs. The last time the VAT was increased—in 2014, it caused a noticeable slowdown in the Japanese economy, a risk the government is clearly aware of and is taking action to pre-empt.

Specific actions include pressuring businesses to increase wages and to offset the tax increase, a record budget for 2019 that includes 2 trillion yen to be spent on measures such as shopping vouchers for low-income households and 500 billion yen in state subsidies to encourage cashless transactions. It is worth noting that the budget includes about 1 trillion yen designated for public works - essentially infrastructure projects.

These spending initiatives add up to about 6.5 trillion yen while the tax revenue increase from the VAT is projected to be 5.6 trillion yen—so the net effect is 0.9 trillion yen of positive stimulus, approximately $9.8 bn or 0.16% of GDP. Therefore, we believe the strong commitment to avoiding a repeat of 2014 should help Japan’s domestic economy to navigate the tax hike.

Emerging Markets: Fiscally expansive overall, with a focus on infrastructure

Despite variance among countries, there is a consistent theme of positive fiscal stimulus—particularly infrastructure spending—in most emerging markets:

- Emerging Asia

The region is strongly positive overall. India is undertaking spending on roads, railroads and rural development, as well as welfare spending on farm income support and tax relief. The Philippines is also increasing spending and raising its budget deficit ceiling to boost infrastructure. In South Korea, the government is pursuing the largest budget increase since the 2008 financial crisis, up 9.5% from last year, primarily in response to economic weakness in China. Taiwan’s spending remains neutral, while Indonesia is one of the region’s outliers, having postponed infrastructure projects. - Latin America

Overall the region is positive on infrastructure spending, but with net fiscal tightening. In Brazil, the government has an incredibly strong pipeline for infrastructure spending, including 12 airports and a major rail line. It will auction four port leases in March, while monetary policy has eased. The new president has brightened the investment outlook, though some in the market have governance concerns. In Mexico, where decade-high interest rates serve to dampen ambitious plans, infrastructure spending remains neutral. - Eastern Europe, Middle East and Africa

Russia has launched a ‘development fund’ for co-financing infrastructure projects, which is a positive step. However, the latest sanctions threaten to inhibit investment.

Inferring from China’s experience

Implications: Beneficiaries of infrastructure spending

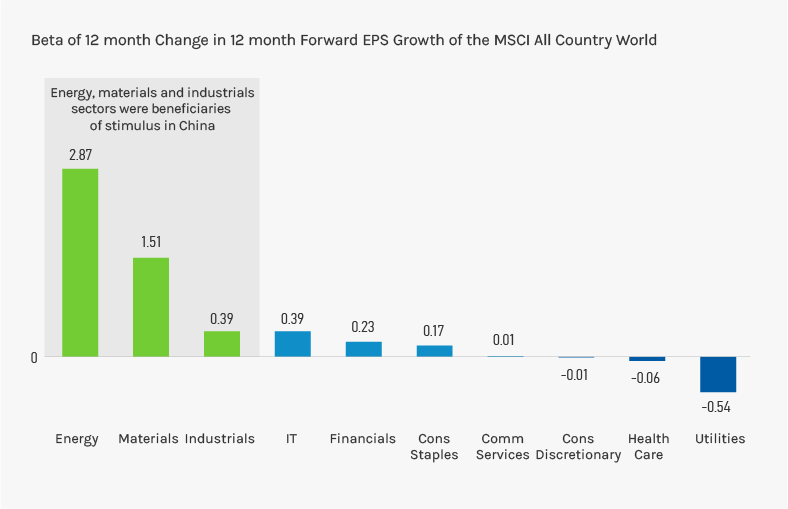

For investors, infrastructure spending has implications across various sectors. To infer what those implications might be, we can look at China’s experience with its recent stimulus programme. Display 3 shows the effect of stimulus on China’s credit impulse expectations year over year for various sectors. It suggests energy, materials and industrials sectors may have the most upside for equity investors. We are also constructive on industrial metals due to their importance in infrastructure, in spite of their low ranking in this table.

From a fixed income point of view, stimulative policies suggest a positive outlook for global growth, and a bottoming out of recent weakness. While short term weakness in economic data and a dovish Fed may cause bond yields to drop, our view is that the return to owning longer dated bonds relative to the risk remains unattractive. The flatness of the yield curve means that any evidence of renewed growth—due for example to a significant US infrastructure stimulus programme - could lead to a sharp rebound in yields and negative returns to longer dated bonds from current levels. Fiscal stimulus would also suggest greater bond issuance, which would likely drive yields higher. Our outlook is for a stronger economy, possibly a modest increase in inflationary expectations, and a greater supply of debt—all of which is negative for long-duration bonds.

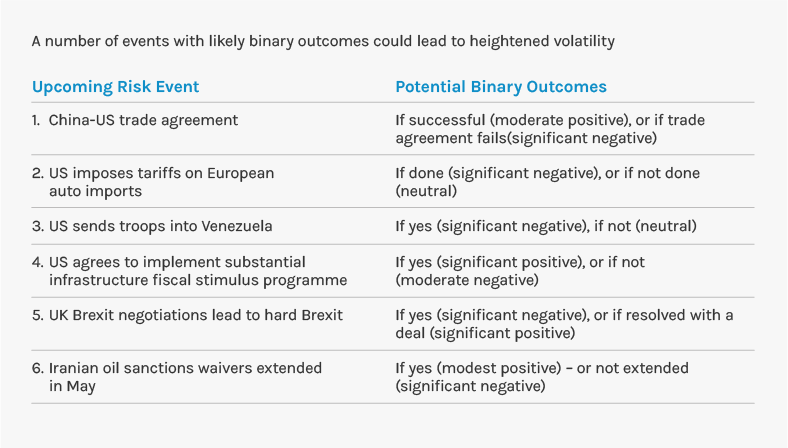

Major risk events could change our outlook

What complicates this generally positive outlook for infrastructure—and the sectors that stand to benefit from it—is an unusually large number of binary risk events that could temporarily setback the markets and dampen the enthusiasm for fiscal stimulus. We would use these more as buying opportunities than commitments to negative positions. These risks are outlined in Display 4.

These binary risks are mostly skewed to the downside.

Near-term risks to our outlook for infrastructure

Let the builders build

The renewed focus on infrastructure is a global trend. Even in Japan, where overall fiscal spending is down, infrastructure spending is marginally higher (Display 5). New projects – in the form of roads, bridges, improved transportation hubs, rural development and many other initiatives – are likely to minimise the threat of a recession. In fact, we think it could get the global economy “back on the road again,” headed toward a meaningful cyclical upswing going into 2020.

Risk Considerations

There is no assurance that the strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall. In general, equities securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Stocks of small-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. The use of leverage may increase volatility in the Portfolio. Diversification does not protect you against a loss in a particular market; however, it allows you to spread that risk across various asset classes.

1

Diesen Beitrag teilen: