Morgan Stanley IM: The Material Risk Indicator

How to record ESG company risks and opportunities in a consistent and comparable way? The International Equity Team explains the Material Risk Indicator.

08.03.2021 | 11:05 Uhr

Here you can find the complete article.

For over twenty years our unchanged investment philosophy for the global strategies we manage has been to own high-quality companies with the potential to successfully compound over the long term.

These companies compound by steadily growing while sustaining their high returns on operating capital. As investors, we persistently look to identify material risks or opportunities to this compounding, including environmental, social and governance (ESG) factors.

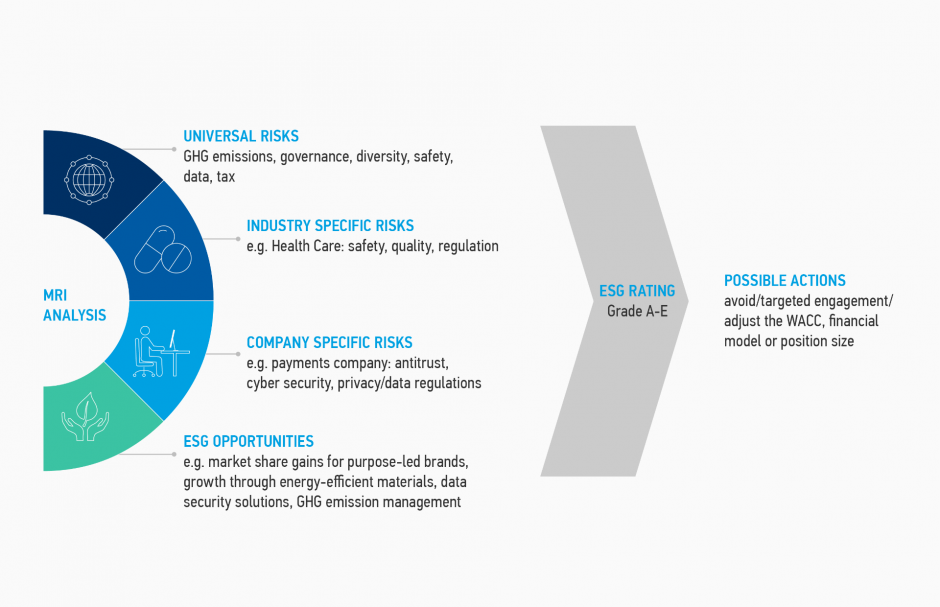

We capture ESG risks and opportunities through our internally developed ESG scoring framework—the Material Risk Indicator (MRI)—a tool designed to record portfolio managers’ ESG company assessments in a consistent and comparable way over time.

The MRI helps to:

- identify material ESG risks and opportunities at the company level

- reflect these risks and opportunities in valuation and portfolio construction, if appropriate

- identify priority areas for future company engagement

The fundamental question each portfolio manager (PM) must answer is whether the factors in question can significantly impair or enhance the company’s long-term returns on operating capital employed, our primary quality metric.

Display 1: ESG is Assessed by the Investment Team Directly Proprietary ESG MRI (Material Risk Indicator) Analysis

Source: Morgan Stanley Investment Management. The views and opinions expressed herein are those of the portfolio management team, are not representative of the Firm as a whole, and are subject to change at any time due to market or economic conditions. There is no assurance that a portfolio will achieve its investment objective or an investment strategy will work under all market conditions.

PMs are the ones who undertake the MRIs analysis as they best know the companies and industries. While we do use third-party ESG data for some of the inputs, this is a supplement to the analysis performed by the PMs.

We believe our clients will benefit from this enhancement. The MRI is designed to improve our capture of risks and opportunities for the companies we invest in. This should further enhance our ability to manage downside risk as well as increase the potential for long-term compounding.

How it works

Each company is assigned a score from A through to E, with A being the highest score attainable. To determine this score, for each company, the relevant PM identifies and records the following:

- Key ESG risk(s), for example product safety or data security

- ESG opportunities, such as technology solutions for decarbonisation or waste reduction

- Investment implications from these risks or opportunities

In addition, for the company in question, the PM will:

- Identify if there is a low, medium or significant level of concern with respect to the following team-agreed universal risks:

- Greenhouse gas (GHG) emissions

- Governance (with a particular focus on management incentives)

- Diversity/culture (board, senior management, staff)

- Safety (product, broader workforce, environmental)

- Data security/privacy

- Tax (transparency, strategy, policy, risk).

- Document the key industry specific risk(s) Include quantifiable ESG data, currently comprising:

- Carbon tax impact on EBIT at $100/t of CO2e

- Equileap1 gender equality score

- Impact of normalised global tax rates

- Pay X-ray score (our proprietary assessment of management incentives).

How does the process impact portfolio construction?

The nature of ESG factors can make it challenging to quantify their impact. As such, we employ a range of methods to reflect the outcome of our ESG analysis in the portfolio:

- Where feasible, we run scenario analyses e.g. forecasting the impact of an ESG factor on the company’s growth rate, profits or capex and the resulting change in fair value — for instance, modelling the impact on profits and valuation of consumer staples companies switching to more sustainable packaging.

- We may adjust the WACC (weighted average cost of capital) to reflect the higher or lower risk.

- We may reflect potential risks by adjusting the position size, in addition to any model or WACC changes.

- Finally, we may choose not to invest in a candidate company if we believe ESG risks as assessed by the MRI are too high.

It is important to note, however, that a high MRI grade does not

automatically suggest a large position and a relatively low MRI grade

does not automatically trigger a reduction or divestment of a holding.

The ESG assessment is an important component of the research process,

not the sole driver of investment decisions.

The strengths of our approach

- It is entirely portfolio manager designed and driven.

- The MRI framework is not reliant on third-party assessments and data— these are simply a resource.

- We assign absolute, rather than sector-relative scores, which helps compare companies across different sectors, reflecting our bottom-up, absolute, benchmark-agnostic mentality.

- We focus on key ESG factors and their impact on the investment argument, rather than tick every possible (and possibly irrelevant) box.

- The MRI allows us to compare companies and identify leaders and laggards in specific areas, enhancing targeted engagement.

- The MRI is structured but not mechanistic—the scores reflect the PMs’ holistic view and are not constructed using a formula.

- Our process allows for team discussion and challenge.

- We can track changes over time.

Conclusion

When we assess stocks and make investment decisions, we debate their key merits and shortcomings as a team. We focus on those elements we believe are most impactful on the long-term sustainability of a company’s return on operating capital, and rigorously break them down, including ESG factors. We believe the MRI strengthens our approach. It adds further structure, reference and integrity to our long-standing investment process, which is designed to identify reasonably priced, well managed, high quality compounders with a strong or improving ESG profile, across the globe.

Diesen Beitrag teilen: