Morgan Stanley IM: Decarbonisation - The Basics

Climate change is often cited as a leading ESG priority for investors. It is the number one issue for asset owners in the Morgan Stanley 2020 Sustainable Signals Survey. 95% already seek, or are considering, to address climate change via their thematic or impact investments.

05.10.2020 | 08:00 Uhr

Here you can find the complete article

Our team’s ESG approach is focused on material issues that could threaten or enhance company fundamentals and/or the sustainability of returns. Our portfolio managers and Head of ESG Research engage proactively with company management, including seeking to understand environmental policies and practices that could materially affect the sustainability of returns.

Climate change is a big beast of a topic. What are the essential facts that are helpful for investors to know? What is believed to be the economic impact of climate change? What is meant by scope 1, 2 and 3 emissions, and why should businesses and investors care about measuring across the full value chain? What options are available to investors wanting to lower the carbon footprint of their portfolio? How can a high-quality equity portfolio help?

"What options are available to investors wanting to lower the carbon footprint of their portfolio? How can a high quality equity portfolio help?”

This paper, the first in our Carbon series, sets out to explore these five areas.

1. Climate Change 101

Climate change is widely seen as the defining issue of our time. In recent years, the political winds seem to have truly shifted, as the public has grown increasingly vocal and the issue more urgent.

Climate science is not exact, given the number of assumptions scientists have to make about things they can’t model exactly. Nonetheless, there is consensus that it is happening fast, it is man-made, we are not doing enough, and we should focus on preventing irreversible extreme damage.

What matters for investors, in addition to the direct physical impact of climate change, is the resulting changes in government policy, consumer behaviour and the impact on companies and their valuations (the ‘transition risk’).

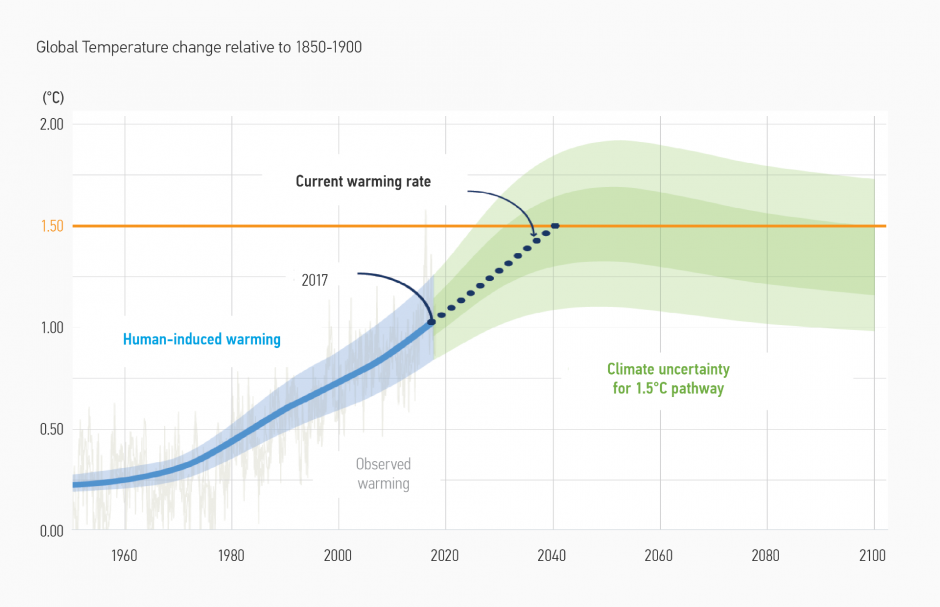

The world is undoubtedly warming, and the Intergovernmental Panel on Climate Change (the most important global climate science body, comprising 195 member countries) expects us to reach 1.5°C above pre-industrial levels in only twenty years, if no action is taken (Display 1).

WHAT IS MEANT BY TRANSITION RISK?

“While the physical risks from climate change have been discussed for many years, transition risks are a relatively new category… Transition risks can occur when moving toward a less polluting, greener economy. Such transitions could mean that some sectors of the economy face big shifts in asset values or higher costs of doing business... As companies disclose more information relating to climate change, financial firms will be able to make more informed decisions.”

– The Bank of England KnowledgeBank: ‘Climate change: what are the risks to financial stability?’

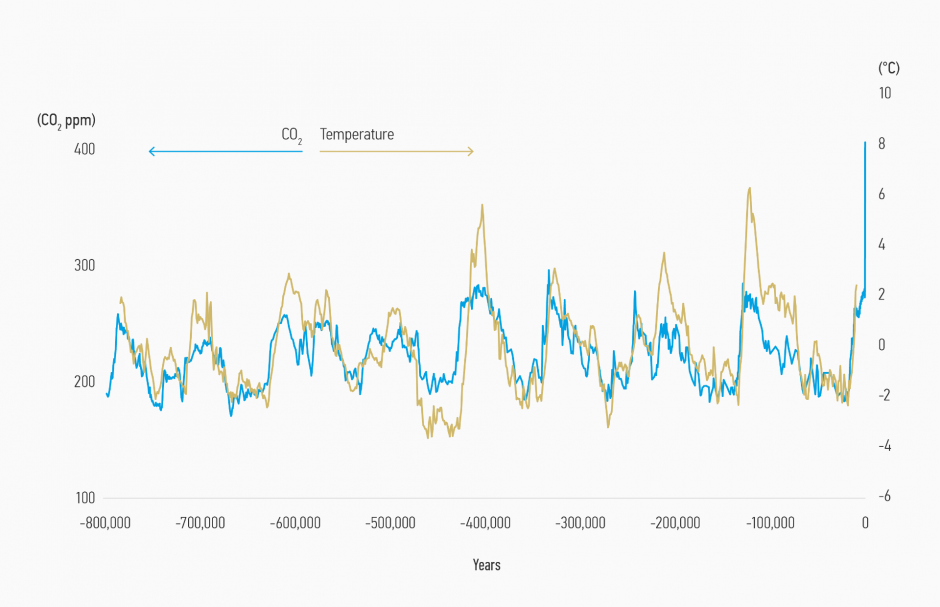

Scientists attribute rising temperatures to the human induced ‘greenhouse effect.’ Carbon dioxide accounts for most of it. As Display 2 shows, current concentrations of CO2 in the atmosphere are already significantly higher than for the past hundreds of thousands of years, and the speed and level of the increase suggest most of it is driven by human activity.

DISPLAY 1: IPCC expects global warming of 1.5°C to be reached in 2040

Source: IPCC AR15 Report October 2018 – Global warming of 1.5°C

WHY DOES IT MATTER IF THE WORLD ‘ONLY’ BECOMES 1.5°C WARMER?

Warming will not be evenly spread. The climate will become more unstable and weather patterns disrupted, with heatwaves in some places and hurricanes and floods in others.

The list of resulting direct physical climate change risks is long: damage to assets from extreme weather events and rising sea levels, water stress, crop failures and lower yields, lower fish catches, higher mortality and lower labour force productivity in hotter countries, among other effects.

But the bigger, longer-term concern is that at a certain point in the warming process, various natural feedback mechanisms will kick in, and warming will self-perpetuate and become unstoppable. These include the albedo effect (as polar ice melts, it reflects less light back into space), release of methane by melting permafrost and the Amazon rainforest dieback among other things. These outcomes are impossible to model exactly, which is why there are a wide range of climate scenarios.

DISPLAY 2: CO2 concentration and temperature over 800,000 years

Source: NOAA (National Oceanic and Atmospheric Administration)

Nonetheless, the damage would be irreversible, and our actions in the next few decades will dictate our planet’s course for centuries to come.

GLOBAL WARMING OR CLIMATE CHANGE?

“We often call [it] global warming, but it is causing a set of changes to the Earth’s climate, or long-term weather patterns, that varies from place to place. While many people think of global warming and climate change as synonyms, scientists use “climate change” when describing the complex shifts now affecting our planet’s weather and climate systems—in part because some areas actually get cooler in the short term.”

– National Geographic?’

"Natural feedback mechanisms will kick in, and warming will become unstoppable.”

TARGETING ‘NET ZERO’ BY 2050 IS NOW A GLOBAL IMPERATIVE

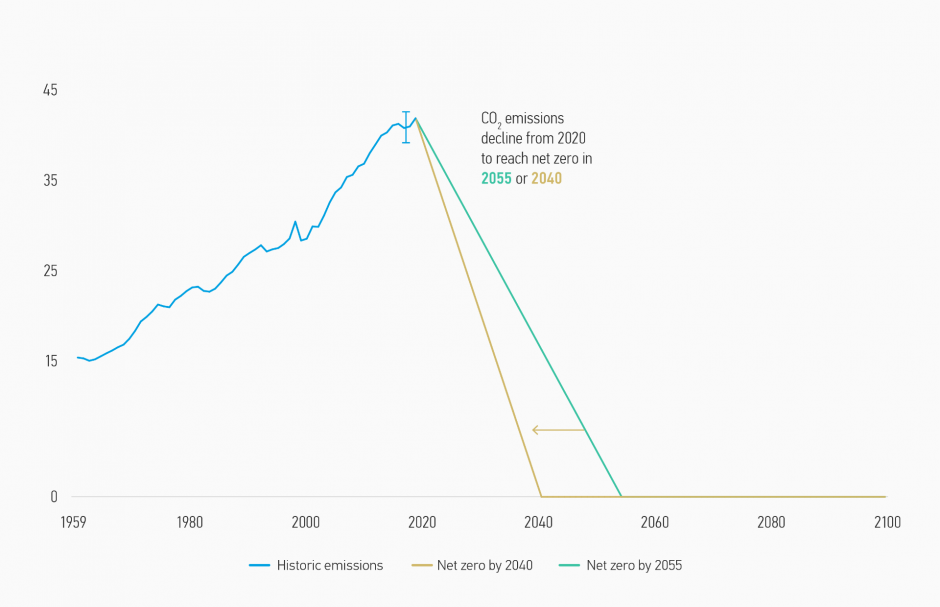

The consensus now is that we have to fully decarbonise—reach ‘net zero’—by around 2050.

Display 3 models the drastic decline in CO2 emissions required with immediate effect in order to reach net zero by both 2055 and 2040.

What many people do not realise is that these oft-quoted IPCC emissions reduction targets in most cases assume only a 50-66% probability of limiting global warming to agreed temperature targets.

DISPLAY 3: Billion tonnes CO2 per year (GtCO2/yr)

Source: IPCC AR15 Report October 2018 - Net global CO2 emissions pathway

Here you can find the complete article.

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy’s assets were invested in a wider variety of companies. In general, equity securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Stocks of small-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Non-diversified portfolios often invest in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater volatility.

Diesen Beitrag teilen: